Dollar Rises as Yellen, Fischer Spur Bets for Fed Rate-Increase

This article by Maciej Onoszko and Lananh Nguyen for Bloomberg may be of interest to subscribers. Here is a section:

“Fischer really maintained the focus on the near-term, whereas Yellen was a bit more comprehensive across the cycle,” said Eric Theoret, a foreign-exchange strategist at Bank of Nova Scotia in Toronto. “That’s where the distinction lies. Yellen’s was a broader discussion, Fischer’s was very much a narrow, near-term discussion and because of that we did see that broad dollar rally.”

Investors’ sentiment has oscillated in recent weeks on the pace of Fed monetary tightening after it raised rates in December for the first time since June 2006. The dollar’s 5 percent loss this year reflects a dimming outlook for the U.S. central bank to reduce stimulus and diverge from unprecedented easing in Europe and Asia.

Bloomberg’s Dollar Spot Index, which tracks the currency against 10 peers, rose 0.8 percent as of 2:41 p.m. in New York, reaching the strongest level since Aug. 10. It fell as much as 0.6 percent. The greenback gained 0.7 percent to $1.1201 per euro and added 1.3 percent to 101.81 yen.

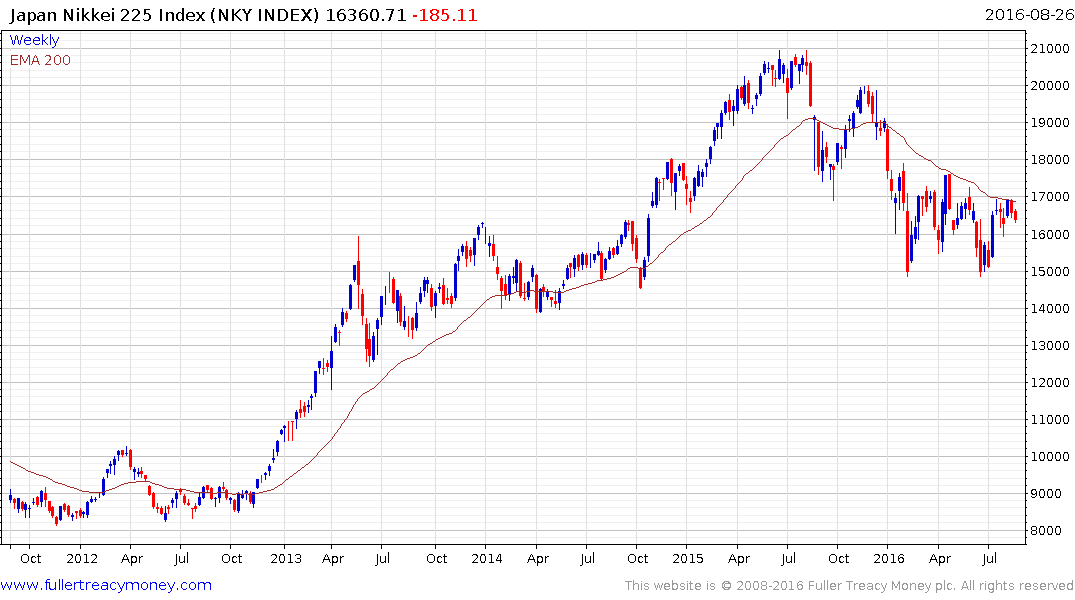

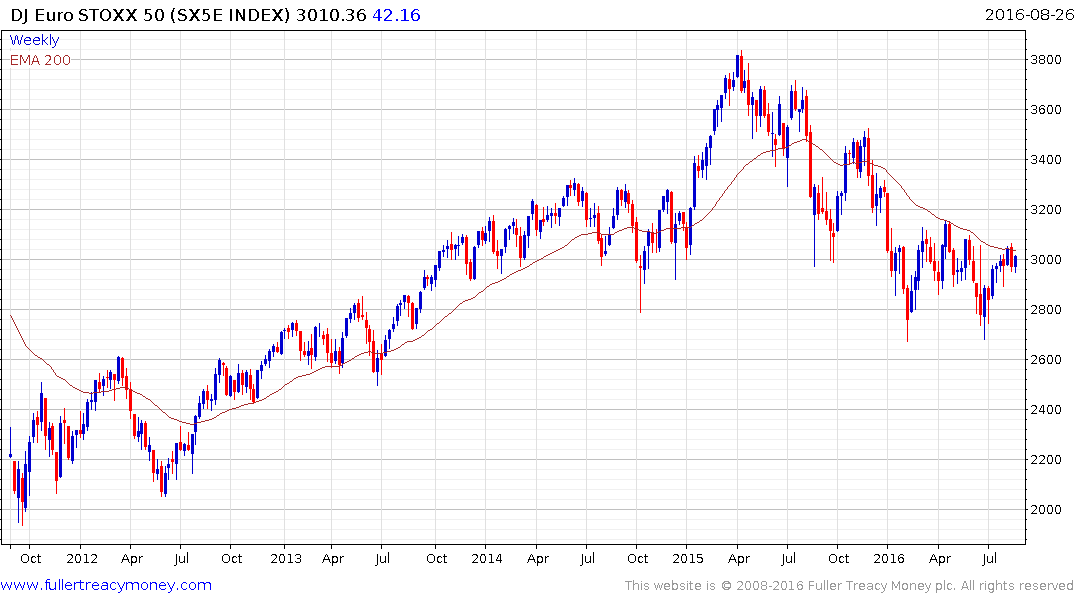

The Yen has been particularly strong against the Dollar this year while the Euro has been largely locked in a range for more than a year. The prospect of the interest rate differential between the US Dollar and other major currencies widening further represents a tailwind for equity markets fighting deflation with weaker currencies.

The Dollar bounced today from the region of ¥100 today and Nikkei-225 futures recouped today’s earlier loss.

The Dollar also bounced against the Euro and recouped all of last week’s decline. The Euro Stoxx 50 has rallied back to retest the region of the trend mean. A sustained move above it would reassert medium-term demand dominance; at least in nominal terms.