Email of the day on central bank balances sheets

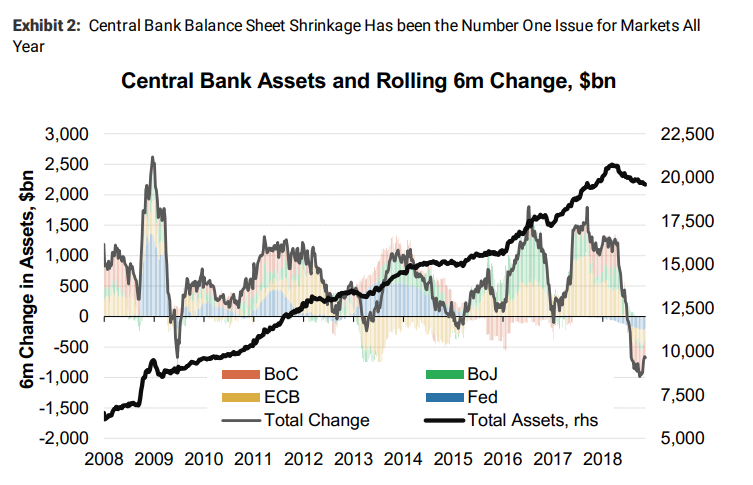

On the Morgan Stanley research document, you posted on Monday, there was "the most important chart in the world" as you describe it (QE globally). The "6-month rate of change" scale on LHS caught my attention. Recently, this QE tightening "rate of change" has moved upwards. Is this an early sign that CBs are starting to shy away from their QE tightening? If so, this is bullish for an equity market discounting future tightening. Maybe the tea leaves are not clear, but they must be monitored.

Thanks for this email which as you highlight raises the very important question of whether central banks have had enough of tightening after taking $1.5 trillion out of circulation since March.

The Federal Reserve appears to be angling towards announcing a pause in December. That has the potential to represent a significant bull catalyst if it does in fact happen.

Additionally, this article from Bloomberg highlighting the efforts underway in China to reverse the restriction of credit is also noteworthy. Here is a section:

Beijing made the right decision to tighten the credit fire hose. Yet even with the slowdown, total social financing continues to grow about 1 percent faster than nominal GDP. In other words, asset prices have yet to feel the knock-on impact of a genuine deleveraging. If asset prices are diving even as debt continues to climb, how much worse would the declines get in the event of a contraction?

As Beijing announces its intent to turn on the liquidity spigots again, this raises the question of whether China is willing to take the pain of restricting credit. The suspicion will be that the government will simply try to buy its way out of an uncomfortable situation again

Meanwhile Europe is still wedded to the idea that the economy can get along fine without monetary assistance with little evidence from the market to back that up.

An additional consideration is that the contraction in central bank balance sheets has also been influenced by the strength of the Dollar. If the Federal Reserve pauses its hiking program that would rob the Dollar of some its impetus and would result in more credit being available to emerging markets in particular.

The Dollar Index continues to trade above its trend mean and has so far held the breakout from its most recent range. A sustained move below the 95 area would be required to question medium-term scope for continued higher to lateral ranging.