El Nino is officially back, and looks stronger than ever

This article by Stuart Tomlinson for Oregon Live may be of interest to subscribers. Here is a section:

The stronger the El Niño, the bigger the impact on fisheries, agriculture and water supplies for hydroelectric power, recreation and municipal supplies.

But it arrives with as many questions as answers.

While El Niño has visited 20 times since 1950, the last really strong El Niño occurred during the winter and spring of 1997-98.

U.S. government scientists say there is about a 90 percent chance that strong El Niño conditions will continue through the Northern Hemisphere during the summer of 2015, and a greater than 80 percent chance it will last through the end of the year.

"By 'strong' we mean it's expected that the three-month average sea surface temperature in the El Niño region will peak at more than 2.7 degrees above normal," said Climate.gov research scientist Emily Becker. "While we're confident that this El Niño event will continue, there's still plenty of uncertainty about how it will evolve."

With a slow start to India’s monsoon, drier conditions in Australia and possible wetter conditions in parts of North America, El Nino can be expected to deliver volatility in commodity prices. I thought it might be opportune to point some of the more overextended trends because weather can act as a catalyst for change.

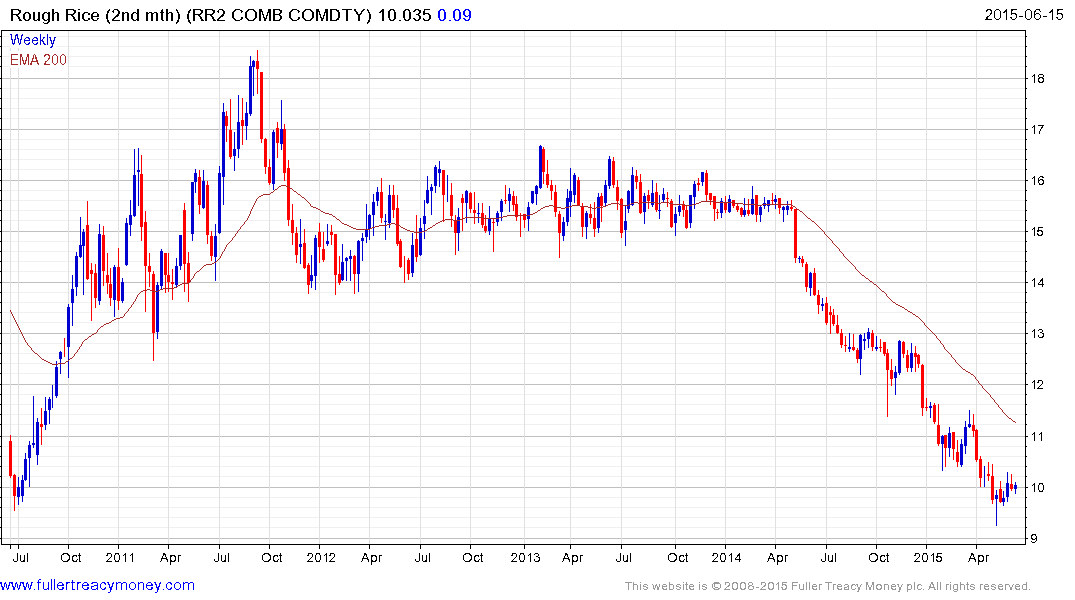

Rough Rice is still in a consistent medium-term downtrend characterised by a progression of lower rally highs. It has returned to an area of previous support at the 2010 low near $10 and a sustained move above the 200-day MA would suggest more than temporary demand dominance in this area.

US Canola and UK listed Rapeseed share similar patterns as they test the upper side of 18-month ranges.

Arabic coffee has lost downward momentum over the last three-months but the progression of lower rally highs is still in place and will need to be broken to suggest a return to demand dominance.

Sugar has been trending lower since 2011 and the pace of the decline has picked up this year. A sustained move above $14 would be required to challenge medium-term supply dominance.

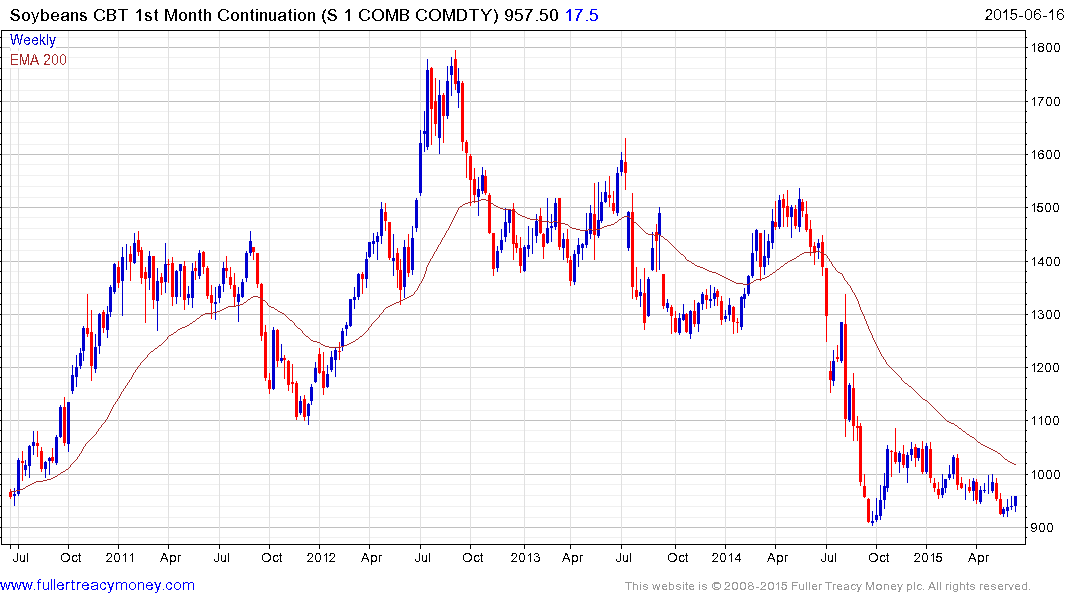

Soybeans are currently firming from the region of the October low and a sustained move above 1000¢ would be required to indicate a return to demand dominance beyond the short term.

Cotton has been confined to a tight range for nearly a year and a sustained move above 68¢ would suggest a return to demand dominance.