Email of the day on central bank balance sheets:

Thanks for a wonderful service Eoin. I'm probably splitting hairs here but one thing has been bothering me lately: to me you seem a bit early in declaring the central banks' total balance sheets as contracting. The US is on a modest reducing mode while the rest are steady/still increasing. The total balance chart is USD denominated, which explains the decline that shows on the chart when dxy has rallied over the last few months. On a bigger picture scale, CB balances tend to increase as the underlying economies grow. Or am I missing something here? All the best.

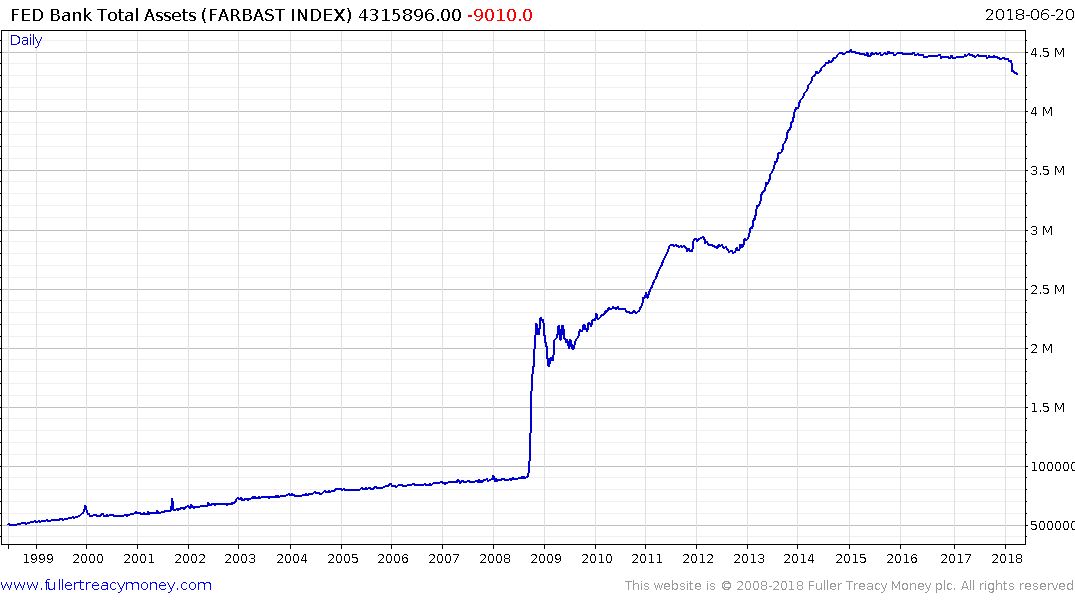

Thank you for this question which highlights some important points. There is little doubt that the US Dollar has been resurgent over the last few months and that will certainly have played a role in the contraction of the total assets on central bank balance sheets.

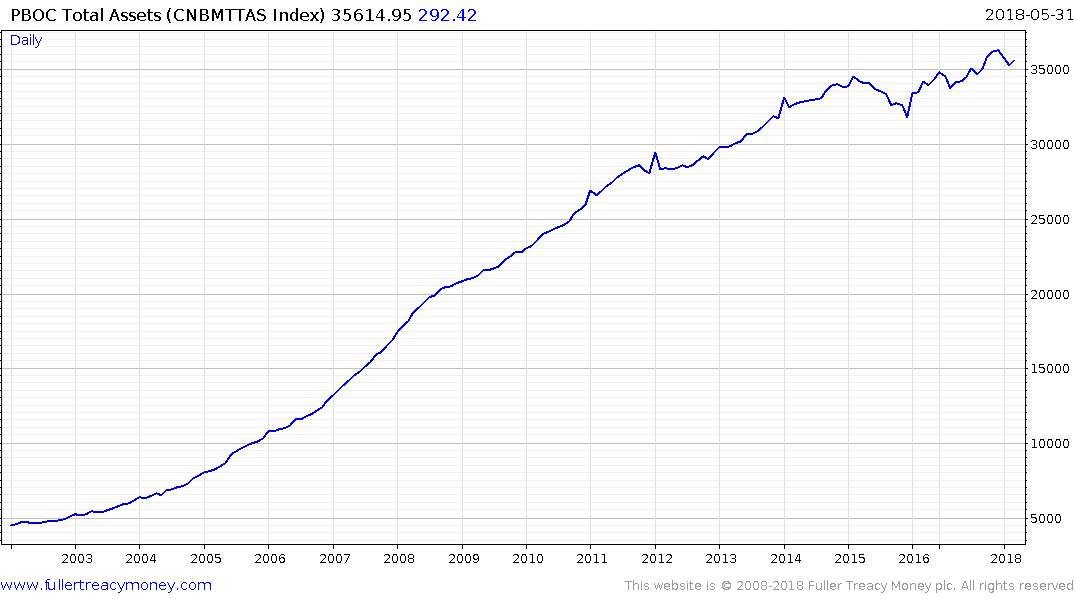

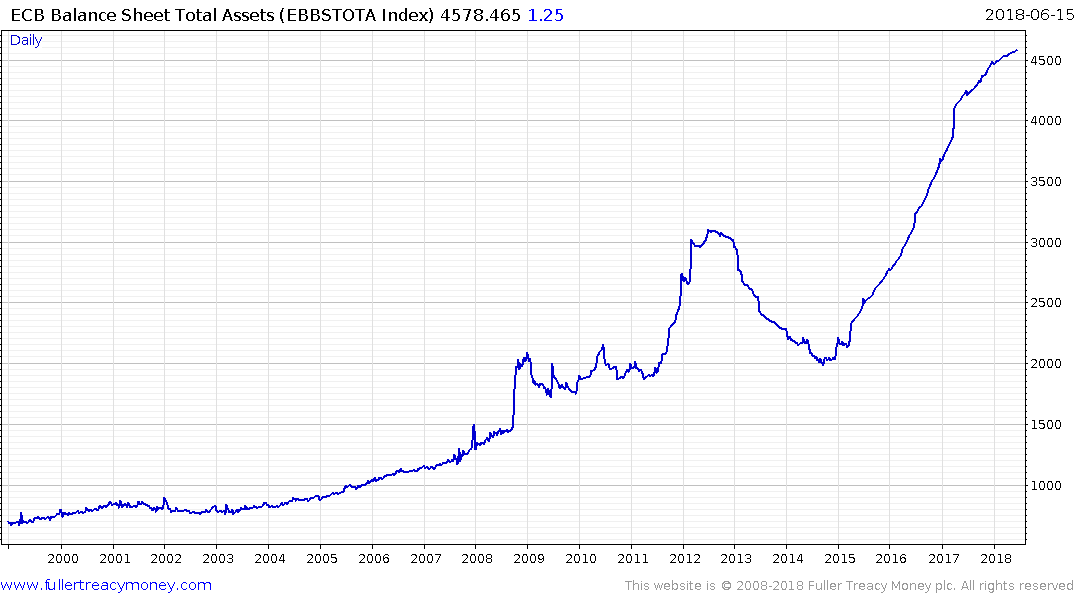

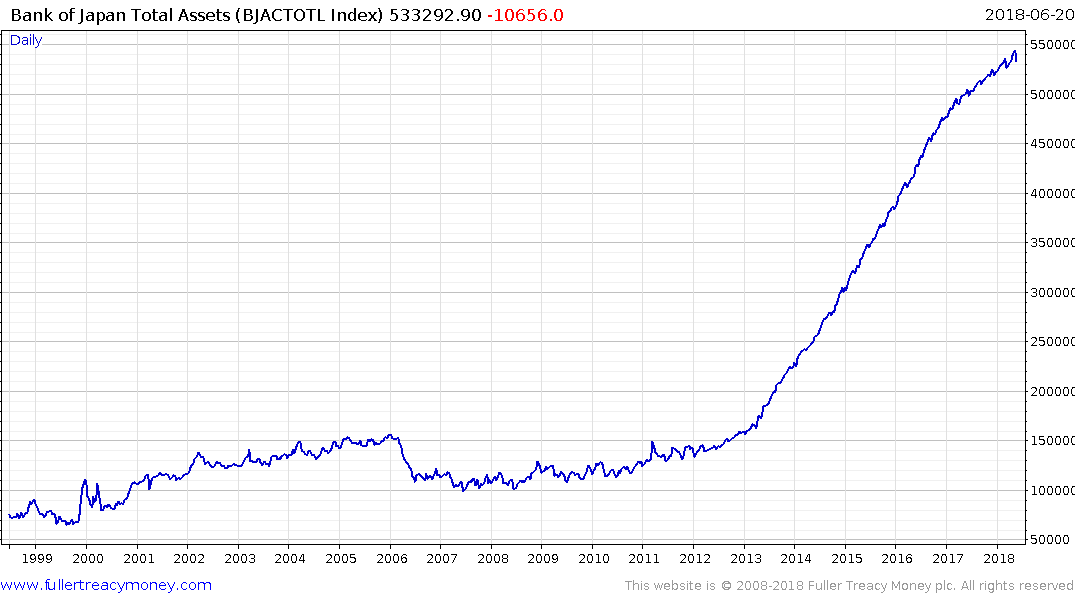

However, if we simply address the charts in nominal terms on an individual basis we can see that the Federal Reserve is reducing the size of its balance sheet in absolute terms. The EU is three months away from ceasing to add new capital. The People’s Bank of China has pretty much stopped adding new money so the onus for monetary expansion falls on the Banks of Japan which is still engaged in quantitative easing.

What these charts tell me is that the Dollar may have had some influence but the conclusion is the same; central bank balance sheets are contracting on aggregate.

I also take you point about larger economies requiring more liquidity but quantitative easing has inflated balance sheets way beyond what could reasonably have been argued for liquidity purposes.

Back to top