Email of the day - on interest rate sensitivity and overbought conditions

At Greatest Risk from Higher Bond Yields? Eoin, we have seen some sizable sell offs in recent weeks from the hottest sectors such as Green Power, and the various Innovation Funds/ETFs as well as Electric Vehicle sector. As you'd pointed out, they are benefit from super low rates as growth is essentially free. What risk for EM though, which otherwise has been on cruise control of late? Today has seen a sizeable sell off, but is this just the first shot across the bow? Which of the EMs would you be most guarded against? What else might be at greatest risk given the run ups we have had in markets over the last 12 months?

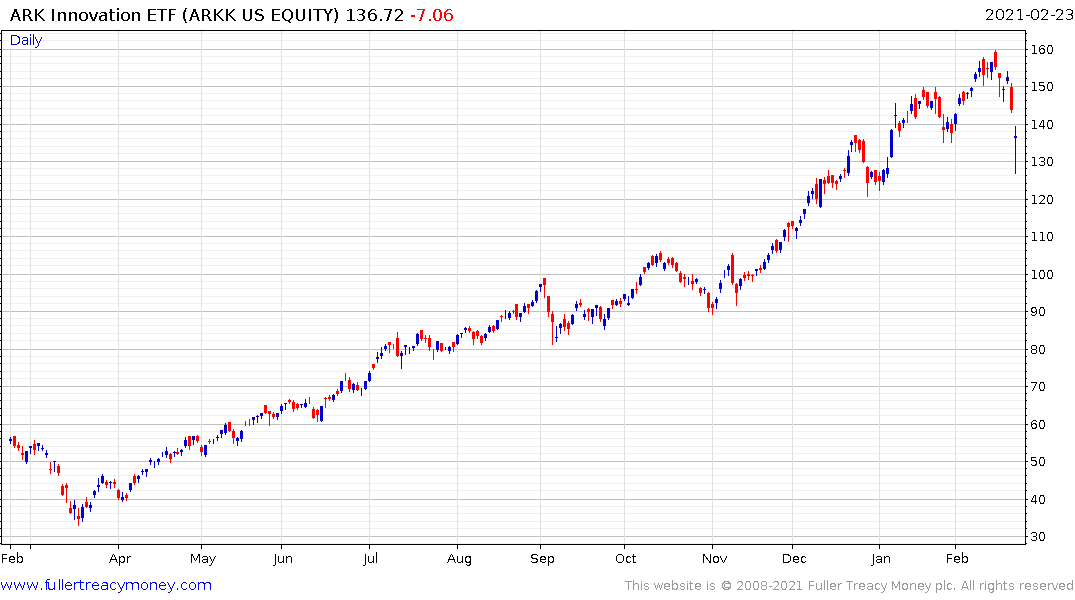

The ARK Innovation ETF has pulled back by about 20% over the last six sessions. That’s a sizable pullback but the fund was up 383% since March 2020 so it was due some consolidation. This reaction has broken the 12-month sequence of higher reaction lows so the trend is no longer as consistent as it was on the way up.

If dip buying is to be successful, today’s intraday will need to hold.

This is what Jay Powell had to say today. “The economy is a long way from our employment and inflation goals, and it is likely to take some time for substantial further progress to be achieved,” There is no way the Fed is going to taper their assistance until the unemployment is back within the pre-pandemic band.My view - The ARK Innovation ETF has pulled back by about 20% over the last six sessions. That’s a sizable pullback but the fund was up 383% since March 2020 so it was due some consolidation. This reaction has broken the 12-month sequence of higher reaction lows so the trend is no longer as consistent as it was on the way up.

The big question from bond investors is how quickly will they increase assistance. The yield curve is steepening and Treasury yields are trending higher. The most interest rate sensitive sectors such as new (unproven) innovation, Tesla, renewables etc. have pulled back first and most. They are unlikely to return to outperformance until we see some evidence of efforts to control the sell-off in government bonds.

Meanwhile, the reflation theme remains in play. No one believes governments are suddenly about to become born again fiscal conservatives. They need inflation to erode the massive swell of new government debt taken on over the last 12 months. That remains Dollar bearish overall.

Emerging markets, commodities and gold all tend to do well in such circumstances. There will, of course, be ebbs and flows along the way. The fact investors need convincing of this suggests the move is still in its infancy. Meanwhile the conviction people have that innovation will save us all from whatever we worry about suggests that trend is already well understood and owned.

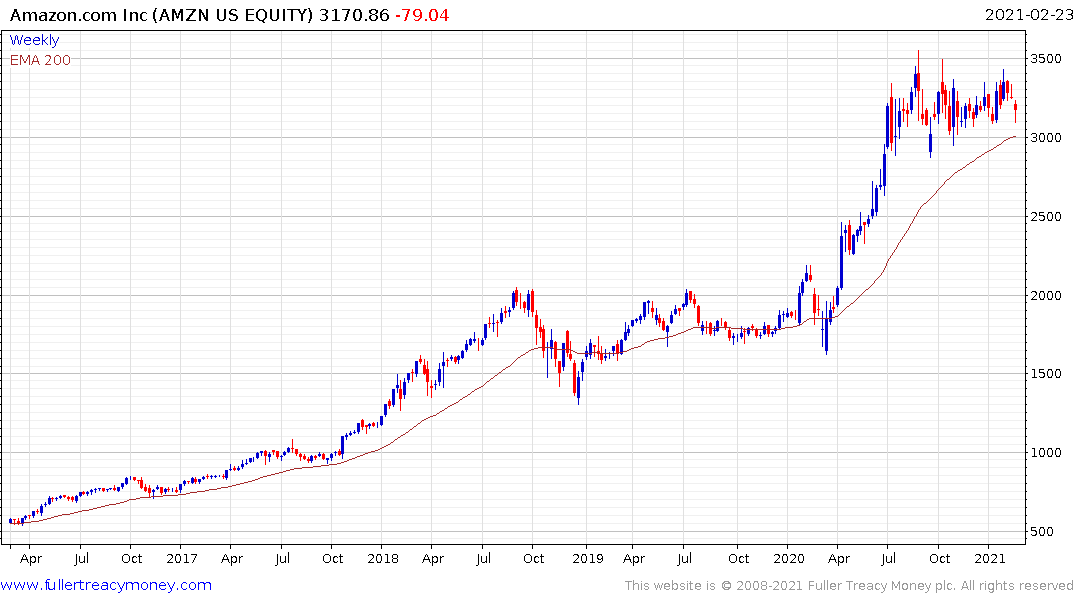

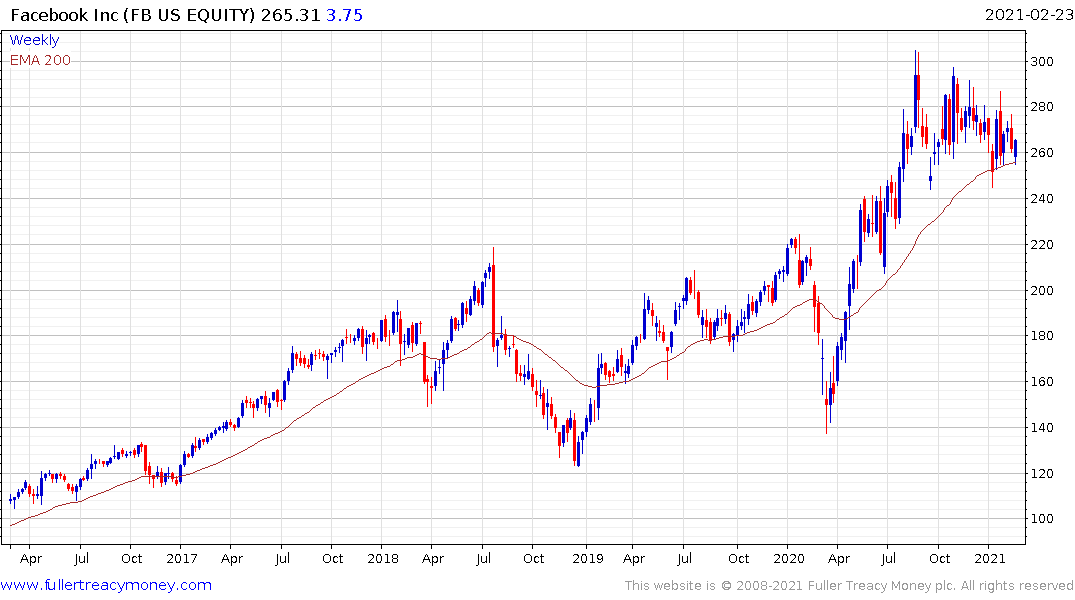

Mega-cap companies like Amazon, Apple, Netflix and Facebook all bounced from the region of their trend means today. Microsoft and Alphabet continue to outperform. That suggests these better capitalised companies may now turn back to outperformance relative to the innovation.