Draghi Defines His Era as ECB Stimulus Locked Into the 2020s

This article by Jeff Black for Bloomberg may be of interest to subscribers. Here is a section:

Thursday’s meeting in fact helped shape the entire span of Draghi’s term in office, reaching from his immediate reversal of his predecessor’s two 2011 rate hikes after he took charge in November that year, through the torturous debate leading up to quantitative easing, and now embedding bank-friendly credit policies until beyond the end.

The president announced cuts to all three of the ECB’s rates, bringing the deposit rate to minus 0.4 percent, and a 20 billion-euro ($22 billion) expansion of quantitative easing that for the first time opens the door to purchases of corporate bonds. On top of that, he announced a new four-year loan program that potentially allows banks to be remunerated for taking the ECB’s money if they expand credit to the real economy, in a quartet of operations stretching to 2021.

Draghi’s policy arc has been in defiance of warnings by monetary conservatives, including those in Germany’s Bundesbank since the beginning of his term, up to more recent calls by the Group of 20 nations to shift the burden of growth generation away from monetary policy and toward structural policies or more government investment.

Instead, Draghi sounded resigned when asked about euro-area fiscal policy. That domain spans countries including Spain, France and Italy that are close to or beyond their legal deficit limits, and nations that can afford to spend more -- read Germany -- that have promised voters they won’t do so.

The message got a bit muddled, which caused a lot of confusion yesterday, but perhaps the biggest question of all is this: Is the Eurozone today where the US was in 2011?

Back then the second round of QE had just ended, the market had pulled back sharply, investors were adamant the economy was not ready for the removal of monetary accommodation and inflationary pressures were non-existent. The decision was made to embark on a much more concerted, wide ranging program of purchases that would persist until there was clear evidence they could safely be removed. It took the market some time to digest this news but the Fed’s commitment to a prolonged program of large purchases contributed to the consistency of the impressive trend between 2012 and 2014.

.png)

Yesterday’s intraday volatility was scary but with the central bank on the side of investors, purchasing €90 billion a month and willing to take just about anything, this is a greenlight for risk-on trading.

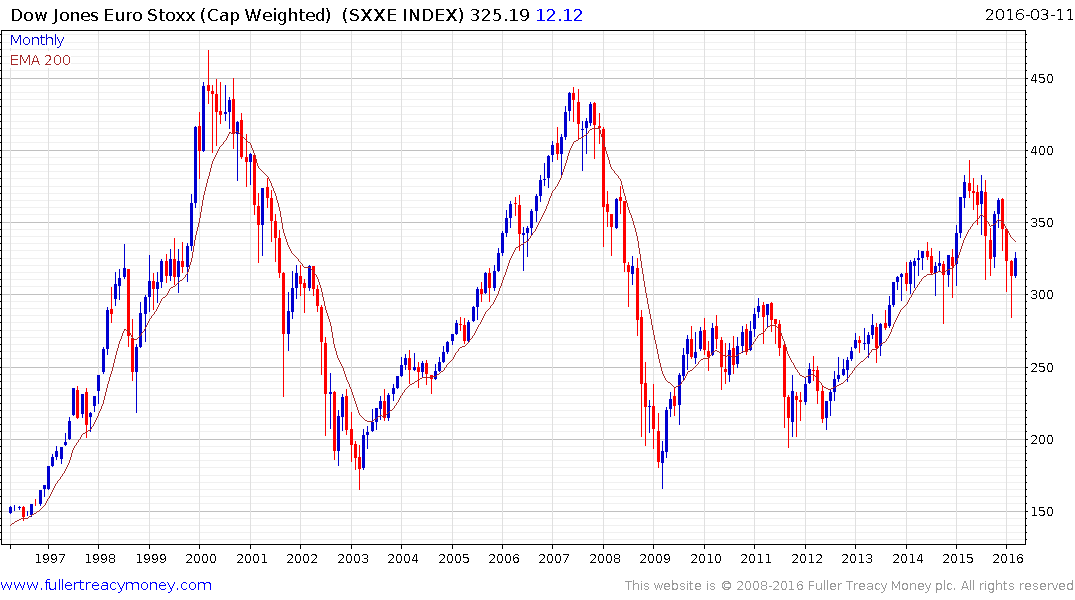

The Dow Jones Euro STOXX Index (SXXE) has been in a correction for a year. The rally from the February low has also most unwound the overextension relative to the trend mean and a sustained move above 340 would break the yearlong progression of lower rally highs. At today’s level the Index is in the middle of the 16-year range.

Both the Italian and Spanish indices are now rallying from the lower side of lengthy Type-3 base formations.

Perhaps the greatest lesson from QE is that it does not do a great job at fostering growth but it is highly effective at inflating asset prices. This is already apparent on the periphery where Ireland’s inflation is picking up and Spanish property is well off the lows. The one size fits all monetary policy for a highly diverse economic area could create misallocations of capital, but this unlikely to become a problem for at least next few years.

Massive money printing is likely to keep a lid on the Euro over the medium-term.

Back to top