Electric Cars May Take an OPEC-Sized Bite From Oil Use

This article by Jessica Shankleman for Bloomberg may be of interest to subscribers. Here is a section:

Wood Mackenzie’s view echoes the International Energy Agency, which last month forecast global gasoline demand has all but peaked because of more efficient cars and the spread of EVs. The agency expects total oil demand to keep growing for decades, driven by shipping, trucking, aviation and petrochemical industries.

That’s more conservative than Bloomberg New Energy Finance’s forecast for EVs to displace about 8 million barrels a day of demand by 2035. That will rise to 13 million barrels a day by 2040, which amounts of about 14 percent of estimated crude oil demand in 2016, the London-based researcher said. Electric cars are displacing about 50,000 barrels a day of demand now, Wood Mackenzie said.

There is the world of difference between predicting that electric vehicles will account for an increasingly large portion of the global automobile market and predicting that aggregate demand for crude oil will decline meaningfully.

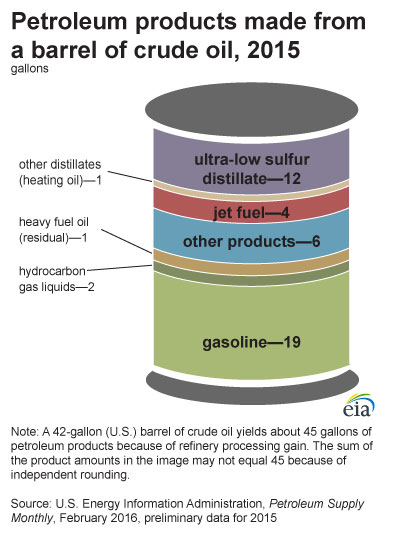

This graphic from the EIA highlights the fact that gasoline represents about 40% of what a barrel crude oil is cracked into. It is the biggest market for crude oil and if demand is peaking in in the automotive sector it frees up supply for other uses. Price will be the key arbiter of demand growth in future as alternatives evolve.

There is little doubt the evolution of solar power, batteries and electric vehicles represent a dramatic catalyst for the energy sector. Suddenly there is much more supply than many had expected and it is hard to imagine how it will all be used. However if history teaches us anything it is that when energy is abundant we come up with plenty of ways to make use of it. Again it is only a question of the marginal cost of production and technology could reduce that cost further over the next decade.

These are medium to long-term considerations because the energy sector relies on massive infrastructure outlays that take years to build on both the supply and demand sides of the equation. It virtually ensures oil prices will remain volatile for the next few years as perceptions of these themes ebb and flow.

In the short-term, OPEC engineered a powerful rally last week to send Brent Crude Oil prices to a new recovery high. Some consolidation of that move is now underway amid a short-term overbought condition.

Back to top