Email of the day on cannabis/marijuana companies

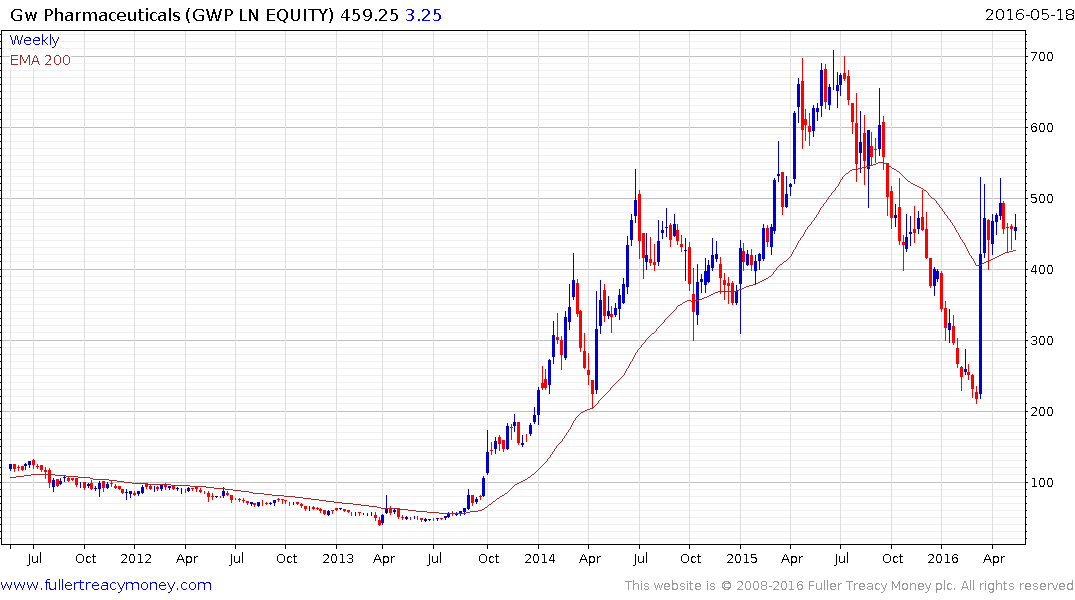

Another company with exposure to the cannabis market is GW Pharmaceuticals, a UK company which has had a significant rerating since it also listed its shares in the US.

Thank you for highlighting GW Pharmaceuticals and I had added it to the cannabis/marijuana companies section of the Chart Library.

The share rebounded emphatically in March, following a lengthy decline, on news that it has had positive Phase 3 results on its anti-seizure drug Epidiolex. It has also secured Orphan Drug status from the FDA for treatment of Dravet syndrome and Lennox-Gastaut syndrome both of which are extreme forms of epilepsy.

GW Pharmaceuticals represents a pureplay on compounds derived from marijuana, but both Abbvie and Valeant Pharmaceuticals also have products in the market with FDA approval manufactured from marijuana. These are Marinol and Cesamet respectively. Both have been approved for use as anti-nausea medications for patients undergoing chemotherapy and for AIDS patients suffering from loss of appetite.

Marinol doesn’t generate enough revenue for Abbvie to report it separately; as it does for its better sellers. The share has held a progression of higher reaction lows since September and bounced this week from the region of the trend mean. A sustained move below $59 would be required to question medium-term scope for additional upside.

Valeant Pharmaceuticals also does not report revenue for its Cesamet drug. The share has been making headlines for all the wrong reasons and collapsed. The estimated P/E of 3.34 reflects a great deal of pessimism that the company will be able to turn itself around now that its business model has received such negative press. The share has become persona non grata among the hedge fund community as major funds have been forced to exit and having a position now represents career risk for potential investors even with a nominally attractive valuation.

From a technical perspective the share is already down in the region of 90% so a lot of bad news is already in the price. It has been mostly ranging between $25 and $40 since March and is currently bouncing from the lower boundary. A sustained move above $40 will be required to confirm a return to demand dominance beyond short-term steadying.