ECB's Wunsch Wouldn't Be Surprised If Rates Exceed 3%: CNBC

This note from Bloomberg may be of interest to subscribers.

European Central Bank Governing Council member Pierre Wunsch said interest rates may eventually have to top 3% to get record inflation under control.

“My bet would be it’s going to be over 2%, and I would not be surprised if we have to go to above 3% at some point,” Wunsch told CNBC in an interview in Washington.

Wunsch also said:

The ECB’s deposit rate, currently 0.75%, will “most probably” need to exceed 2% year-end

“Frankly on the basis of our base case, which is now more or less a technical recession in Europe, I think we are going to have to go real positive somewhere”

“We’ve been claiming that what happens in Europe is different from the U.K., from the U.S. But over the last six months basically the direction we’ve been taking was not that different”

The ECB’s rate peaked at 4.25% in 2008. That suggests the anticipated peak of hiking, at 3%, will be well below that 2008 peak. That’s only relevant because the Fed Funds rate could exceed its 2007 peak at 5.25% before this hiking cycle has ended. That raises the question why is the Euro rebounding?

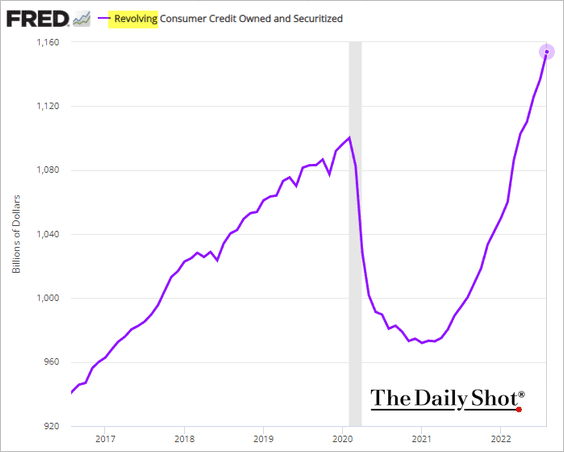

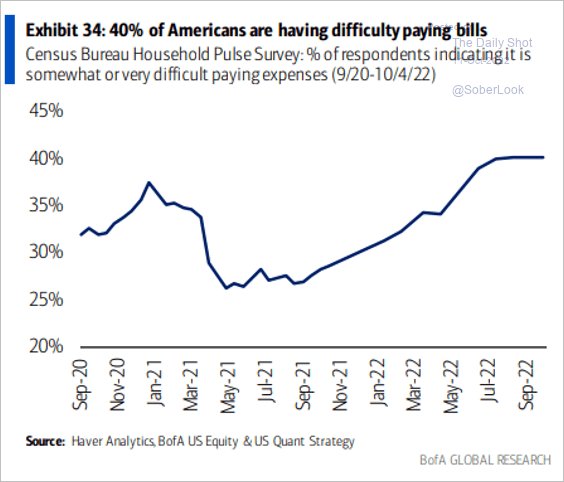

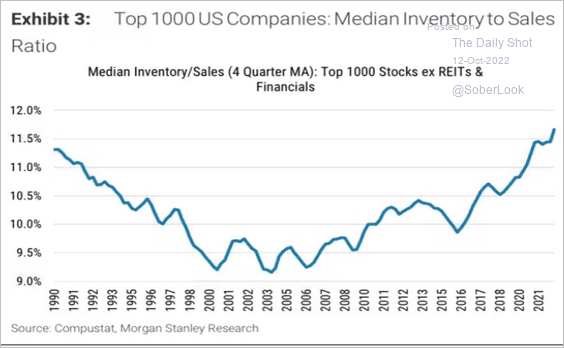

The stronger than expected PPI and CPI figures in the USA confirm inflation is stickier than expected. However, inventory figures have surged, savings are decreasing and house prices have peaked. The market appears willing to accept that the USA’s economic relative strength will not be sustained and Europe’s difficulties, while bad, might not be quite as bad as feared.

The Euro has now posted two upside key day reversals in less than a month. That suggests a low of at least near-term significance. Medium-term, the sequence of lower rally highs is still intact and a sustained move back up through parity with the Dollar will be required to signal a return to demand dominance.

The Euro has now posted two upside key day reversals in less than a month. That suggests a low of at least near-term significance. Medium-term, the sequence of lower rally highs is still intact and a sustained move back up through parity with the Dollar will be required to signal a return to demand dominance.

The Euro STOXX 50 reversed an early decline to confirm support above 3200. Some steadier action to unwind the overextension relative to the 200-day MA is likely.

The Euro STOXX 50 reversed an early decline to confirm support above 3200. Some steadier action to unwind the overextension relative to the 200-day MA is likely.

Gold is also in the process of putting in a higher reaction low as it continues to move in an inverse manner to the Dollar.

Gold is also in the process of putting in a higher reaction low as it continues to move in an inverse manner to the Dollar.

Both Apple and Microsoft opened down but reversed the early weakness intraday. Both shares have positive divergences on their RSI indicators which supports the view a rebound is underway.