Elephant Book

Thanks to a subscriber for this report focusing on South Africa for Deutsche Bank. Here is a section:

Economic growth has faltered and corporate profits are in a recession. There are strong indications that a business cycle downswing is already 12-18 months underway. But the worst is yet to come. The lingering profit squeeze will have damaging consequences for the economy. In our view, it spells the end to a six-year boom in consumer demand. For 2016 we see a slowdown in growth to 0.5%, and a modest rebound to 1% in 2017. We are particularly bearish over the consumer, with growth in real spending seen at 0.2% and -0.3% in 2016 and 2017, respectively. Tighter fiscal and monetary policies, significant inflation pressures, capex and job cuts and negative wealth effects will weigh on demand. Add to this rising political uncertainty that is unlikely to dissipate in a local government election year. This year will see a re-emergence of labour tension and strike activity could rise. Wages will be renegotiated in the automotive, platinum and electricity sectors, where union militancy is rife. This adds to our pessimism over the investment outlook, rendering exports the main driver of growth this year.

Is South Africa the next “fallen angel” in EM?

On our economic assessment, South Africa may be downgraded to junk this year, possibly as soon as June. The upcoming Budget (24 February) could change this outcome, but it will require a review of government’s spending trajectory. Lowering government expenditure will aid the economy’s growth potential over the medium-term. However, structural reform is still an essential part to keeping investment grade status in the long-term. We do think Moody’s and Fitch credit agencies will appraise the sovereign credit below sub-investment grade. One downgrade to junk tends to result in a sell-off by conservative investment funds, which may already be in the price. However if two or more agencies revise the sovereign to junk status, it will no doubt trigger more capital flight. Rand-denominated assets are supported by the credit uplift from higher local currency ratings.Macro-backdrop supports underweight equities, overweight bonds, overweight cash and underweight listed property.

Given the challenging EM backdrop, South Africa remains in the bad camp. We prefer to go underweight equities, especially interest rate sensitive counters, while maintaining exposure to non-commodity rand hedges. We are bullish South African rates, and recommend rand-hedged positions for foreign investors.

Here is a link to the full report.

South Africa’s volatile administration means sentiment towards the country’s prospects has deteriorated even further over the last couple of months. The Dollar accelerated to its January peak against the Rand but consolidation has so far been reasonably orderly and little has yet happened to chasten bears on South Africa’s prospects. Concrete evidence of improving governance would certainly help but that would require anyone replacing Zuma being a better administrator than he is.

For gold miners the decline of the Rand and low energy prices are both positive not least as the metal’s price firms. Gold rallied this week to test the psychological ZAR20,000 level, a new all-time high, so there is scope for some consolidation. However significant deterioration would be required to question medium-term scope for additional upside.

Sibanye Gold (Est P/E 30.54, DY 0.46%) moved to a new high today, almost tripling since December. It is overbought in the short term but a clear downward dynamic will be required to check momentum.

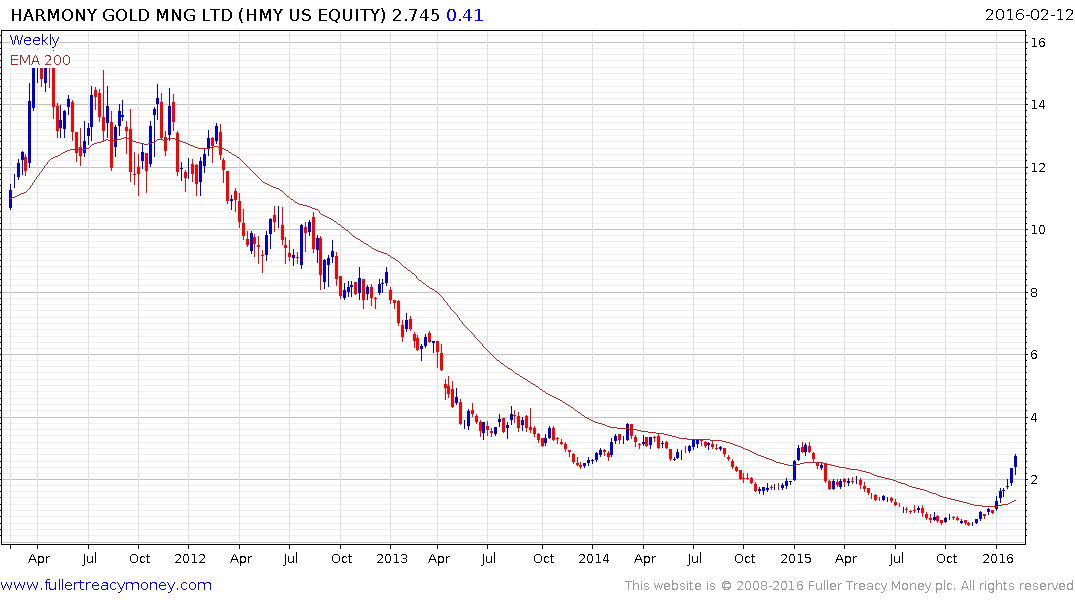

Harmony Gold (Est P/E 21.06 DY N/A) rallied in January to break the medium-term downtrend and continues to extend the breakout.

Gold Fields (Est P/E 62.58, DY 0.13%) is also rebounding from what had been depressed levels.

Anglogold Ashanti rallied last week to push above tis 200-day MA and to break the medium-term progression of lower rally highs.

Perhaps the most compelling case for gold shares is that following a number of years where they went through painful rationalisation they were among the most depressed equity sectors. They now offer leverage to the gold price which is something they were unable to do when cash flow was being diverted to expansion. .

Back to top