Dow's Merck Swipes Immuno-Oncology Share From Heavyweight Rivals

This article from investors.com may be of interest to subscribers. Here is a section:

Four immuno-oncology drugs from Merck, Bristol-Myers and Roche brought in $464 million in February, declining 4% from $483 million in January, Leerink analyst Seamus Fernandez said, citing data from tracker Symphony Health.

But February was a shorter month, which could be partly responsible for the decrease, Fernandez said in a research report. Despite the slowdown, Merck's Keytruda sales grew 2% in February vs. the prior month.

Meanwhile, Bristol-Myers' drugs Opdivo and Yervoy held on to a collective 69% market share, falling 1% vs. January. Merck's Keytruda now has 24% of the market, up from 23% the prior month. Roche's Tecentriq was flat at 7% share.

Immuno-oncology drugs fight cancer by teaching the body's immune system to identify cancer cells hiding behind specific proteins. Those proteins are called checkpoints.

CRISPR-Cas9 gene editing is quickly revolutionising the genetics sector by reducing the cost and increasing the speed of innovation. That is particularly good news for cancer treatments because there are so many different mutations and each needs a tailored approach. In fact the end point of research and another area receiving a great deal of interest is the synthetic biology sector where custom viruses can be written to attack a patient’s personal cancer.

The immuno-oncology sector has been among the leading performers in the biotech sector this year because the route to commercialisation has improved so rapidly with the introduction of CRISPR. The above article focuses on the larger companies in the sector which have been active acquirers of smaller companies.

Merck has encountered resistance in the region of $60 on a number of occasions since 2002 but broke above it late last year and is currently consolidating that gain. A sustained move below that level would now be required to question medium-term scope for additional upside.

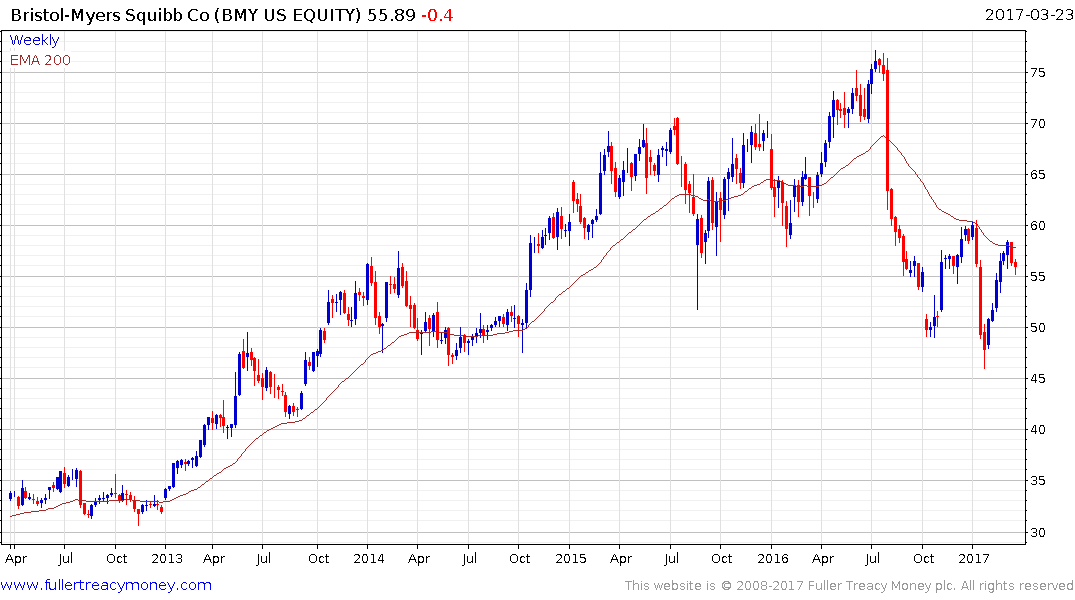

Bristol Myers Squibb was among the better large cap performers following the biotech sector base formation completion in 2011. It also experienced one of the larger pullbacks in 2016 and has encountered resistance in the region of the trend mean since. It pulled back from the region of the 200-day MA again this week and will need to sustain a move above it to confirm a return to demand dominance beyond short-term steadying.

Roche hit a medium-term peak in 2014 and has held a progression of lower rally highs since. It pulled back from the $260 area three weeks ago and will need to hold the above $240 if potential for additional upside is to be given the benefit of the doubt.

The performance of the above shares suggests the best way to play the sector is in the smaller companies that have potential to develop new drugs and then will either be successful in their own right or be taken over.

Incyte Corp for example is priced for growth, with an estimated P/E of over 500. It accelerated to its recent peak and at least some consolidation of that move is now underway.

Bluebird Bio Inc. has paused in the region of the psychological $100 over the last week.

Kite Pharma has also paused following an impressive run-up.

Clovis Oncology remains in a steep uptrend but has also paused.

Immunogen has now closed its overextension relative to the trend mean.

Editas, which controls the majority of the patents regarding CRISPR, has returned to test the region of the trend mean.

Illumina, the leader in genetic sequencing machines, is challenging a medium-term progression of lower rally highs.

Also see. http://www.fullertreacymoney.com/search/?search=Immuno-oncology

Back to top