Elon Musk Inspires World's Top Miner to Target Electric Vehicle Boom

This article by David Stringer for Bloomberg may be of interest to subscribers. Here is a section:

“As we delved in to understand more about the lithium-ion battery market, it became clear that demand from EVs was accelerating,” Haegel said Wednesday in an interview. “It also became clear that we had competitive advantages.”

As a result, BHP approved a $43 million project to begin production at its refinery from April 2019 of nickel sulfate, a product needed for lithium-ion batteries. The move will make BHP the top exporter of the material, Haegel said in Kalgoorlie, Western Australia.

Global nickel demand could more than double by 2050, fueled in part by rising electric-vehicle sales, Bloomberg Intelligence analyst Eily Ong wrote in a June report. Demand for nickel from lithium-ion batteries may rise to more than 190,000 metric tons a year by 2030 from about 5,200 tons in 2016, Bloomberg New Energy Finance analyst Julia Attwood forecast in April.

Lithium, nickel and cobalt are the primary metals used in the manufacture of lithium batteries. With demand for large batteries from the transportation and utility sectors growing the mining and refining sectors are scrambling to keep up.

Nickel has been in need of a bullish catalyst as the one industrial metal which has not yet demonstrated a return to demand dominance; largely sitting out last year’s surge. However, it is now trading back above the psychological $10000 level and has broken a more than eight-month progression of lower rally highs.

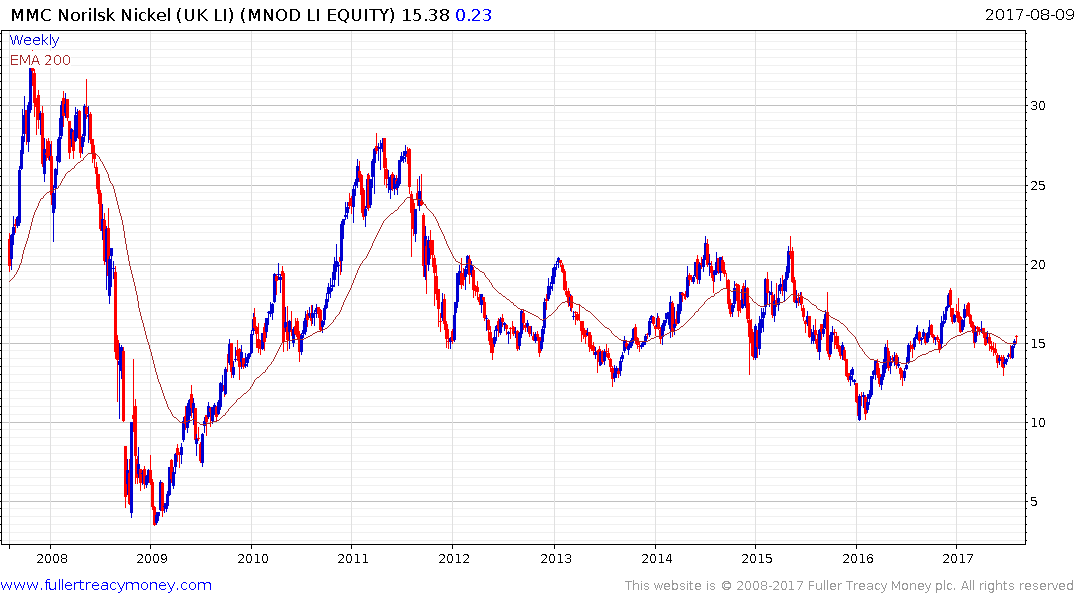

Norilsk Nickel, Vale and BHP are the three largest producers of nickel. Norilsk Nickel represents the closest thing to a large cap pure play along with its dominance of the palladium market. The share rallied this week to break this year’s progression of lower rally highs.

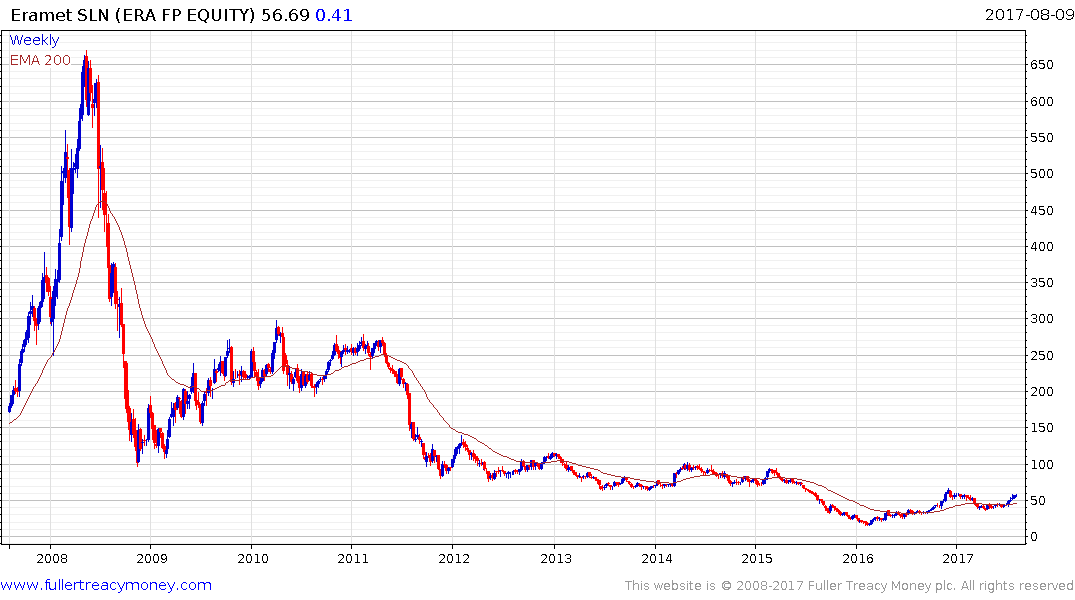

Both Canadian listed Sherritt and France listed Eramet have relatively similar patterns to the nickel price.

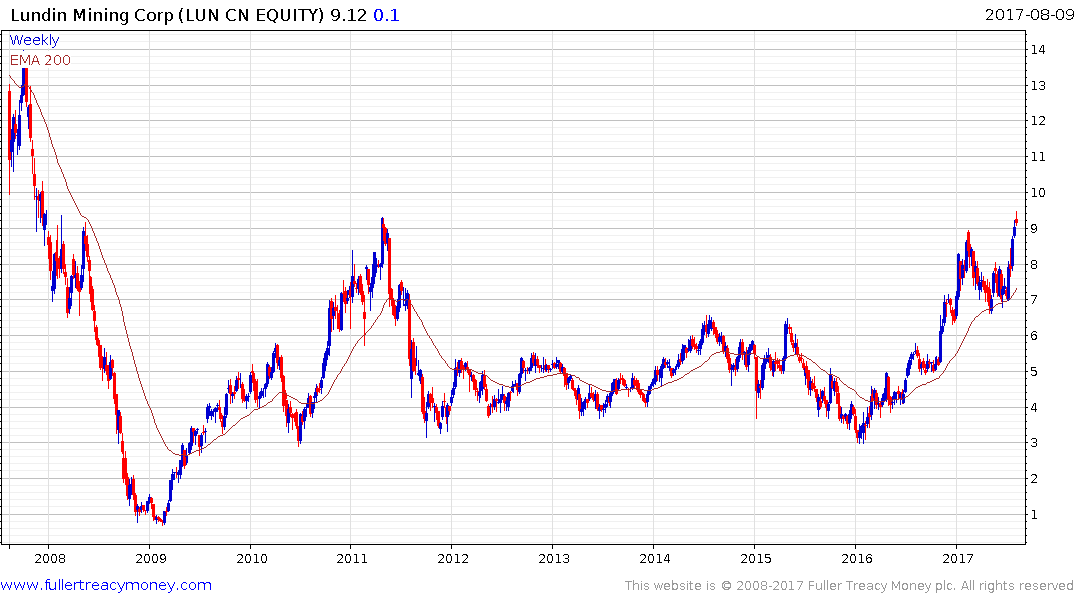

Canadian listed Lundin Mining produces both nickel and cobalt. The share has been forming a first step above its five-year base, so far, this year but broke out to new recovery highs this week.