Email of the day on an expected copper supply surplus

Thanks for your insightful reports from the meeting in Saudi Arabia. Amazing to have taken part in presentations by so many important CEOs.

I was particularly interested in your story of the mining companies salivating at the thought of all the coming increased demand for copper. Yet a number of reports I have seen recently predict that the copper price will actually fall in 2022. For example:

https://www.indexbox.io/blog/copper-prices-to-slump-in-2022-on-rising-supply/

https://www.spglobal.com/platts/en/market-insights/latest-news/metals/120721-feature-copper-market-to-be-well-supplied-in-2022How can I reconcile these views in your opinion?

Thanks for keeping the videos going despite time changes and jetlag. It is particularly impressive that you manage to keep the audio completely intelligible, even if one isn't watching the video at the same time. That makes it possible to listen to it while for instance having breakfast, which is my habit.

Thank you for your kind email and this topical question. I’ve seen these same kinds of reports anticipating a surplus this year and next. Ultimately, it is going to be a question about how many of the policies committed to at COP26 and other forums will in fact be acted upon.

If the world does in fact adopt some form of global carbon pricing, moves towards reducing reliance on oil and fossil fuels and pioneering new technologies, we are in for an epic mining boom. If even a fraction of the trillions in spending committed to comes to fruition it will be enormously bullish for the mining sector. If all we have had is virtue signalling then it will be difficult to sustain high prices after the pandemic recedes as a global priority.

Copper’s futures curve has a significant belly. That implies perhaps some supply excess in the next few months but there is a backwardation priced in between June 2022 and September 2024. I would point out, however, that despite the shape, the curve is very flat. The belly of the curve is at $4.28. that’s only 14₵ from current prices. Against a background of rising yields, that’s very tight.

Copper’s futures curve has a significant belly. That implies perhaps some supply excess in the next few months but there is a backwardation priced in between June 2022 and September 2024. I would point out, however, that despite the shape, the curve is very flat. The belly of the curve is at $4.28. that’s only 14₵ from current prices. Against a background of rising yields, that’s very tight.

The price has held a 10% range for most of the last year and is currently steadying in the region of the trend mean. As long as the $4 area is holding, I am willing to continue to give the benefit of the doubt to the upside.

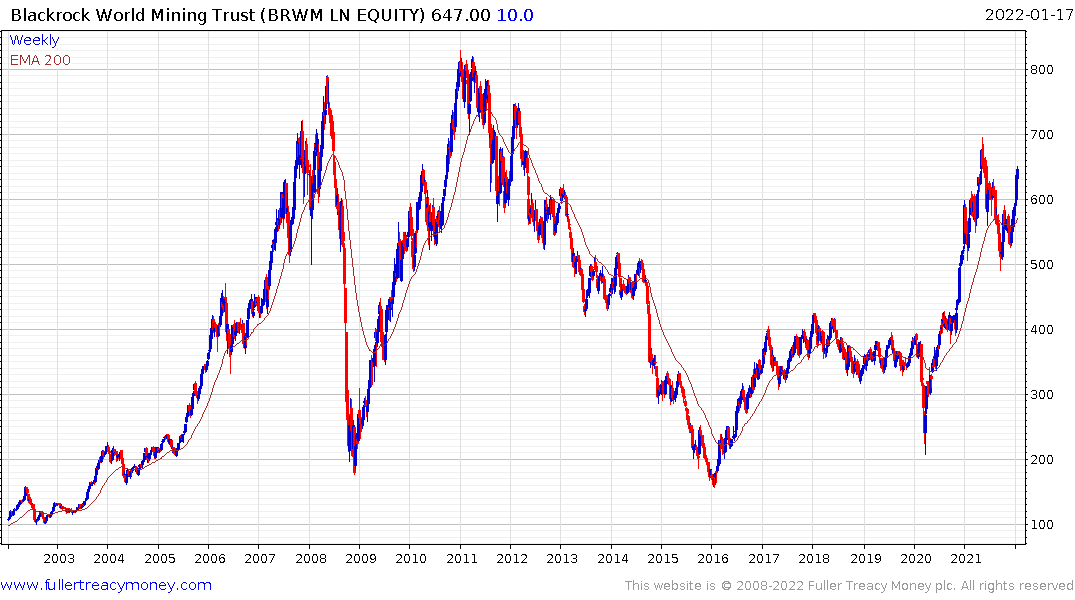

The Blackrock World Mining Trust is currently trading at a discount to NAV of 1.33% and is firming in a dynamic manner from the region of the trend mean.