Email of the day on accelerating trends in the currency markets

Just finished to watch the video

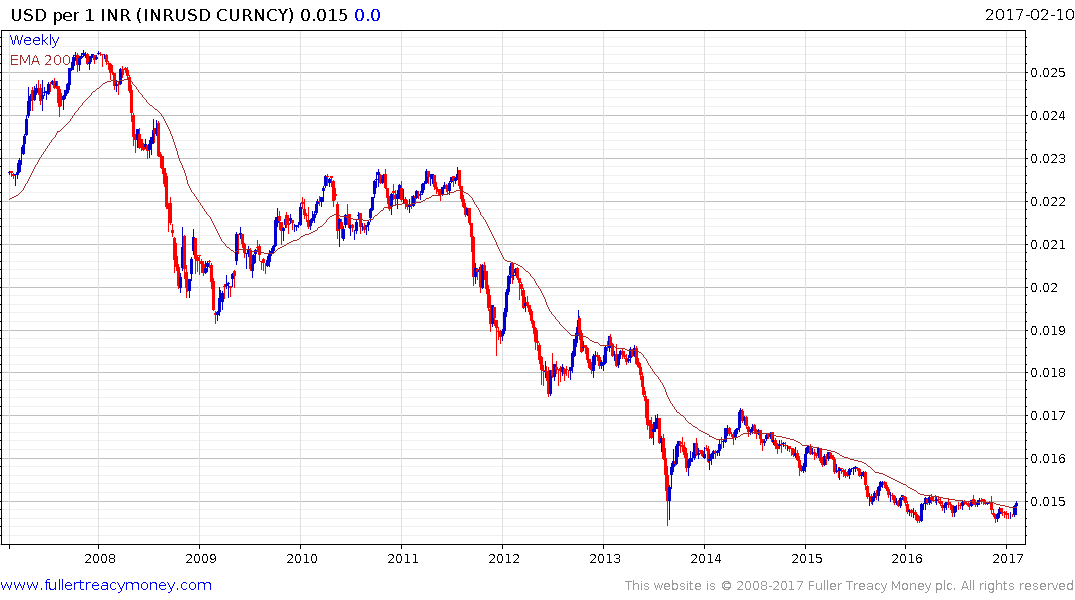

Interesting take on India and the Rupee

Last week I entered a short Non Deliverable Forward NFD on USDINR for myself for the same reasons you mentioned in the video . Now I feel mentally confirmed …confirmation bias through an expert opinion J

I did the same in December with MXN . I will start to place stops here - in case we have some kind of “Trump induced” relapse

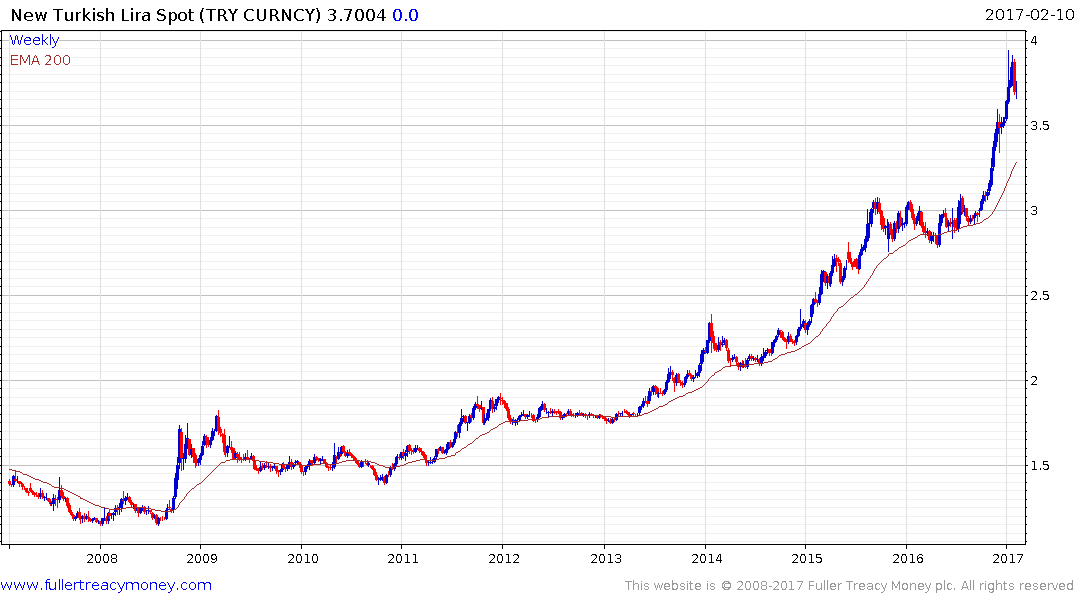

On TRY I still don’t dare..(though the Turkish ISE index equity market is the best market YTD if you have noticed , even in USD and EUR terms) . but TRY has just started to barely move below the 4 level on the €

Thank you for the lots of insight in the commentaries . The next challenge will really be the bond market

Thank you for sharing your views and congratulations on seizing opportunities in what have all been counter trend moves against accelerating moves.

At The Chart Seminar we describe acceleration as a trending ending. In an uptrend the trading activity which creates the acceleration expends the available demand very quickly so that the point when there are no more buyers available is quickly reached. At that point all that are left are overextended leveraged holders sensitive to even small moves against their positions. When the reversal comes it can be violent as stops are hit. The pullback is often contrary to the received wisdom propagated by the media which is exactly what we have seen recently in the currency markets. .

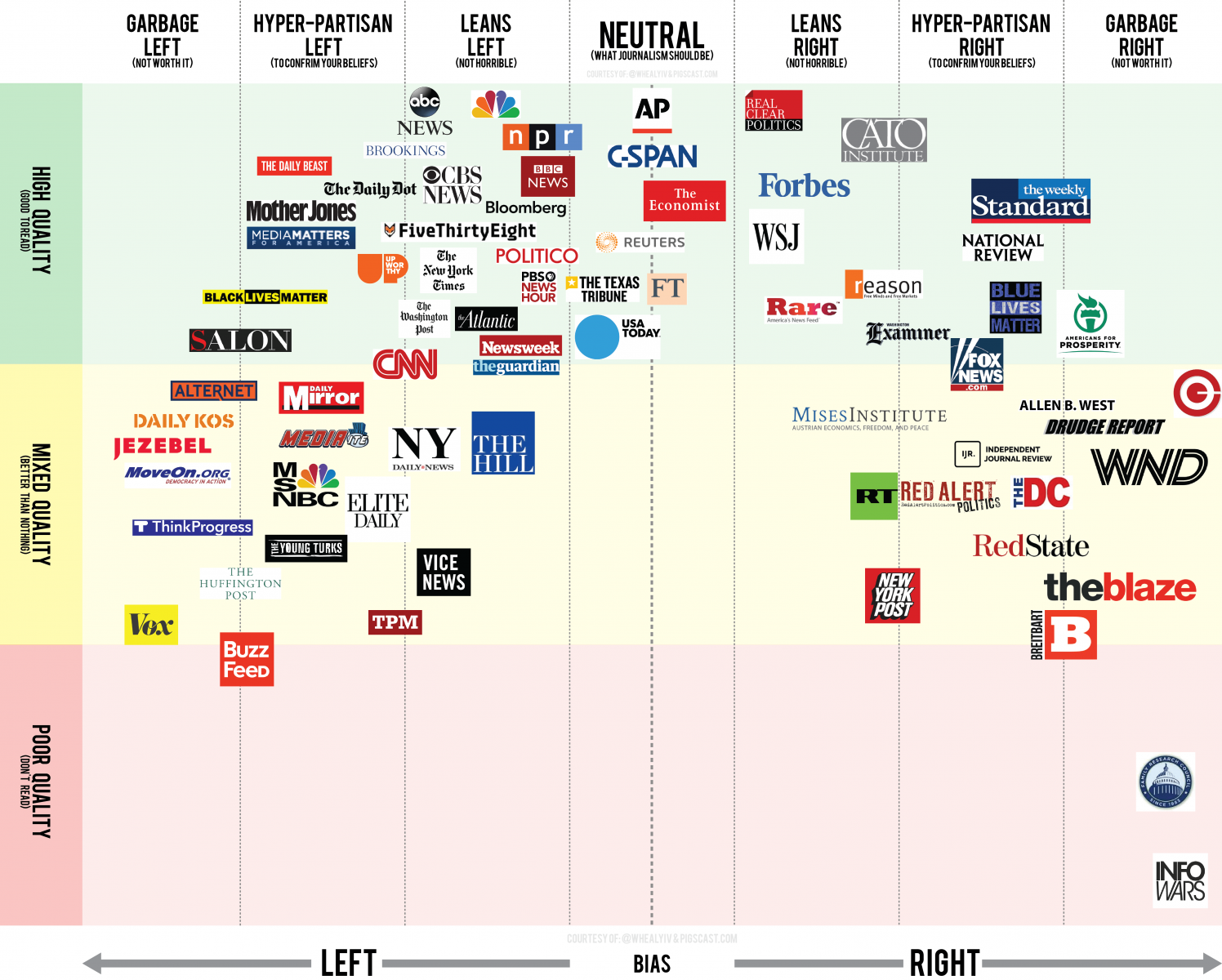

Thanks to a subscriber for this illuminating graphic detailing how news outlets arrange themselves so that they appeal to very particular demographics and then rank on how emotionally charged and polarising their commentary is.

Considering that the primary goal of news outlets to is to get as many people to consume their material as possible they have a vested interest in writing about only the most interesting stories. Those have usually been in the public sphere for some time already. As an investor, it is often best to pay at least as much attention to the motivations of the author of an article, or report, as to the content.

Despite negative news flow, not least via Twitter, the Mexican Peso has now unwound the majority of its overextension relative to the trend mean. Measures are underway to support the currency such as raising short-term rates, now at 5.75% from 3% in late 2015. Nevertheless a sustained move below the trend mean will be required to challenge medium-term Dollar dominance.

The Indian Rupee has been trending lower for decades but has at least stopped going down. It is now trading in the region of the trend mean and will need to sustain a move above it to confirm a change to the medium-term trend.

The Turkish Lira has been trending lower for six years and accelerated to its January low below TRY4 against the US Dollar. At least some consolidation is underway and a reversion back to the mean is looking increasingly likely. How well the dollar finds support in the region of the trend mean will tell us a lot about how the medium-term trend is going to unfold.