ECB Set for Summer Tussle Over Possible September Rate Hike

This note may be of interest. Here is a section:

President Christine Lagarde said the ECB still has ground to cover on borrowing costs and is “very likely” to raise again on July 27. Highlighting policymakers’ commitment to data-dependency, she avoided giving guidance on what may happen beyond that as investors ramped up bets on a hike at that meeting too.

The primary issue for the ECB is Germany’s economy is contracting. Raising rates when the region’s largest economy is struggling is a hawkish move. Draining €500 billion from the banking sector by calling in TLTRO loans is an additional hawkish move. That is aimed at actively removing the excess liquidity that is fuelling speculative activity and inflationary pressures.

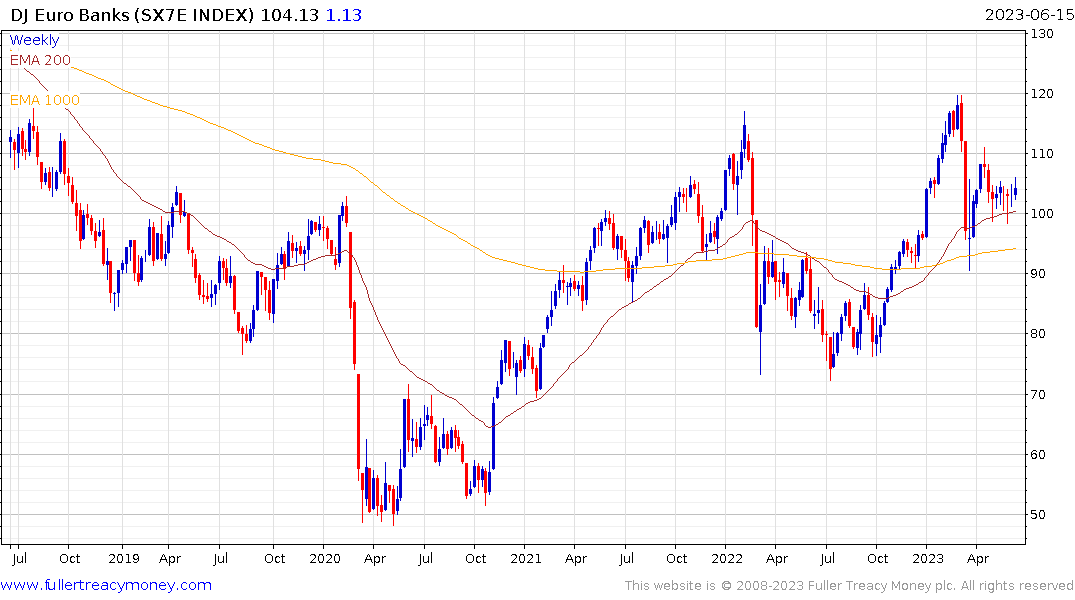

The Euro STOXX Banks Index is firming from the region of the 200-day MA and will need to hold the 100 level if the benefit of the doubt is to be given to the upside.

The Euro popped on the upside to confirm support in the region of the 200-day MA. The tight range between the 200-day and the 1000-day MAs is likely to give way to a powerful breakout.

Gold pulled back in early trading but rebounded as soon as the Euro began to rally. The ECB is now more hawkish than the Fed and is more active in withdrawing liquidity. That relative value prospect is dollar negative. Gold rebounded versus the Euro too which suggests investors are more worried about the outcome of tightening and what that will mean for the ultimate trajectory of rates and remedial action.

Gold pulled back in early trading but rebounded as soon as the Euro began to rally. The ECB is now more hawkish than the Fed and is more active in withdrawing liquidity. That relative value prospect is dollar negative. Gold rebounded versus the Euro too which suggests investors are more worried about the outcome of tightening and what that will mean for the ultimate trajectory of rates and remedial action.