Dollar's Trump-Inspired Surge Sets Off Intervention Across Asia

This article by Narayanan Somasundaram and Lananh Nguyen for Bloomberg may be of interest to subscribers. Here is a section:

“We are seeing carnage in Asian FX markets,” said Robert Rennie, head of financial markets strategy at Westpac Banking Corp. in Sydney. “It’s providing a very strong reminder that the S&P 500 is not the correct barometer of Trump-driven risk aversion -- it’s Asian currencies.”

And

Investors are betting Trump will cut taxes, ramp up infrastructure spending to spur economic growth and inflation, triggering Fed rate increases. Traders see an 84 percent probability of a quarter-point hike at the central bank’s December meeting, according to pricing in federal funds futures.

After Trump’s election, benchmark 10-year Treasury yields climbed above 2 percent for the first time since January on speculation the likely spending to spur growth will quicken inflation. Trump’s proposals include pledges to cut taxes and spend as much as $500 billion on infrastructure.

“The market’s tone remains negative on bonds, emerging markets, positive on U.S. stocks and the dollar,” said Nizam Idris, head of foreign-exchange and fixed-income strategy at Macquarie Bank Ltd. in Singapore.

Lower taxes, higher rates and outsized US growth are a powerful siren for US funds to be repatriated. That means the case for investing in emerging markets will have to be even more attractive than normal in order to compete on a risk-adjusted basis. Currency trends are a big part of that. US Dollar investors are less inclined to invest abroad when the currency market is not in their favour.

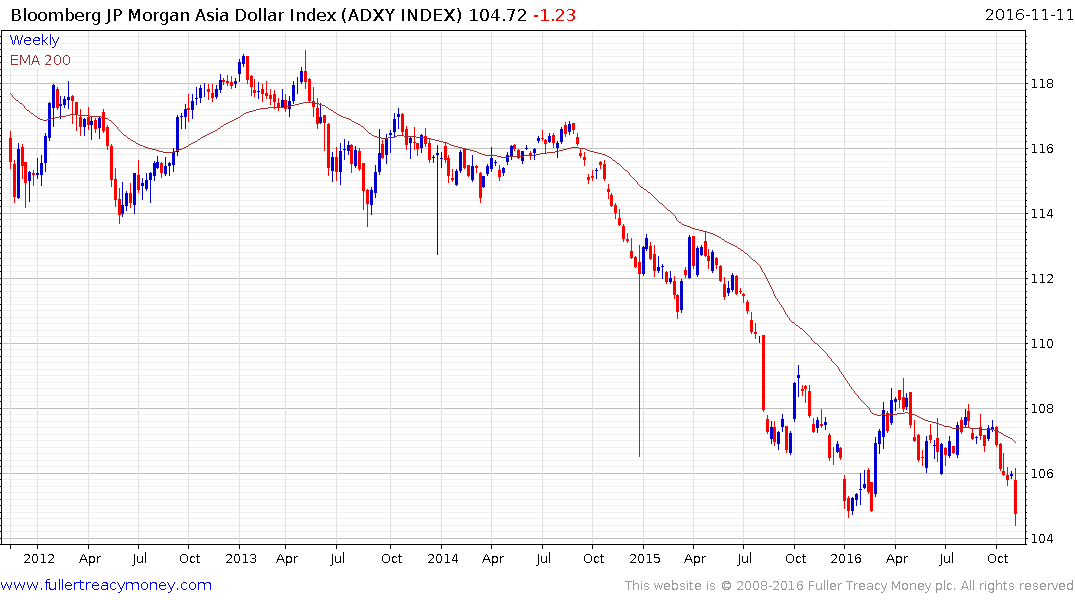

The Asia Dollar Index dropped back in a dynamic manner to test its January low this week and while somewhat oversold in the short term, a clear upward dynamic will be required to check momentum beyond a brief pause.

The Indonesian central bank intervened to arrest the decline of the currency today and has been active in supporting the Rupiah over the last 18 months which is in rather sharp contrast with the actions of other central banks. Nevertheless it is too early to conclude whether this will translate into stock market outperformance.

The Jakarta Composite failed to hold the move to new highs on Wednesday and pulled back in a dynamic manner today to form a large downside weekly key reversal. There is still a great deal of uncertainty surrounding the outlook for emerging markets following the US Presidential Election results and a clear upward dynamic will be required to question potential for additional downside.