Dudley Says September Hike Is Possible, Markets Too Complacent

This article by Matthew Boesler for Bloomberg may be of interest to subscribers. Here it is in full:

The Federal Reserve could potentially raise interest rates as soon as next month, New York Fed President William Dudley said, warning investors that they are underestimating the likelihood of increases in borrowing costs.

“We’re edging closer towards the point in time where it will be appropriate, I think, to raise interest rates further,”

Dudley, who serves as vice chairman of the rate-setting Federal Open Market Committee, said Tuesday on Fox Business Network.

Asked whether the FOMC could vote to raise the benchmark rate at its next meeting Sept. 20-21, Dudley said, “I think it’s possible.”

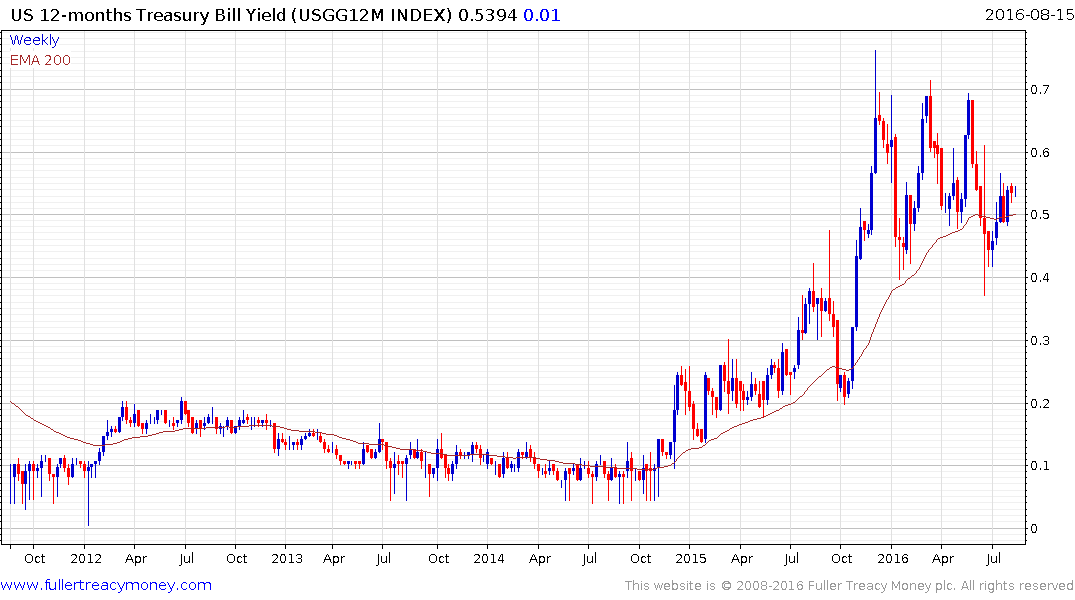

Investors only expect about one rate hike between now and the end of next year, according to federal funds futures contracts. Dudley said such estimates are too low and that “the market is complacent” about the need for rate hikes. With Treasury yields low, the bond market “looks a little bit stretched,” he said.

“We are looking for growth in the second half of the year that will be stronger than the first half,” Dudley said. That should be enough to support sturdy job gains and keep the Fed’s outlook intact, he added.

Dudley has been quite adamant that the Fed’s intention to raise rates cannot be dismissed. However, the performance of the Dollar and low bond yields suggest market participants are sceptical.

12-month yields are trading at just under 54 basis points suggesting the bond market is in no hurry to price in imminent rates hikes. The rationale being that the Fed is unlikely to want to influence the outcome of the Presidential election not least because the event itself is a source of uncertainty that can have economic consequences.

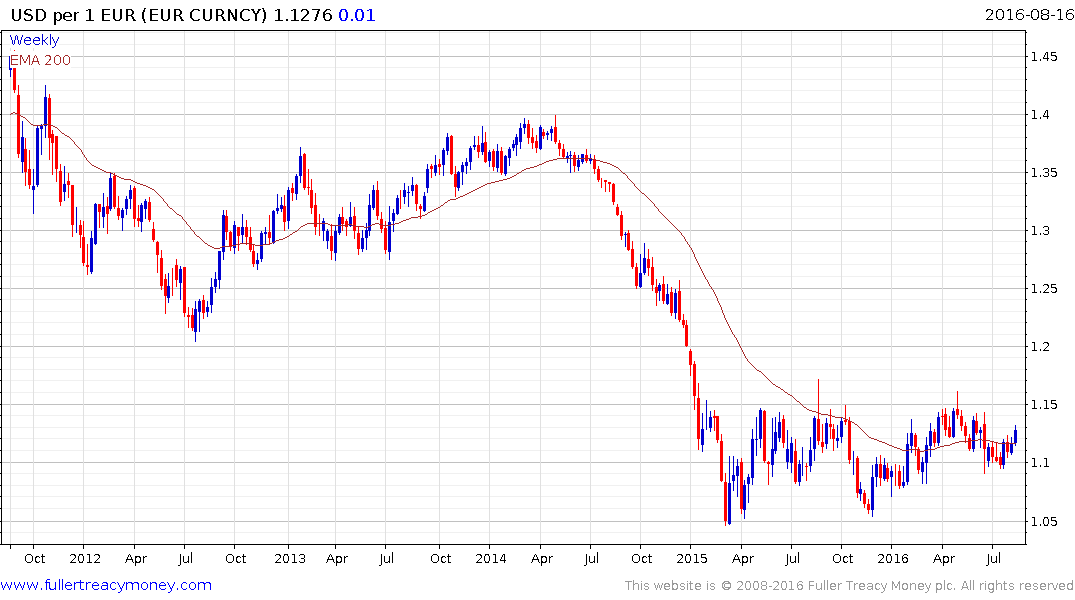

The Dollar pulled back today against the majority of currencies but there are some standout charts that are worth taking note of.

Despite the cacophony of opinions expressed about the prospects for the Eurozone there is no denying that negative interest rates are deflationary and act to withhold supply of the Euro which has contributed to its stability. Following a steep decline in 2014 it has base formation characteristics against the Dollar and a progression of incrementally higher reaction lows is evident since early 2015. A sustained move below $1.10 would be required to break that sequence and signal a return to Dollar strength.

The Dollar traded briefly below ¥100 today amid a deep short-term oversold condition. A clear upward dynamic will be required to signal continued support in this area and to boost the prospects of a reversionary rally.

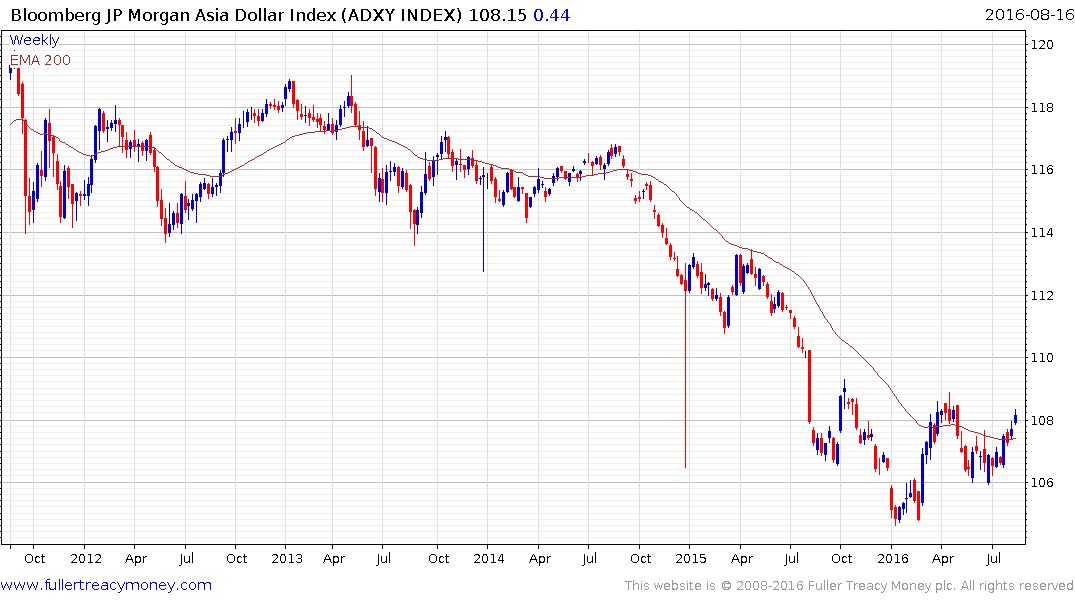

The Korean Won continues to strengthen as it extends its short-term overbought condition against the Dollar. While the Won is firm it is also emblematic of the renewed currency strength evident across the region.

The Asia Dollar Index is trading back above the 200-day MA and is approaching the highs posted over the last year as it continues to exhibit evidence of support building.

The deflationary environment evident in Europe and Japan has meant that when their currencies advance stock markets come under pressure. Meanwhile emerging market stocks have tended to benefit from currency strength since it is seen as a vote of confidence among international investors.

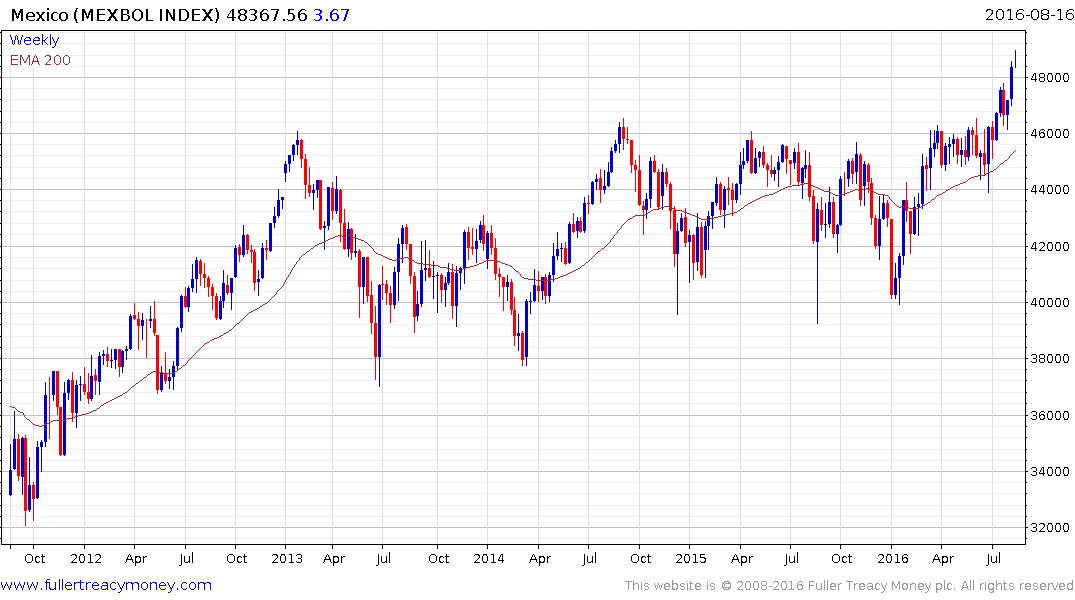

The Mexican Peso is also worthy of mention as the Dollar falls to test its progression of higher reaction lows and the region of the trend mean. Meanwhile the Mexican Bolsa is somewhat overbought as it tests the psychological 50,000 area.