ECB Greek Bond Purchases Limited by SMP, Conditions: Berenberg

This article By Deborah L Hyde for Bloomberg may be of interest to subscribers. Here is a section:

ECB’s waiver for “program countries” may not help Greece as the scheme doesn’t start until March by which time the country could be outside of a program, Berenberg’s Christian Schulz says in client note.

ECB also built in a barrier for Greece by limiting total holdings of each issuer

ECB still holds large amounts of Greek debt from 2010-2012 SMP program so Greece would only become eligible after the bond repayments to ECB in July and August

Other “snags” include ECB abandoning traditional risk sharing, which may be interpreted as a slippery slope toward a renationalization of monetary policy

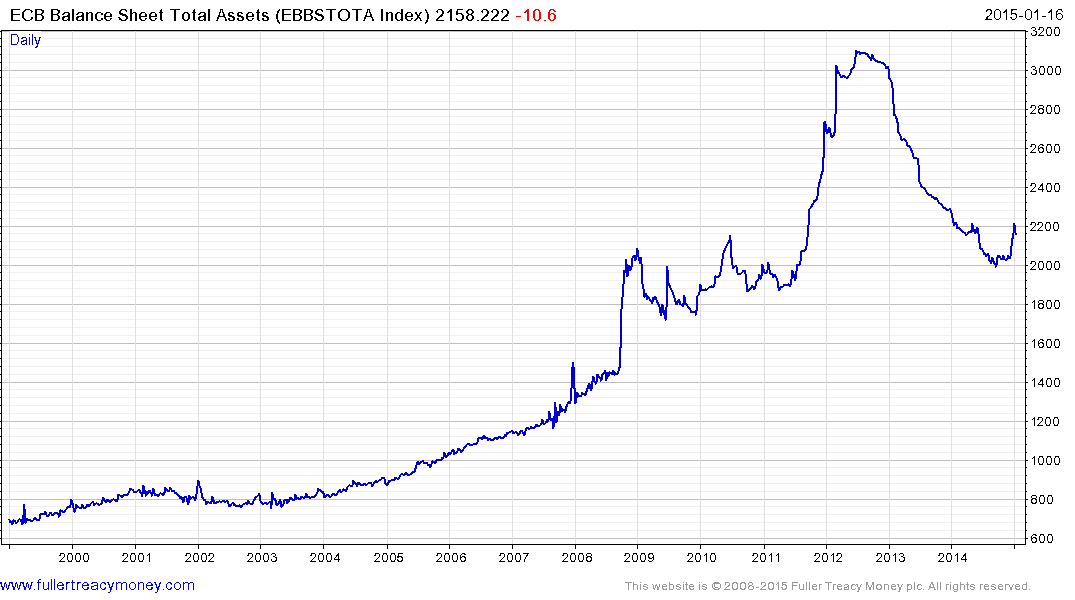

The contraction of the ECB’s balance sheet between the end of the LTRO program in 2012 and late last year succeeded in unwinding its first stimulus package. While this appeased followers of the Austrian School of Economics it had a sharply deflationary effect on the region’s economy. The policy of sanitising stimulus while at the same time the Federal Reserve was still engaged in QR resulted in the Euro being firm against a wide basket of currencies.

Mario Draghi signalled a number of months ago that he was intent on reflating the ECB’s balance sheet back to the 2012 peak. This removed an important support from the Euro which also coincided with the end of the Fed’s QE program. In the Chart Library the German Mark represents the long-term history of the Euro and is still updating.

.png)

The US Dollar has held a progression of higher reaction lows within its base since 2009 and continues to extend the breakout. It might be overbought in the short-term but a clear downward dynamic would be required to signal a consolidation. A sustained move below DEM1.6 would be required to begin to question medium-term Dollar dominance.

The ECB already holds a significant quantity of sovereign paper as collateral on loans made to the banking sector and with today’s announcement we can anticipate it will come to dominate ownership of various sovereign issues just as the Fed did during its QE campaign.

German 10-year Bund yields have fallen so much that the German government could not wish for more attractive borrowing conditions. Despite the issues France has with long-term liabilities its debt trades at less than 20 basis points over Bunds.

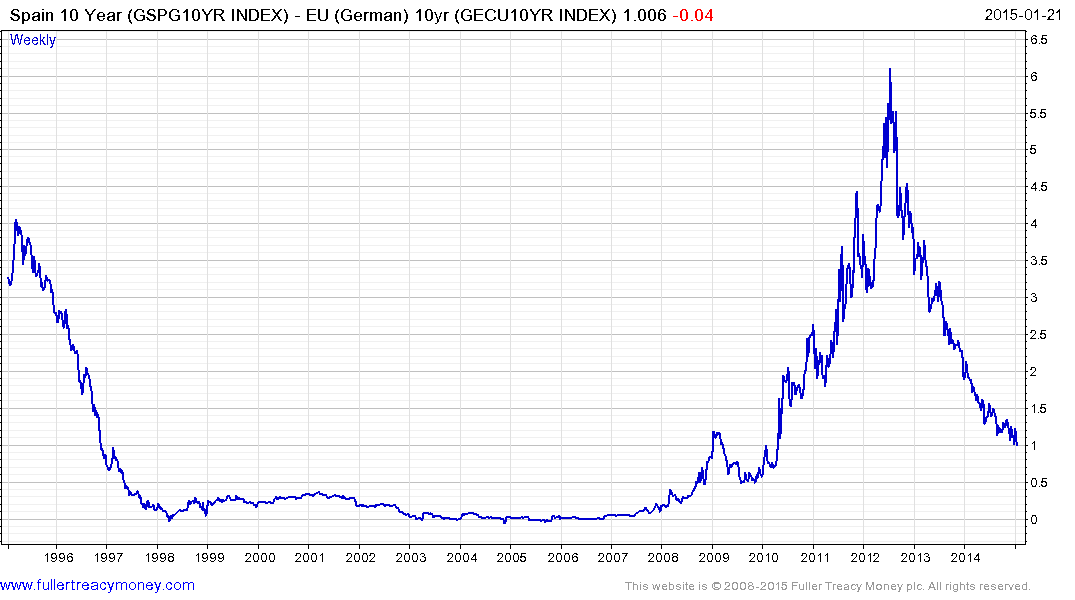

Spanish and Italian spreads over Bunds currently trade at approximately 100 basis and the ECB is lining to make significant purchases. Before the financial crisis Eurozone sovereign spreads were less than 10 basis points and could get that tight again if the ECB’s purchase program proceeds as expected.

It is reasonable to state that while QE has a mixed performance in helping to generate economic growth it has been very successful at inflating asset prices. I posted a review of Eurozone equities on Monday in advance of today’s decision which remains just as relevant today.

The performance of European equities has been flattered by the weakness of the Euro and currency market volatility represents a significant risk for foreign investors. I propounded the view over the last six months that a currency hedge was necessary for foreign investors in Eurozone equities for just this reason.

From the perspective of a US investor the Wisdomtree Europe Hedged ETF has a dividend yield of 2.46% and paid out a return of capital in December that took the indicated yield to over 5%. It is performing in line with the Euro Stoxx.

Back to top