Draghi Whatever It Takes Plan Goes on Trial at Top EU Court

This article by Stephanie Bodoni for Bloomberg may be of interest to subscribers. Here is a section:

The German court said in its February judgment that the OMT may violate EU rules because it amounts to economic policy that is outside the ECB’s mandate. Judges there said the plan may also be seen as monetary financing of governments, which the EU treaties ban.

The OMT program could pass the test if it were limited and placed under certain conditions, like banning debt cuts and unlimited purchases bonds of selected member states, the German court said.

“The real issue will be to see to what extent the EU court will pick up on the German court’s alternative interpretation,”

Conac said by phone. “The decision will most likely validate the OMT and at the same time take into account as much as possible” the compromise proposed.

The EU court usually takes about 16 months to rule on cases once they have been referred by national judges.

The German top court in 2011 threw out cases against the bailout packages for Greece and the country’s participation in the European Financial Stability Facility, the predecessor of the ESM.

I’m sure that the ECB would be delighted to dispense with the pantomime of various bodies deliberating on the legality of its actions. The reality of managing a currency union with widely differing fiscal policies and no federal taxation system (at least not yet) means that the central bank has needed to step outside its strictly defined role in order to ensure the Euro’s survival. Necessity has seen the ECB take on additional responsibilities and now that it has this control, it is unlikely to relinquish it. Rather than questioning the legality of previous actions, the upcoming ruling may have an impact on the timing of new easing measures.

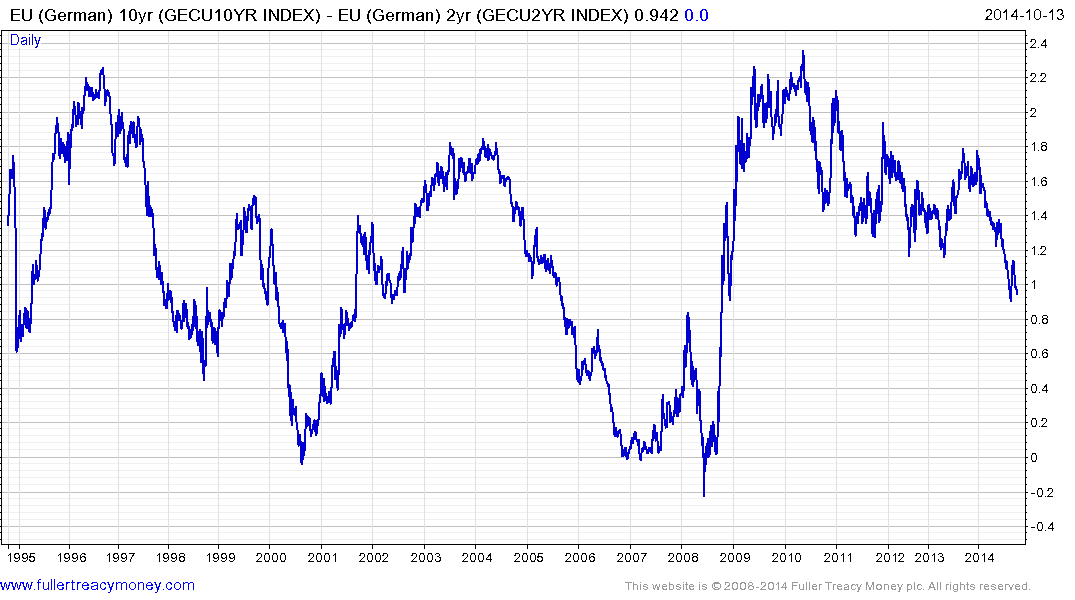

The 10-year – 2-year yield curve spread for German bonds continues to contract from the highs posted in 2012. Despite the fact that the 2-year has a negative nominal yield the 10-year’s is contracting faster. The spread encountered resistance in the region of 120 basis points last week and a sustained move above that level will be the minimum required to signal the return of easier monetary conditions. As the ECB prepares an additional quantitative easing program, the recent contraction in the yield curve spread will be an important consideration that may influence how large the project will be.

.png)

This is little doubt that the contraction of the ECB’s balance sheet over the last 18 month has had a deflationary influence but acted as a support for the Euro. As a new easing program is anticipated, the Euro has been subject to some aggressive selling. It tested the $1.40 area between March and May but was unable to sustain a move above it. It then dropped back to test the region of the 200-day MA and extended its decline in July to break a yearlong progression of higher reaction lows. The Euro found support in the region of $1.25 last week and will need to hold that level during the current pullback to indicate demand is beginning to regain the upper hand.