Email of the day - on chasing outperformers

With respect to the second note, and knowing your own preference to stay with the "winners" and cut the "losers", at what point do you look to valuations and question the sky-high prices people are willing to pay for these "winners"? I personally have a tough time chasing stocks that have already run, but for now at least, they just keep going, proving highly frustrating!

Thank you for this question which others may also have an interest in. The best time to buy is following a significant pullback. The next best opportunity is following the first reaction from an important low. The next will be when a breakout to new highs occur.

However, the farther away the price gets from the low, the more difficult it is to make the decision to buy, the more faith has to be put in the emerging bullish hypothesis and the smaller the position has to be to allow for a pullback.

Gold shares and dividend aristocrats represents some of the best opportunities in March. (See Commend of the day on March 20th , the go-to buy-the-dip shares also rebounded extremely impressively. http://www.fullertreacymoney.com/general/reduce-re-orientate-equities-raise-cash-favour-usd-eur-and-chf-/. I wrote this piece on March 23rd, the day of the low.

A rebound in the S&P500 was predictable as early as March 17th but I was surprised by how far the rebound has gone. For the Index to get back to the region of the 200-day MA in such a short period of time is truly impressive and is a testament to the continued power of massive liquidity infusions to boost asset prices.

We have not yet seen a significant pullback with evidence of support being found above the lows. There is the potential it will be a shallower pullback than many might wish but the risk/reward of buying now and betting a consolidation does not occur is unfavourable in my view.

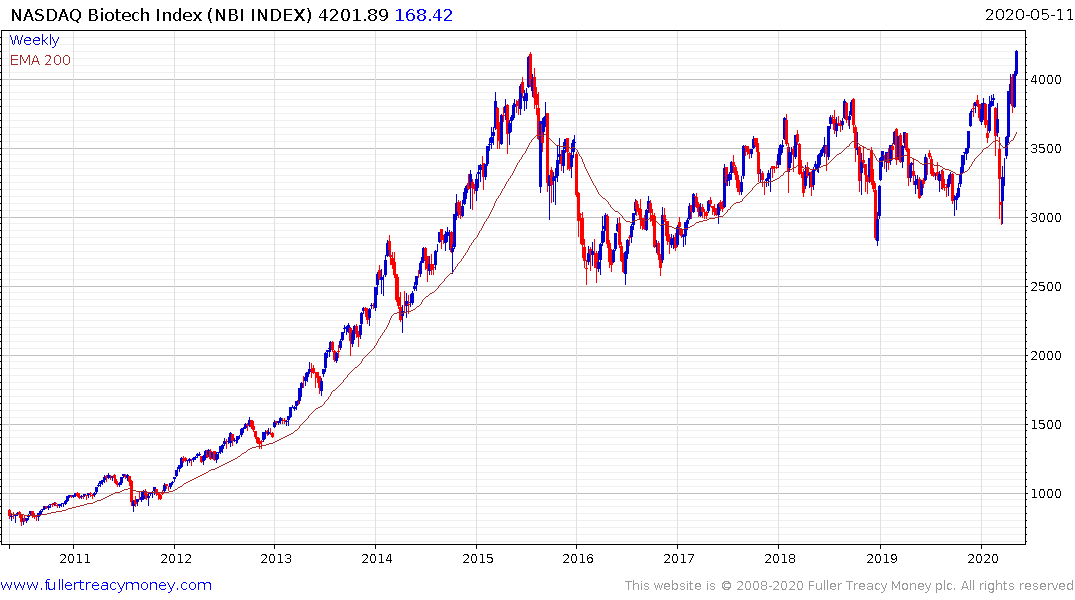

The one sector that has clear base formation completion characteristics today is biotech. The Nasdaq Biotech Index just broke out of a five-year range. That suggests we are only at the beginning of a new medium-term bull market for the sector, subject to it continuing to find support in the region of the trend mean. .