Draghi Calls for Caution as Flagship Stimulus Heads to Exit

This article by Carolynn Look and Alessandro Speciale for Bloomberg may be of interest to subscribers. Here is a section:

Mario Draghi warned that the European Central Bank will remain cautious even as he put his signature stimulus measure on the road toward an exit.

Starting in January, the ECB will take a step toward ending one of its more controversial tools by cutting monthly purchases of public and private debt to 30 billion euros ($35 billion), or half the current pace. The shift in stance comes six years into Draghi’s presidency, a new phase after his unprecedented actions to prevent the breakup of the euro area and stave off deflation.

The decision “reflects growing confidence in the gradual convergence of inflation rates towards our inflation aim on account of the increasingly robust and broad-based economic expansion,” he said in a press conference after Thursday’s Governing Council meeting. “At the same time, domestic price pressures are still muted overall, and the economic outlook and path of inflation are conditional on support from monetary policy.”

While Draghi toned down his language, saying the euro area still needs “ample” stimulus instead of the “substantial” used in previous statements, he emphasized the need to tread carefully as long as consumer prices remain weak. QE will be extended again if needed, even if only to draw it to a gentle halt, and will take total holdings to at least 2.55 trillion euros.

The ECB has added 2.3 trillion to its balance sheet in less than three years. That’s a substantial sum and in tandem with the Bank of Japan, has been responsible for the continued flow of liquidity into global financial markets.

However, no market has benefitted more from the ECB’s largesse than German government bonds. German debt out to maturities of 7 years is still trading at negative yields and in fact the ECB has bought so many they are running out of fresh bonds to purchase.

This section from Anthony Peters note for SOL Capital highlights the issues arising from this condition:

But the real crux was summarised by a very bright friend of mine in New York who put it as follows “America has an equity culture. We had the Greenspan put. Then we had the Bernanke put. There will be Yellen put; we just haven’t either seen it or needed it yet. Europe has a bond culture. Europe has had its Draghi bond put. The problem is that one day they will wake up and discover that they don’t have a put at all. When Italian junk issuers are paying less for their money than the US Treasury you know it’s got to be wrong”. And therein lies Draghi’s conundrum. It’s not about whether the economy can support a tightening of monetary conditions which no doubt it can, it’s about what the money men in Frankfurt, Paris, Milan, Madrid and all stations in between perceive the effect to be and how they react to the ECB’s quiet struggle to get itself out of the monetary straitjacket is has let itself be strapped into.

Put another way, the EU is not a single unified country even though the ECB and European Commission behave as if it is. The situation where Italian, Spanish and French bonds trade at lower yields than US Treasuries appears nonsensical but the reality is the ECB can buy whatever it likes with the money it is creating. The point at which the bond market explores whether the European project can in fact hold together will probably be when the ECB stops buying.

The market most likely to feel the effects of a change of strategy is the one which benefitted most from it, which is the German government bond market. At present there is little evidence of anxiety in the market since the ECB decision was so well telegraphed.

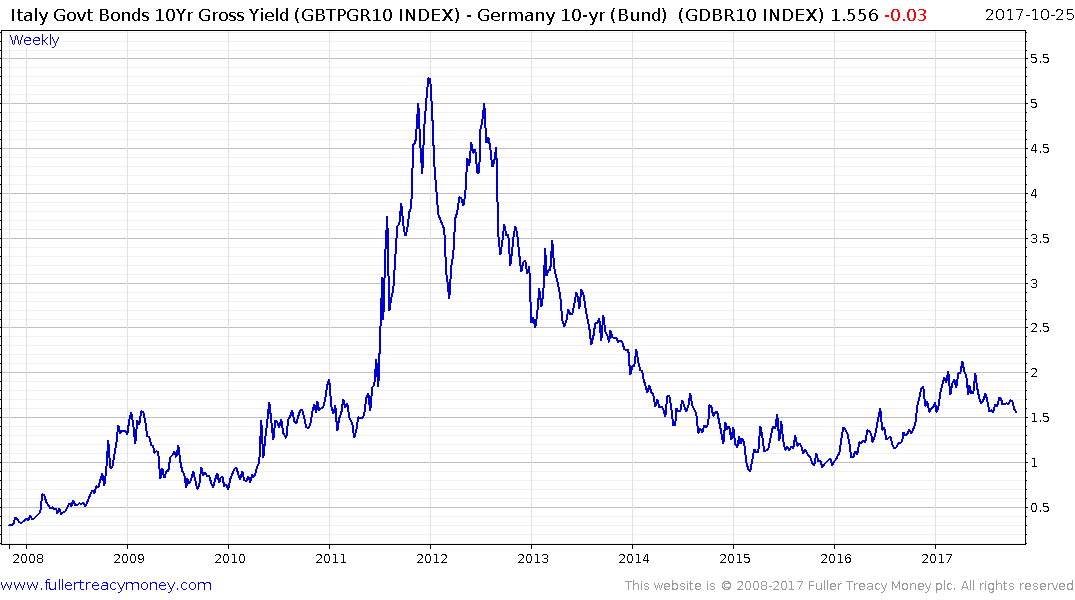

Italian spreads over Bunds had trended higher from late 2015 but have contracted by 50 basis points since April. That move has broken the progression of higher reaction lows and suggests that despite a more moderate pace of intervention, the ECB is still supporting the Italian sovereign debt market.

Very public announcements by Ray Dalio et al that they are shorting Italian securities have so far focused on the equity market. Here is a section from an MarketWatch article:

Other countries are facing the same question of how to plug the ECB hole, but Italy has two things specifically going against it: 1) An election in 2018, with several euroskeptic parties making headway in the polls, including former prime minister Silvio Berlusconi’s Forza Italia party. And 2) concerns over debt sustainability.

Clicking through the constituents of the Italian Banks sector the majority continue to hold progressions of higher reaction lows; albeit within almost decade long volatile ranges. That suggests these predictions of imminent doom are at best early.

In the insurance sector Cattolica Assicurazioni broke out of an over two-year range three weeks ago and a sustained move below the trend mean would be required to question medium-term scope for additional upside.