Email of the day on bank excess reserves

Happy New Year to you and your family in California

Thank you for responding to my question, directly on the daily commentary .

In that commentary you said that banks still prefer to hold a reserve at the FED in their balance sheet rather than holding Treasuries (as a result of the balance sheet reduction) , although both have same credit rating (i.e. the credit rating of the US government)

I don’t understand the last point. Why should banks prefer holding a lower yielding reserve asset than a higher yielding Treasury bond, if we isolate the duration difference between the 2? I am struggling to understand why balance sheet reduction is so bad a thing for banks (as liquidity providers as you point out) if they exchange one asset for the other. Their lending power is not impaired as a consequence. Or am I wrong? actually lending activity by commercial banks in the US has been picking up until end of 2018 notwithstanding the equity markets gyrations

Btw. I am attaching a link of chart showing the increase of Treasuries and Government agency papers + MBS by commercial banks in US. They are picking up. They have accelerated in December so much that the new 10 years yield now discounts only one rate hike for 2019. Very bearish an implicit scenario

Thank you for this follow-up question. (The original was posted in the Comment of the Day on December 21st )

The money the central bank pay banks for parking reserves is guaranteed but Treasuries change in value from day to day and therefore have more volatility. Any volatility represents more risk than none and therefore more uncertainty

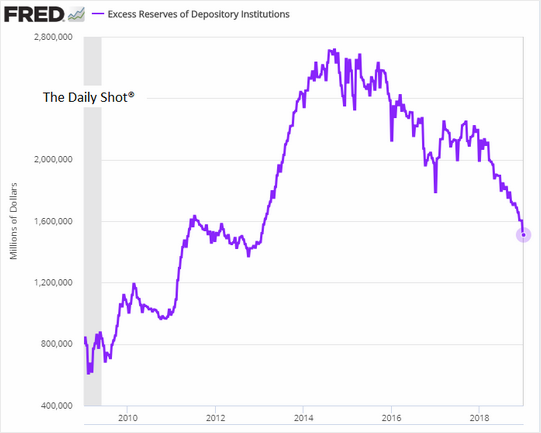

Excess reserve balances have been falling since 2016 but the pace of the contraction picked up after the Fed reduced the interest rate relative to Fed Funds Rate. More risk in the banking sector means interbank rates should rise. That’s the primary reason LIBOR rates have been trending higher.

I agree, the significant contraction in Treasury yields is reflective of strong appetite for safe havens against a background of slowing global growth and where the market does not yet have evidence of a Powell Put to rely on. However, Treasury futures are short-term overbought and susceptible to some consolidation right now.