Draghi Braves QE Hype With Boost That Leaves ECB Room to Do More

This article by Jeff Black and Maria Tadeo may be of interest to subscribers. Here is a section:

The fresh stimulus coincides with a shift in global monetary policy, with the ECB adding stimulus as the U.S. Federal Reserve prepares to start its process of normalization. Even so, financial markets reacted with skepticism, sending the euro up as much as 2.6 percent and equities and government bonds down in a sign that Draghi’s measures fell short of expectations.

“The expectations were too high, and this was the minimum he could do,” said Marco Valli, chief euro-area economist at UniCredit SpA in Milan. “I think this was a mix of Draghi being held back by the conservatives, but also him wanting to keep some powder dry in case more is needed.”

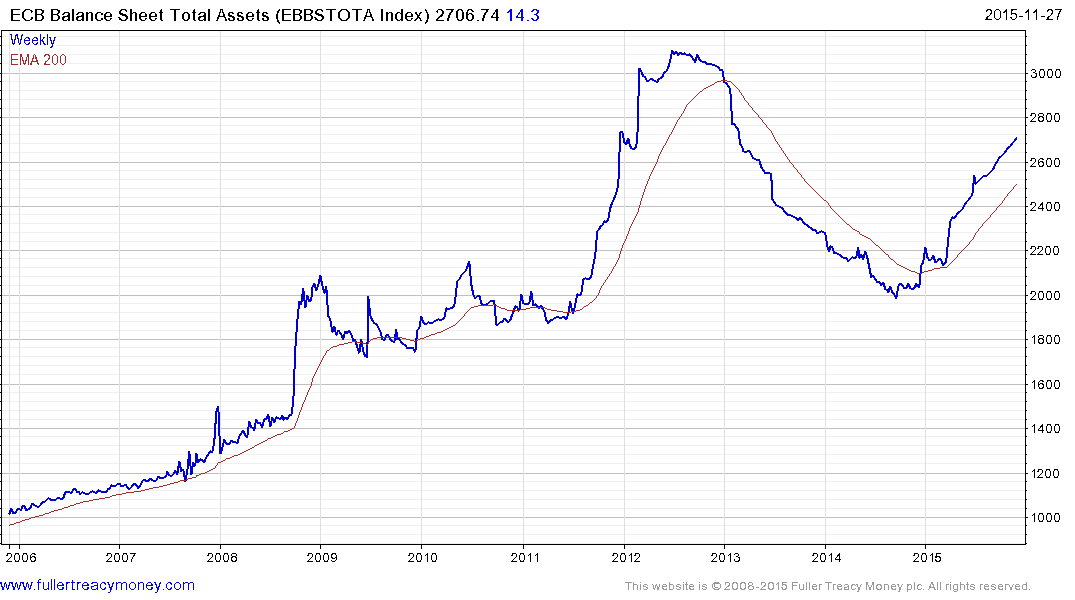

The ECB’s balance sheet is currently in the region of €2.7 trillion. At €60 billion a month until March 2017 they will add an additional €960 billion which will take the total to well in excess of the previous peak in largesse; reached during its previous expansionary program. With the announcement that they will continue to reinvest maturing issues the prospect of the balance sheet contracting is almost zero. Meanwhile they leave the door open to additional easing should the need arise.

Today’s volatility across Euro denominated assets in particular highlights the fact the market is really only concerned with how effectively QE can help to inflate asset prices. In that regard there is a certain sense of diminishing returns the higher prices go so that ever increasing quantities of additional liquidity are required to fuel momentum moves. This is particularly the case in government bonds which are the primary focus of ECB purchases.

German Bund yields rallied today to challenge the progression of lower rally highs and the size of the dynamic suggests supply is returning to dominance following a steady period. Follow through tomorrow or next week would help to confirm that view.

Out on the periphery of the Eurozone Greek 10-year yields rallied today to break a medium-term progression of lower rally highs suggesting the yield compression has gone about as far as it can.

The Euro Stoxx 50 is representative of pullbacks right across the European equity markets today as its forms a downside weekly key reversal. A sharp rally tomorrow will be required to question potential for a further test of underlying trading.

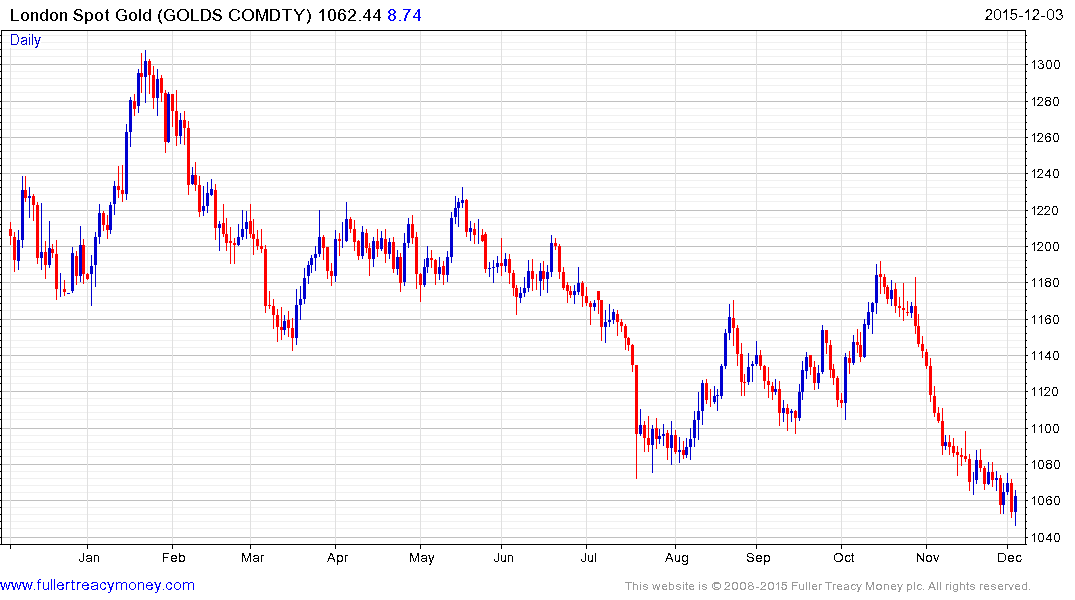

With the uptick in risk perception, gold was firmer today; rallying from a five-year low. Additional upside follow through will be required to break the progression of lower rally highs evident since mid-October.