Earnings, Not Donald Trump, Are Stocks' Best Friend in 2017

This article by Akane Otani for the Wall Street Journal may be of interest to subscribers. Here is a section:

“It’s earnings growth that drives stocks over the long term,” said Tom Cassidy, chief investment officer at Univest Wealth Management Division. While “we won’t know if any of these policies will actually be implemented until later next year,” a continued rebound in earnings should nevertheless prop up stocks for additional gains, Mr. Cassidy said.

Earnings for companies in the S&P 500 grew 3.1% in the third quarter from a year earlier, according to FactSet, entering positive territory for the first time since the first quarter of 2015, when they grew 0.5%. Analysts polled by FactSet expect the rebound to continue, and are estimating a 3.2% growth rate in the fourth quarter of 2016.

An end to the longest earnings slump since the financial crisis also comes against a backdrop of improving economic data. U.S. gross domestic product, a broad measure of the goods and services produced across the economy, posted its strongest quarterly pace of growth in two years in the third quarter, according to data released by the Commerce Department in December.

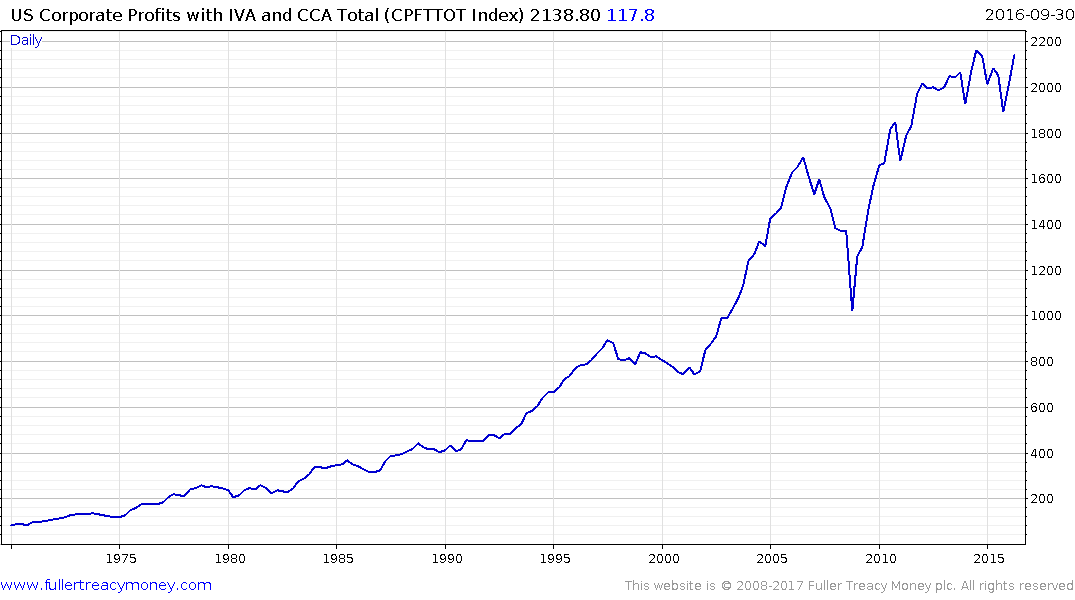

There is no doubt that the earnings recession which prevailed for the last 15 months acted as a headwind to sentiment and more importantly corporate profits. There were fears that the loss of momentum in margin expansion was a precursor to recession and this was enough to keep many investors on the side lines.

The breakout to new highs following the election, amid renewed optimism that a business friendly administration is about to enter office, has been a catalyst for bullish bets on the market and has no doubt been a contributing factor in improving earnings.

The US Corporate Profits chart in the Library will next be updated on January 27th so the above news story is pre-empting confirmation of the news. However the stock market may already be reflecting a breakout in corporate profits. The Russell 2000, as a predominately domestically oriented index, exhibits a short-term overbought condition, but a sustained move below the trend mean would be required to question medium-term scope for additional upside.