Email of the day on bearish precious metals forecasts

I note your recent silver position. The Clive Maund “Gold Market Update” presents a persuading case for an end to the recent strong rally in PMs. He begins, “ The latest COTs are indicating another false start...with the downtrend from 2012 intersecting with the long-term uptrend from 2001”. And, “A retreat back to the support at last year’s low looks likely”

Thank you for this interesting email. How traders are positioned in an important factor but as you know we put greater emphasis on price action.

Gold has been ranging between $1200 and $1400 since June 2013. Until we see a breakout in either direction we will not have confirmation that demand or supply have returned to dominance. I find the fact that the $1250 area held on the last pullback to be a positive outcome which increases potential that the $1400 area will be retested.

Additionally the fact that gold has been linked with the industrial metals in the Qingdao port rehypothentication scandal raises the potential for consumers to invest in restocking which should be a net positive.

Silver is at an interesting juncture. It has also been ranging since June 2013 but a progression of lower rally highs is still evident. It has rebounded again from the $19 area and is now testing the region of the 200-day MA. Silver hasn’t sustained a move above the MA since late 2012 so if it can continue to hold in this area the potential for an additional rally will improve.

Generally speaking, sentiment towards the precious metals has been quite bearish suggesting shorts were in place, longs had been liquidated and participation had dropped. Against that background, improving price action is generally an indication that the bearish case has been overstated.

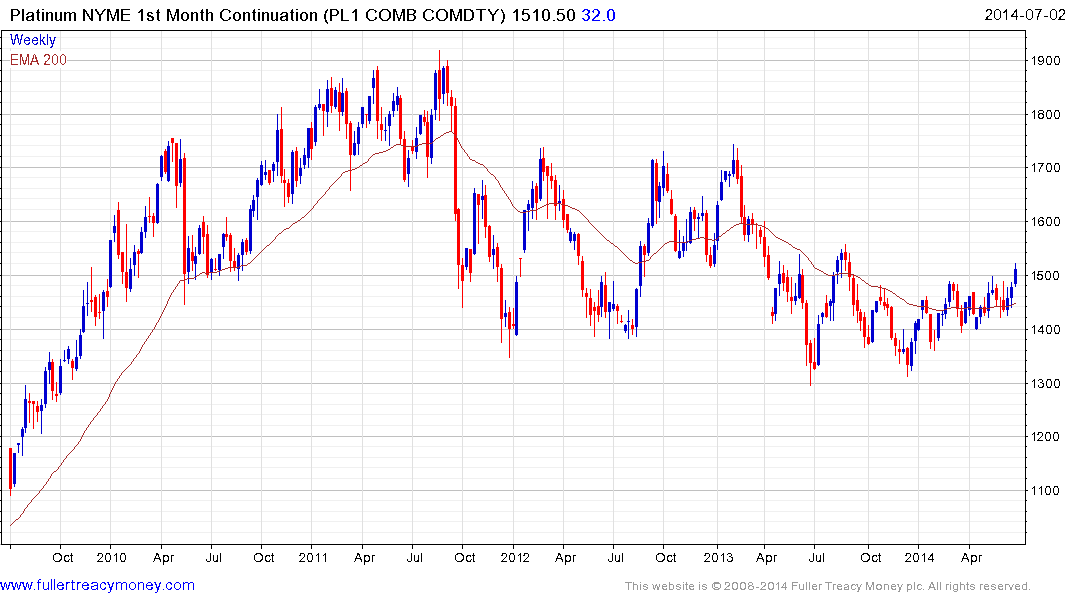

Platinum has held a progression of higher reaction lows since December and broke successfully above the psychological $1500 area for the first time since September this week.

Palladium has rebounded from the $800 area and a sustained move below that level would be required to question the consistency of the medium-term advance.