Email of the day - on what the market reaction to the coronavirus portends

Today’s commentary regarding the developing crisis in the credit markets is a major concern. With that worry in mind, the Boeing chart and S & P Banks Index chart become alarming.

The financial markets appear to have been kept afloat only by increasing credit at lower and lower interest rates which may have reached their bottom limit.

In Australia, the COVD-19 is already affecting the economy. A New Zealand/Australia cricket match today was played without spectators. Next week’s opening round of Australian football will also be played behind closed doors! Micro businesses, such as coffee shops, are reducing staffing levels. Small business loan defaults are inevitable and will put extra pressure on banks which are already under threat.

Are equity markets signalling a debt crisis that even the Fed cannot overcome?

And

Thanks for your calm evaluation of the current situation. I just want to remind the collective of one of David's mantra: I remember him saying, "If you are going to panic, panic early". I know it is not easy but with your analysis of past recessions, would you be willing to make a very rough prediction as to how long do you think before markets will start to stablise. Thanks again. Best rgds

Florida has hurricanes every year. People know when they are coming, so they stock up on essentials, take out a subscription to Netflix and hunker down to wait it out for a few days. Hurricanes have an economic impact that measures in the billions because of the damage done to physical infrastructure but economies pick right back up afterward because of the additional spending on rebuilding. It’s the classic version of the broken window argument in economic theory.

Hurricanes cause isolated credit events in the most overleveraged, least well-insured businesses but does not result in a wider credit event even when they are particularly disastrous like Hurricane Katrina. The coronavirus is worse than a hurricane. Let’s try and unpick why that is:

Geographical dispersed rather than concentrated - For one thing it is global and while the intensification of infections is concentrated in regions at present, everywhere is going to have to deal with it at some point over the coming year.

Physical infrastructure will be unscathed - When a hurricane ends, everyone knows the end of the season will result in an end to the storms and they get busy rebuilding which is an economic stimulus in itself. There is plenty of old infrastructure that needs to be replaced. Everything from oil roads, powerplant, dams and bridges are overburdened and need to be replaced but that is going to be required substantially more spending than the aftermath of a hurricane because of the geographic dispersion of the viral effects.

Consumer confidence - A hurricane represents a short-term hit to consumer confidence but once the sun comes out people get back to their regular routine almost immediately. The quarantine for the virus is 14 days but if other people enter quarantine either before or after me there will be a staggered impact. Additionally, the only way I can safely leave quarantine is with the knowledge neither I nor my family are currently infected or likely to be at heightened risk of infection if we re-engage with social activities. The only way that can be achieved is with pervasive and repetitive testing. Even then the impact on consumer activity is likely to be prolonged and we are only at the beginning of that process. Additionally, the staggered nature of the global outbreak means lockdowns will need to stay in effect for as long as the virus is spreading anywhere in the world. Singapore’s refusal to allow any cruise ships dock is a good example of that.

Business activity - The challenge for business will be to ensure they can continue to function through the crisis. That is impossible for anything where person to person contact is essential so the low-end services sector is where the damage is going to be most apparent. Importantly, this sector is where the majority of job growth has been in during this expansion.

All restaurants, hotels, Airbnb renters, B&Bs, sports clubs, dance studios and gyms are going to be under severe strain for months. Many businesses do not have the financial assets to meet payroll and fulfil lease terms while there is no income. Where they are relying on debt to supplement cashflow bankruptcy in largely inevitable. The valuation of companies like Uber and Lyft is based on rising number of journeys. Right now, they have declining journeys and that is before unemployment rises.

The trickle-down effect of large numbers of businesses feeling strain is the effect that will have on cloud companies that rely on B2B and B2C sales for their entire business model.

Obvious versus covert - Hurricanes are big messy obvious affairs. Everyone can see them; the effects are obvious and needs for action urgent. A virus is covert. Its effects are confined to statistics and very few people initially have any conception of what it is like to be sick or what the personal risk of lasting injury or death is. That means there is a lot of argument about what the best way of dealing with the threat is.

Take these two examples: A friend in Singapore took a Grab with his family to the beach and was alerted later that day, the driver had been exposed by a previous passenger. The whole family was quarantined for 14 days. They got out of quarantine on Valentine’s Day. This week, a sick individual on a Southwest Airlines plane was removed on landing in Florida and everyone else on board went home. It’s not difficult to understand why Singapore has been able to get a handle on its outbreak and the UK and USA have resigned themselves to mitigation.

This article from Bloomberg today is of particularly interest. Here is a section on the UK’s NHS:

One of the main concerns for the government is potentially overburdening the already stretched and understaffed National Health Service. The U.K.’s strategy has drawn criticism from medical professionals. Richard Horton, editor of the prominent British medical journal The Lancet, said on Twitter this week that the government is “playing roulette with the public.” Officials have been too slow to implement measures to delay the spread of the virus, including canceling events and “social distancing,” he said.

Sridhar, the public health specialist, said there’s a middle path between a complete shutdown and carrying on as normal and called the government’s position “puzzling” given the U.K. agrees that the outbreak is very serious. She worries about giving up on the effort to track down contacts of infected people, which is essential in delaying the spread.

“If you look at the success of Singapore, South Korea, Hong Kong and China, they had really rigorous contact tracing,” she said. “It’s almost throwing in the towel too early.”

The estimate of 60% equates to about 40 million cases in the U.K. and 800,000 deaths, assuming a fatality rate of 2%. Herd immunity is usually used in the context of diseases for which there are vaccines, Sridhar said. So far, there’s none for the new coronavirus.

U.K. government officials said as many as 10,000 Britons may already be infected and that the peak of the outbreak could be in 10-14 weeks.

This willingness to let the virus roll through in a 10-week period, taking the economic toll to about June seems to be incredibly reckless and the lack of testing kits is only going to make the job of improving sentiment all the more difficult.

So, the coronavirus is bigger, longer and more damaging to sentiment than a hurricane. It therefore has a much more pronounced effect on debt servicing ability. That would be a problem at the best of times but when leverage ratios are so high it represents a significant issue.

The big similarity is it will end, but we are looking at a hit to global economic growth in the 1st and 2nd quarters on par with the financial crisis. The 3rd quarter will likely bring some stability and the 4th quarter a recovery in economic conditions. If the virus returns for a second time in the winter, like the Spanish flu did, we are likely to have a major economic contraction. The stock market is likely to lead the economy by at least one quarter and possibly two.

.png)

.png)

The 10-year - 3-month yield curve spread is now rising in a dynamic manner. That is a reliable indicator we are at the beginning of a recession.

The massive underperformance of banks and the fact the TED spread is breaking on the upside also supports the view we are going to have a recession because of stress in the banking sector as liquidity becomes tight.

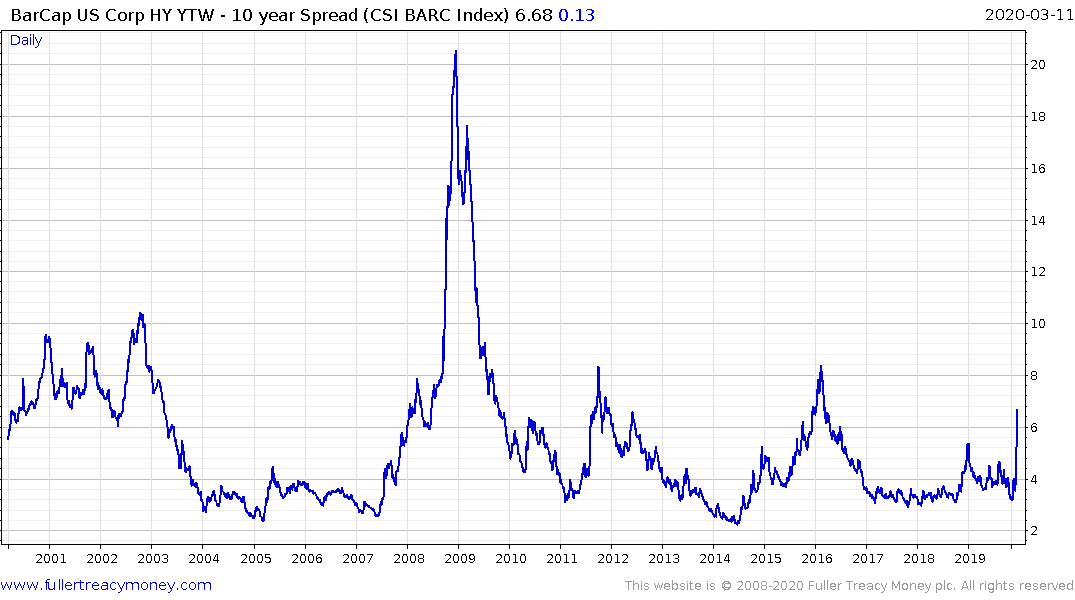

High yield spreads are back in the region of the peaks from 2016 and 2011.

The Dollar’s rally is representative of the desire for cash but it is also going to put funding pressure on emerging markets in particular.

The significant declines in the stock market, amplified by quantitative systems all reaching the same conclusion at the same time is a modern-day redo of the 1987 crash. It is enormously debilitating to sentiment but everyone knows what happened after the crash. The economy bounced back quickly because the underlying economy was strong.

This is a unique situation but people are going to get cabin fever from being cooped up for long periods of time. It is reasonable to conclude sentiment will be slow to recover but it will recover. I strongly believe we are going to see a range of policy supports at least on par with, and quite likely in excess of, those implemented during the financial crisis. The infrastructure spend alone is enough to drive a global reflation trade but the next six months are going to be very difficult.

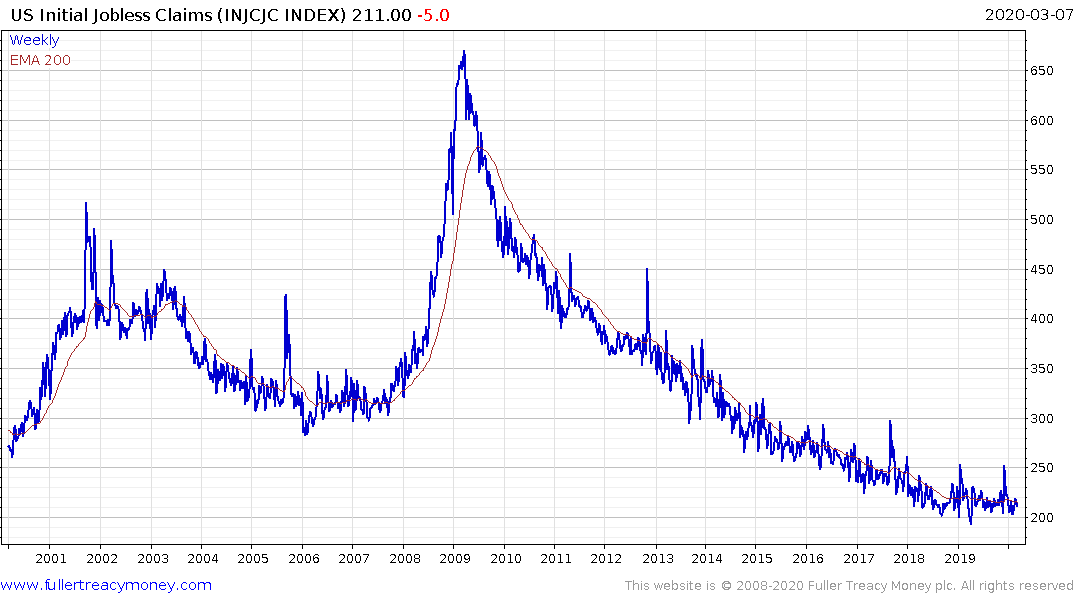

It is reasonable to expect a large spike in unemployment as small businesses go bust and as factories reduce capacity because of a lack of demand in the short term. Importantly that is not yet showing up in the data.

The efforts to ease that burden and/or defray that threat will include tax holidays, stretched maturities, forgiveness for missed payments, temporary support on lease agreements, government-funded sick leave and anything else that is deemed necessary to preserve the economy and it will work; albeit with a delayed impact.

The most important point to remember is massive reactions against the prevailing trend always elicit the kind of response from people like the questions in the above emails. Accelerations are trend endings and we have very deep short-term oversold conditions. In a secular bull market, the 1000-day MA is generally the most significant area of potential support during medium-term corrections.

.png)

The peak in 2007 resulted in a pullback to the region of the 1000-day MA and it subsequently encountered resistance in the region of the 200-day MA following a rebound. That was clear confirmation of the bearish trend because it represented a first step below the type-2 top.

We have seen enough trend inconsistencies to support the medium-term peak conclusion. It is looking increasingly likely we are due to rebound and next week’s Fed statement could easily be a catalyst for an additional short covering rally. The big question will be whether it can sustain a move above the 200-day MA. This is a bear market and it is for the bulls to prove their case.

The technology sector has been a relative strength leader so far and the Nasdaq-100 has only unwound the October-February portion of its advance. However, it has experienced significant technical deterioration with the failed upside break.

Best case scenario is the majority of markets range for the next six months and break higher in the third quarter. From that perspective monitoring the performance of China and regional Asian markets, with the best success rates in controlling the infection, will be instructive for what to expect from everywhere else later.

Worst case scenario is the major economies continue to fumble their response and the economic impact drags out which puts further pressure on loss making companies. The potential extinction of loss-making unicorns has the real potential to move further up the food chain as their spending evaporates. If that is deemed likely then the major indices will sustain moves below their 1000-day MAs and break the decade-long uptrend.

The debt issues of municipals, highly leveraged home owners, governments, companies and the outlook for buybacks and dividends is all predicated on government bond yields continuing to remain low. Trouble would really become manifest if bonds yields trend higher without a meaningful uptick in the economy because it would implicate solvency/sustainability issues.

Back to top