Elephant Book Periodical

Thanks to a subscriber for this edition of Deutsche Bank’s report which may be of interest to subscribers. Here is a section on Aspen Pharmacare:

Business description: South African-based Aspen is a supplier of branded and generic pharmaceuticals in more than 150 countries across the world and of consumer and nutritional products in selected territories. Aspen is represented in Africa, Asia-Pacific, Europe, North America and Latam. Acquisitions announced in 2013 have further extended the group’s emerging market presence to the Commonwealth of Independent States, comprising Russia and the former Soviet Republics as well as to Central and Eastern Europe. The group currently has 50 business units. The group has 26 manufacturing facilities at 18 sites on six continents and approximately 8,200 employees.

Drivers: New deals: Aspen’s acquisitive nature means a significant chunk of earnings growth is expected to come from the integration of recently acquired products and businesses. The two largest transactions, MSD products and facilities and GSK anti-coagulant products has given Aspen access to various new markets and territories through established brands. Key for Aspen will be to improve its market share in these territories in the near term and register the acquired products in other countries. Furthermore, Aspen will look to deliver margin expansion within this product suite through control of raw material costs and operational efficiencies.

Existing businesses: Globally, pharmaceutical pricing is under pressure as governments look to cut healthcare budgets that have been rapidly expanding on the back of an older, increasingly unhealthy population. Positively, emerging markets still exhibit relatively low generic usage rates. We expect penetration rates to rise, which will support volumes at Aspen.

Outlook: Going forward, Aspen's two largest earnings contributors, South Africa and Australia, are expected to deliver slowing growth. Admittedly, both regions are likely to benefit from increased demand for generic medication; however, legislative pressure on pricing will suppress overall pharmaceutical market growth. In our opinion, incremental value will need to be extracted from outside the Australian and South African markets. Whilst exciting prospects lie ahead for the company, given its expanding presence in emerging markets, it's difficult to model significant inroads being made, given the start-up nature of Aspen's current offerings in these markets.

Here is a link to the full report.

South Africa is a country of contrasts where natural beauty, the resources sector, historical enmity between races and standards of governance that leave much to be desired combine to create some very different conclusions of the country’s potential.

From an inv estor’s perspective the weakness of the Rand is a major consideration while the heavy weighting of major international companies in the Johannesburg All Share acts as a buffer for currency devaluation.

estor’s perspective the weakness of the Rand is a major consideration while the heavy weighting of major international companies in the Johannesburg All Share acts as a buffer for currency devaluation.

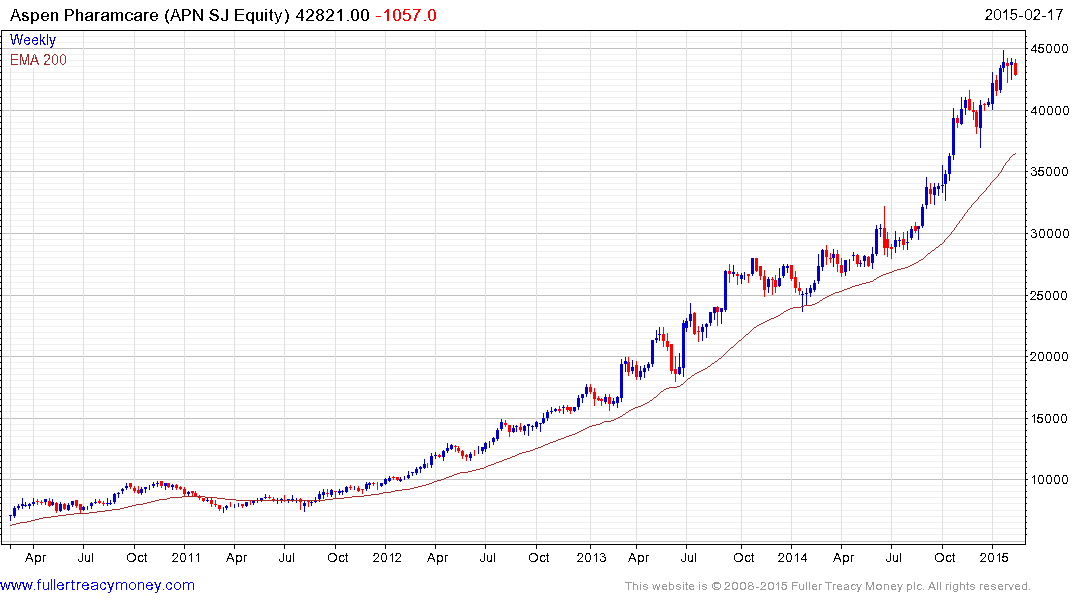

Aspen Pharmacare generates almost 70% of its revenue from outside South Africa and continues to grow from a low base in much of Sub Saharan Africa. The share is currently somewhat overextended relative to the 200-day MA, following an impressive advance, and is susceptible to mean reversion at least in nominal terms.

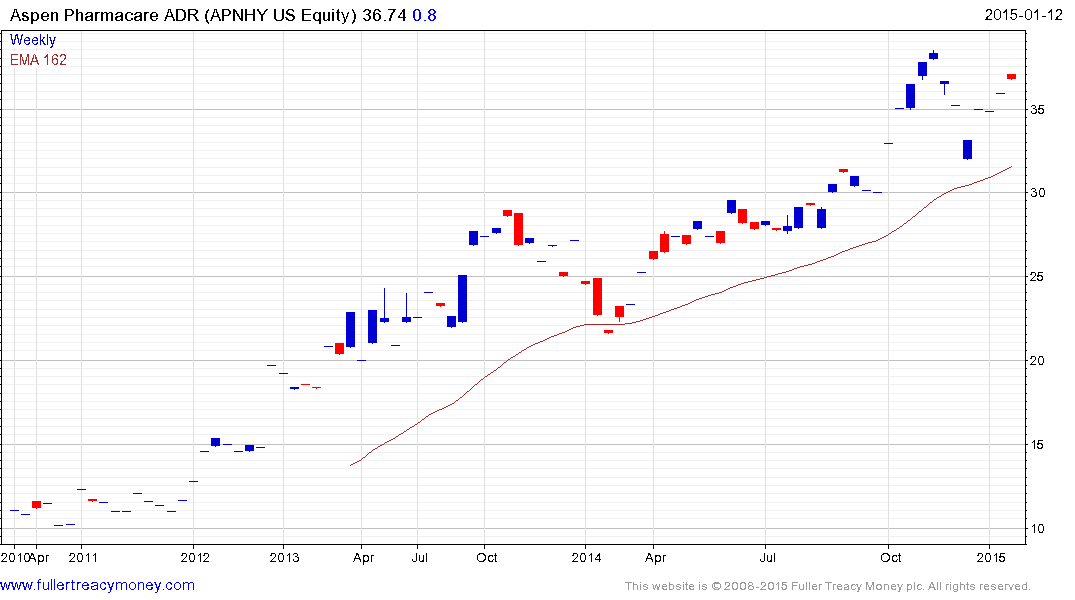

The US ADR is less liquid but remains in a consistent uptrend. It offers a picture of just how much the weakness of the Rand has affected the performance of the South African listed share.