Dollar Rises to 4-Month High as GDP Tops Forecasts; Euro Drops

This article by Andrea Wong for Bloomberg may be of interest to subscribers. Here is a section:

The U.S. currency strengthened for a ninth day versus the yen as the spread between Treasury two-year note yields and those of similar maturity German bunds reached the most in more than seven years. The euro fell to an eight-month low as German inflation slowed. The ruble snapped a four-day drop as some investors saw U.S. and European sanctions against Russia as milder than anticipated. Emerging-market currencies declined a fifth day in the longest skid in six months.

“The main components of the gross domestic product numbers look quite strong,” Brian Daingerfield, currency strategist at Royal Bank of Scotland Group Plc’s RBS Securities unit in Stamford, Connecticut, said in a phone interview. “It supports the Fed’s base-case scenario that the economy is gradually improving. It’s quite positive for the dollar. It just adds fuels to the fire.”

The USA’s economic outperformance relative to the tepid expansion in Europe has helped to bolster the attraction of the Dollar. Concurrently the Eurozone needs a weaker currency in order to bolster competitiveness and reignite peripheral economies.

The Euro has dropped from $1.40 to its current $1.3375 since May and broke its progression of higher reaction lows in the process. While somewhat oversold in the very short term a sustained move back above the 200-day MA, currently near $1.36, would be required to question medium-term potential for lower to lateral ranging.

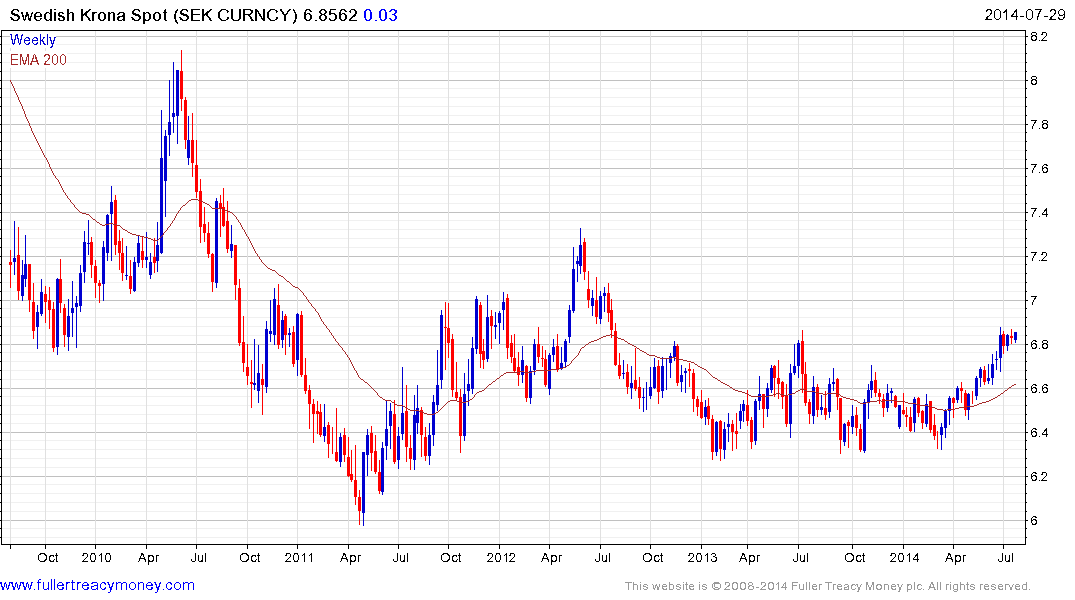

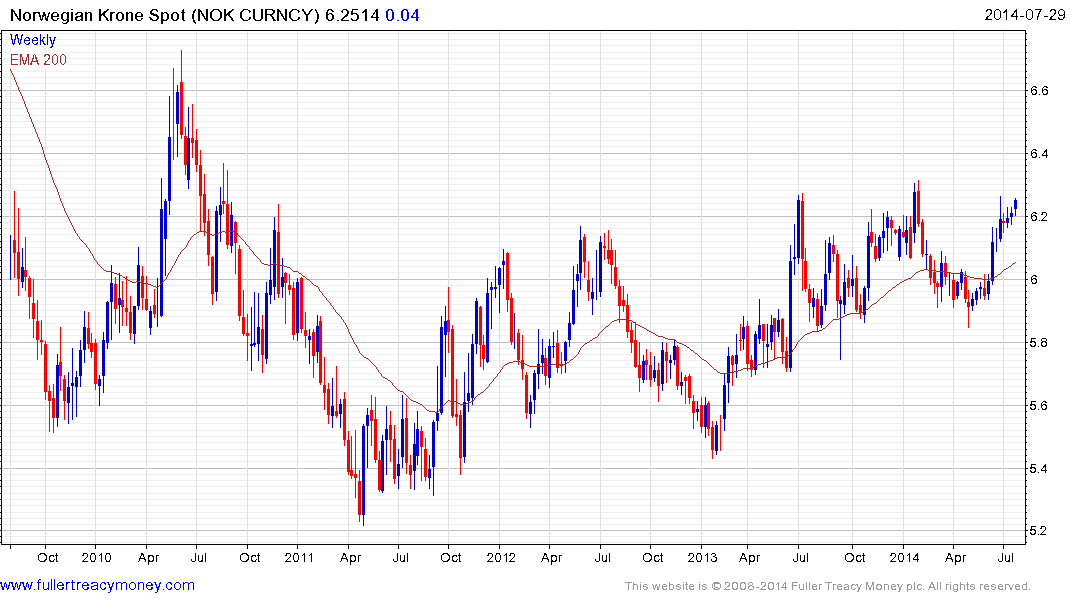

The Euro’s weakness has pressured neighbouring countries such as Sweden and Norway to also seek weaker currencies. The US Dollar is breaking out of a two-year base against the Swedish Krona and is testing the upper side of a yearlong range against the Norwegian Krone.

Europe and Japan compete in many of the same markets so the Euro’s weakness represents an additional impetus to weaken the Yen. The Dollar continues to firm from the region of the 200-day MA and a sustained move below ¥101 would be required to question medium-term scope for additional upside.

Against an environment where a number of currencies are weakening against the US Dollar, the recent strength of the Chinese Renminbi is worthy of note. The Dollar has held a progression of lower rally highs since April and completely unwound its over extension relative to the 200-Day MA in the process. While somewhat oversold in the short term a clear upward dynamic will be required to demonstrate a return to demand dominance in this area.