Email of the day - on bitcoin and cryptocurrencies:

Having reached a certain age, I confess to being a Bitcoin sceptic. I thought today's piece on Twitter by Nouriel Roubini just confirms my anxiety regarding digital currencies. He's no fan!

Thank you for highlighting this article which may be of interest to subscribers. Here is a section:

Vitalik Buterin, a co-founder of the cryptocurrency Ethereum, argues that no crypto can be at the same time scalable, safe and decentralised. Traditional financial systems are scalable and safe: if your credit card or bank account is hacked or stolen, you are made whole. But they are centralised because participants and assets are verified by trusted institutions. Right now, crypto is neither scalable nor safe. If your private key is stolen or lost, the assets are gone for good.

It isn’t even decentralised. Oligopolistic miners control most bitcoin mining. Many are out of reach of western law enforcement in places such as China, Russia and Belarus, creating a national security nightmare. About 99 per cent of bitcoin trading occurs on centralised exchanges, which may be hackable. Furthermore, the original programmers retain outsized control over their creations. In some cases they act as police, prosecutors and judges, and reverse transactions that are supposed to be immutable. Nor is crypto equitable: a small number of “whales” control much of bitcoin’s value.

This undermines claims that crypto will decentralise finance, provide banking services to the unbanked, or make the poor rich. Blockchain claims to enable cheap money transfers to refugees, but crypto is much more likely to provide cover for scam artists, conmen, tax evaders, criminals, terrorists and human traffickers.

There are a couple of points that one needs to consider with the above account. The first is that there are well understood limitations with bitcoin. It is decentralised, supply is limited and the speed of transactions is extremely slow. The need for forks every time a change is required makes it unwieldly. It stands to reason that if cryptocurrencies are eventually going to fulfil their promise it will be without bitcoin.

However, the fact it is decentralised and is in limited supply helps to support prices. We live in an era of extraordinarily loose monetary policy. Bitcoin was born in the embers of the financial crisis and its value inflates right along with the worst proclivities of governments to rob us through currency devaluation. The price has jumped in the year after every other halving of the reward for mining. The May 2020 event has been no different. These events burnish the limited supply argument.

.png)

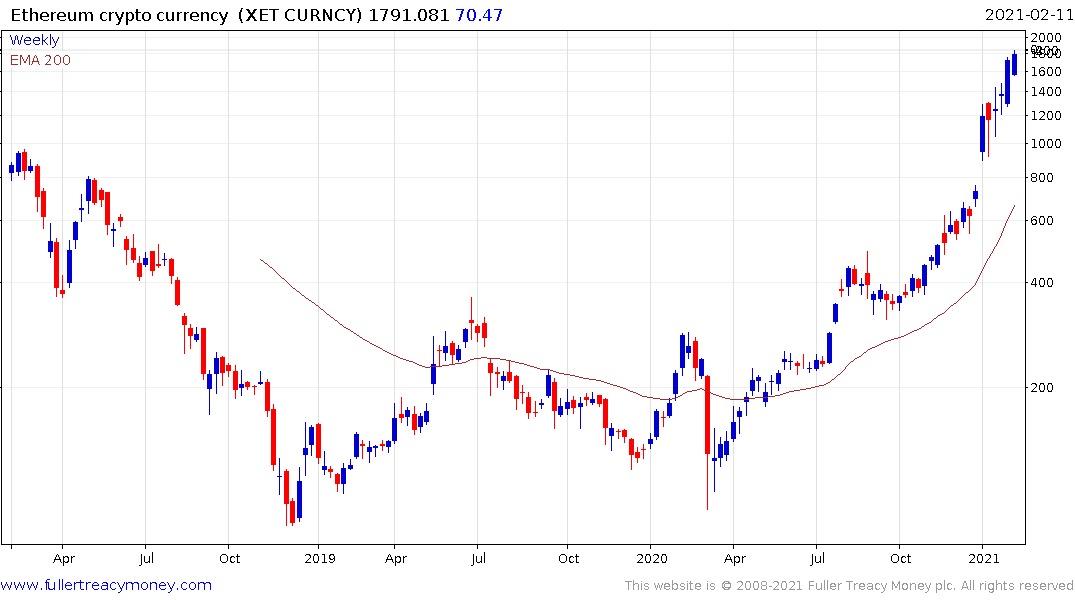

Following the accelerations, reversions to the 1000-day MA are normal for the market. Nothing has occurred to question bitcoin’s boom to bust cycle.

Ethereum’s 2.0 rollout began in December and could take three years. The ultimate aim is to have processing speeds quicker than Visa while also being decentralised and secure. Therefore, the trilemma challenge is in sight of being addressed. Many other projects are chasing the same goal.

I don’t want to bet against the potential for a small group of talented engineers, chasing a big prize, to change the world. It’s what the progress of the entire economy is based on. The challenges of bitcoin and its massive energy consumption, the scalability issues etc are all fixable by various upstart projects.

IOTA, for example, is designed from the bottom up to address all of these issues and its network gets faster the more popular it becomes. It’s still in its gestation phase. My stated view for at least the last few years is Bitcoin is analogous to Netscape. It will eventually be superseded by a much better product but right now it is what we have.