Email of the day - on bitcoin

“Since you've been commenting on bitcoin recently. You may find it interesting for posting on Fuller Treacy Money site, but I am also asking for your comment for our article. Since the article is in Russian, I will summarize for you.

Moscow is experiencing an acute shortage of videocards. Actually, there are none in computer shops now (you have to order and wait for 7-10 days). Also, due to feverish demand, prices grew twofold in the last six weeks. Sellers in shops tell us that this is because buyers have been often buying 200-300 videocards at a time. The demand comes from a growing number of PC users mining bitcoin and other cryptocurrencies on their computers, i.e. using complex mathematical methods to create and get a bitcoin. Videocard processors, it appears, are the best for such mathematical calculations. This activity jumped recently, with bitcoin rising from about $1,000 in late March to $3,000 on June 12. While another popular cryptocurrency, Ethereum, increased more than 20-fold since early March to June 13.

I noticed, that in late May you mentioned Russia among several countries whose activity in creating bitcoins increased significantly. Here, we've got hard evidence of that. Dear Eoin, could you please provide a comment on this from the market point of view? Can this herd behavior be a sign of a bubble and market reaching its high? The bitcoin chart seems to suggest just that, with violent correction in recent days.

Thank you for this topical question. The supply of bitcoin might be limited but the number of different cryptocurrencies is limited only by the imaginations of anyone who wants to create one. Therefore we can conclude a bubble is evident because supply within the asset class is increasing rapidly, as is investor interest with the explosion in demand for mining equipment i.e. graphics cards.

Like any bubble the lustre will eventually fade and most of the initial coin offerings now hitting the market will disappear, with remaining investors coalescing around a few survivors. Right now the most likely are bitcoin, ethereum and possibly ripple however that could change over time as the market evolves.

The biggest challenge for the cryptocurrencies is that private blockchain technologies can be developed which do not depend on them. Since the long-term usefulness of cryptocurrencies is tied to their value inside the blockchain that means the sector’s long-term sustainability is not entirely settled.

From an investor’s perspective something we talk about at the Chart Seminar is that a consistent trend often loses its consistency at the penultimate peak. We have some evidence of that in bitcoin over the last couple of weeks. The price accelerated above $2500 in late May before experiencing its largest pullback in its price history. Both the acceleration and pullback were inconsistencies. It then surged back to hit a new high before pulling back again.

That suggests there were investors waiting for a pullback that used the dip to pick up a “bargain”. However the subsequent failure to hold new highs signalled not enough new buyers were coming in to support higher levels. I would not be at all surprised to see blockchain range for a number of months as the near hysteria of the recent period cools down.

Bitcoin mining rig costs are relativelylow for the upfront hardware. The ongoing cost of electricity is a much bigger concern because a rig needs to run 24/7/365. However that is less of a concern in major energy exporting countries like Russia or the Middle East where electricity costs are lower.

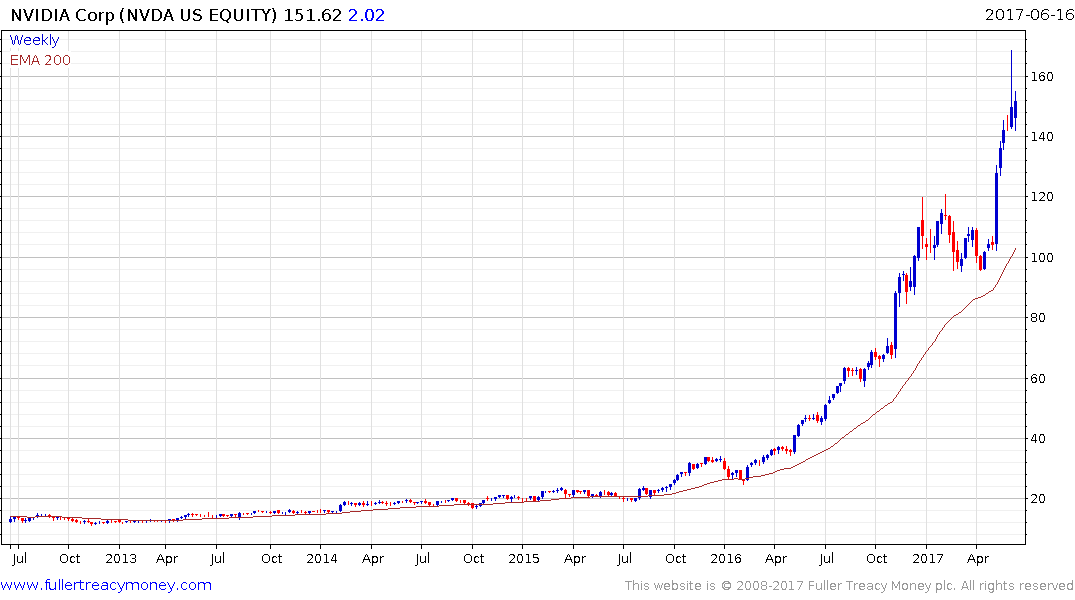

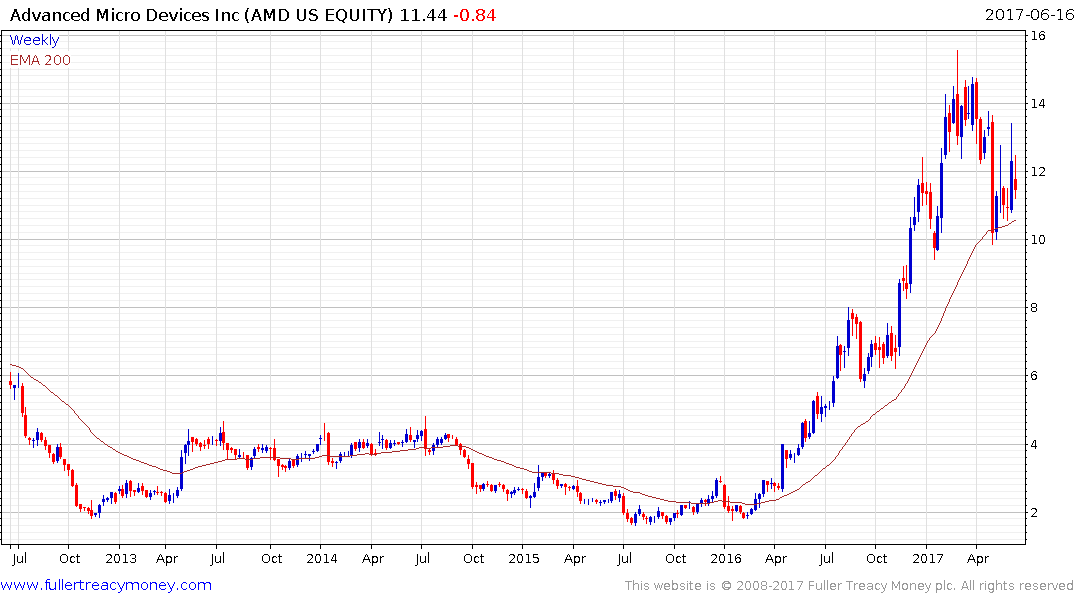

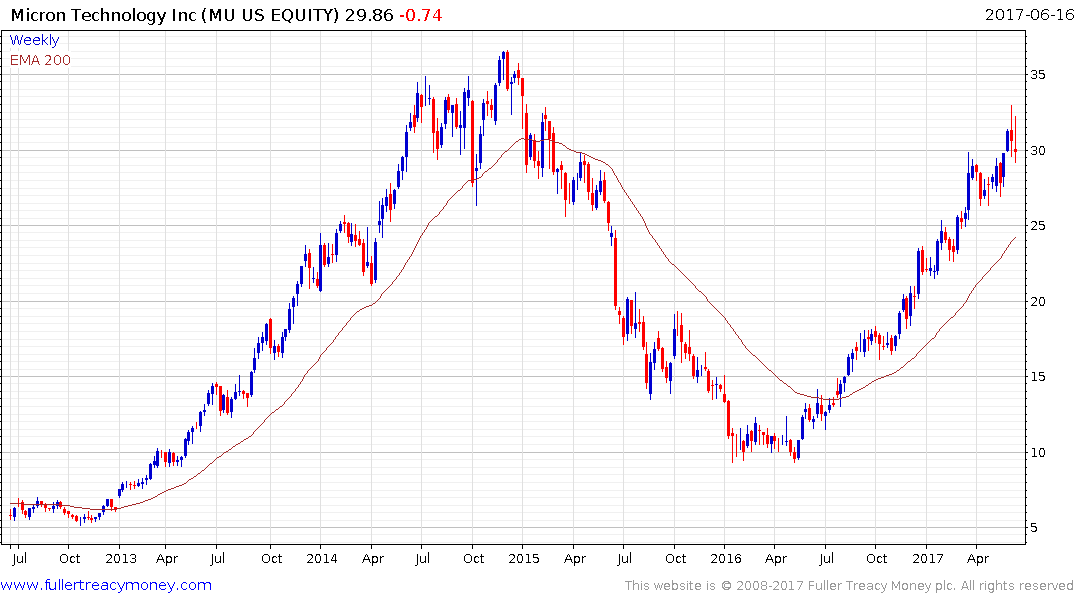

Some of the companies that could benefit from demand for cryptocurrency mining architecture include NVidia and AMD which have or are in the process of releasing dedicated mining chips while Intel and Micron Technology could also benefit.

NVidia hit at least a near-term peak on June 9th suggesting at least a pause following the most recent acceleration. A break below $140 would likely signal a process of mean reversion is unfolding.

AMD pulled back violently in March to close it overextension relative to the trend mean and has since bounced from the $10 area. A sustained move below that level would check potential for

continued support building.

Intel has been largely rangebound for more than two years and is now testing the region of the trend mean near $35.

Micron Technologies has held a progression of higher reaction lows since May 2016 and a sustained move below $27 would be required to challenge that sequence.