Email of the day another email on the CAPE and the merits of cash

In your 30th April response to my email, you say as follows "The only problem I have with comparing the current environment to that which prevailed from the early 1960s is that the market spent 13 years ranging from 2000 to 2013 so it would be unusual to begin another similar range so soon after the last one ended"

My response: Yes, it is true that it would be unusual to "commence a similar such range so soon after the last one ended." However, in this circumstance, there are a range of other very unusual related circumstances.

In the last 10 years, we have had a unique period of historically extreme money printing with very little consumer prices inflation as measured by the official CPI number, but this extreme period of money printing has caused very high asset price inflation - pushing many sectors back up into fairly extreme valuations as measured by historical norms.

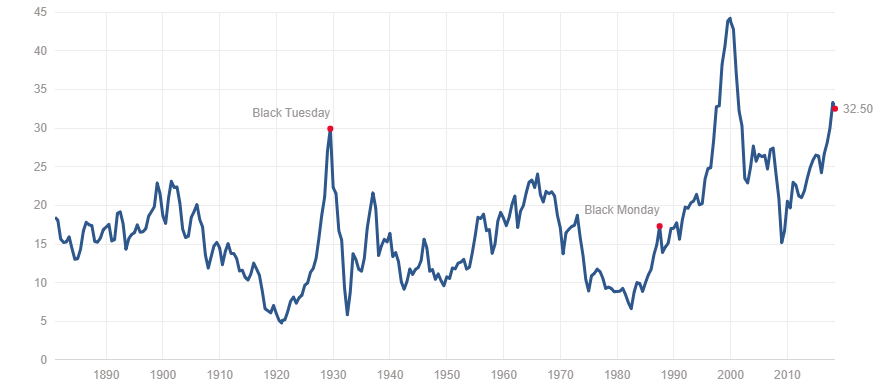

We can also look at this phenomena from another. If we look at Professor Robert Shiller’s cyclically adjusted price/earnings ratio series commencing 1880, we can see that secular bear markets have typically ended with a single digit CAPE - at the end of a secular bear market, the cyclically adjusted P/E has been in the range of 5-7 in 1982 and 1921.

By contrast, the January 2018 peak in the US cyclically adjusted P/E of 33 was the second highest instance since 1880 - only being surpassed by the dot com peak in 2000 but surpassing the 1929 peak by a small margin.

So, by this (Shiller CAPE) normally fairly reliable valuation measure, the US share market on broad averages is at a fairly extreme level. I think it is fair to say that if you buy expensive assets, you should expect poor to bad average real returns over the following 10 years or so.

One last point to you 30th April comments, to the section where you say "The stock market is a better hedge against inflation than bonds because companies have the ability to raise prices and therefore dividends while bond coupons are fixed." In a period of rapidly rising inflation like the 1970s, all listed securities including shares and bonds tend to do poorly because of the rapidly rising discount that needs to be applied when valuing such assets. By contrast, in Australia at least, during the 1970s, cash and hard assets like gold and commercial property were better investments.

Thank you for this riposte to my answer to your original question posted in Comment of the Day on April 30th.

Please see my comments on the Shiller CAPE above but one other point is worthy of consideration. US corporate earnings are a lot more international today than they were previously. Therefore, it is a reasonable argument that it is not a fair comparison to plot today’s corporate earnings against those of the 1920s or even the 1980s.

There is no doubt stocks are a better hedge against inflation than bonds. However, I agree that as interest rates rise the relative merits of cash and assets with limited supply such as gold, commodities and property tend to also be better appreciated by investors. The run-up in the shares of luxury goods manufacturers over the last few months is another example of people frontloading purchases in anticipation of inflation.

I am personally long of gold, gold shares, silver and nickel right now because I believe their have favourable chart patterns that will be resolved by clear breaks on the upside. That hypothesis has been challenged somewhat over the last couple of sessions but this increasing evidence that the short-term oversold condition could soon be unwound.

I don’t think the unwinding of QE is going to go smoothly either. That is one of the primary reasons for the run-up in US sovereign yields and the rally in the US Dollar. However, so far, the effects have not been concentrated on the stock market. The biggest question is what is going to happen with QE when we get the next recession. Will central banks simply start up the printing presses again but this time on an even larger basis?