Email of the day on changing diets

Given the change in dietary recommendations, do you have a list of listed butter, coconut water/oil and palm oil producers (or brands preferably)?

Thank you for a question of general interest to the Collective. As with anything both supply and demand should be considered in an assessment. As incomes improve demand for better quality and higher calorie food increases. Beef, milk, butter, coconut oil/water and palm oil all fall into that category.

On the supply side the removal of subsidies, particularly for milk, have resulted in supply surging. At the same time palm oil came under pressure as oil prices fell. In some cases this has meant higher margins for listed companies while it has meant just the opposite for others. It is certainly an interesting time to think about the subject.

Veolia (Est P/E 21.09, DY N/A) has morphed from being a utility to a consultancy firm and the share has performed well following that change of focus. Valuations have expanded somewhat and the share has been ranging with a mild upward bias for most of this year. A sustained move below the trend mean would be required to question medium-term scope for continued higher to lateral ranging.

Bottled water represents about 7% of Nestle’s (Est P/E 22.17, DY 2.96%) revenue but its largest segments are dairy products and coffee so it sits in a very favourable position as a leader in delivering an attractive suite of products to the emerging middle class. The share has been largely rangebound since early 2014 but has sustained the medium-term upward bias.

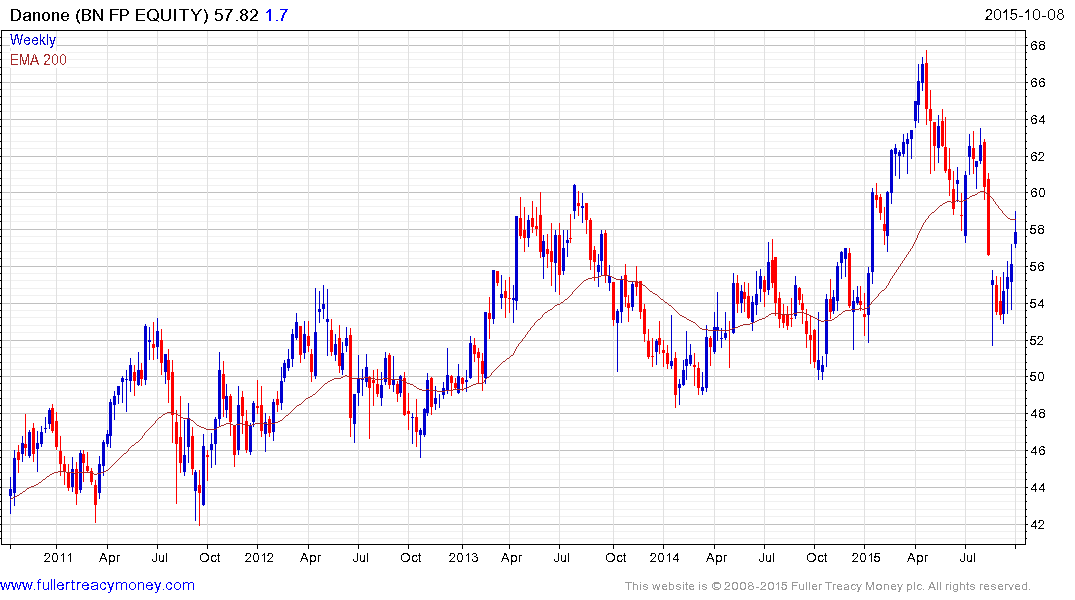

Bottled water represents almost 20% of Danone’s (Est P/E 20.01, DY 2.59%) revenue while dairy and baby foods are its largest segments at 52.6% and 20.8% respectively. The share retraced its entire advance from early this year but continues to hold the medium-term progression of higher reaction lows. Potential for continued higher to lateral ranging can be given the benefit of the doubt provided it holds the €50 area.

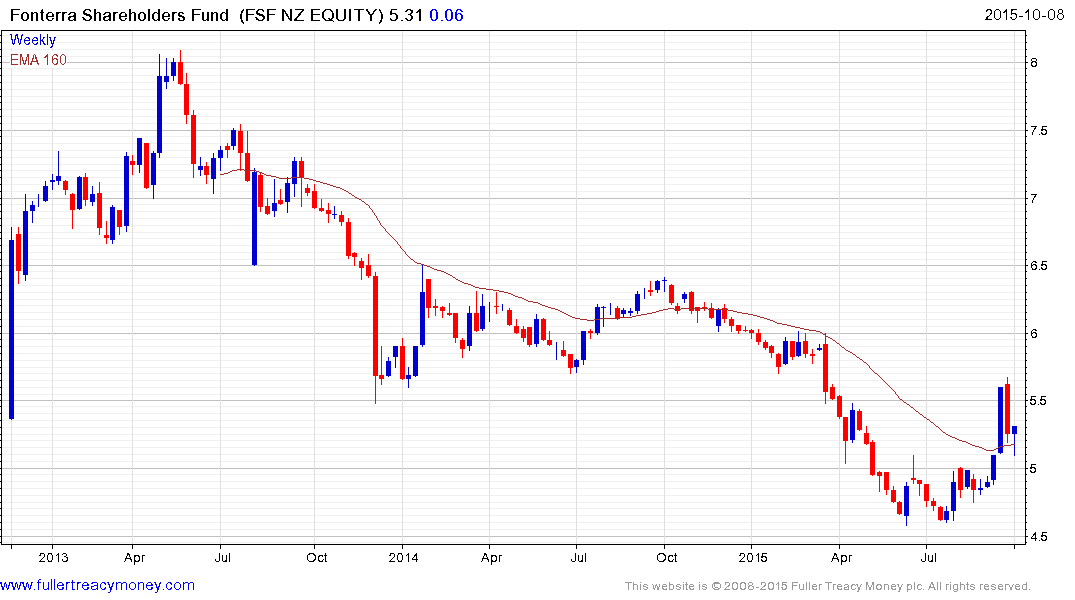

If one is looking for a pure-play on milk, the New Zealand listed Fonterra Shareholders Fund (Est P/e 13.31, DY 4.71%) is a vehicle that allows those wishing to sell their interest in the co-operative to determine a fair price. The share found support in June near NZ$4.50, has held a progression of higher reaction lows since and firmed this week from the region of the 200-day MA.

Kerry Group (Est P/E 22.47, DY 0.69%) has evolved from being a co-operative dairy to offering both dairy and pork products. The share remains in a consistent medium-term uptrend and a sustained move below the trend mean would be required to question medium-term scope for continued upside. The company’s long record of impressive dividend growth has contributed to the consistency of the trend.

In the edible oils sector Singapore listed Wilmar International (Est P/E 10.71, DY 2.84%) broke downwards from what had looked like a three-year base earlier this year. It is currently unwinding the oversold condition but will need to push back up into the overhead range to begin to suggest a return to demand dominance beyond the short term.

Back to top