Dimon Says QE Unwind May Be More Disruptive Than You Think

This article by Cindy Roberts may be of interest to subscribers. Here is a section:

“We’ve never have had QE like this before, we’ve never had unwinding like this before,” Dimon said at a conference in Paris Tuesday. “Obviously that should say something to you about the risk that might mean, because we’ve never lived with it before.”

Central banks led by the U.S. Federal Reserve are preparing to reverse massive asset purchases made after the financial crisis as their economies recover and interest rates rise. The Fed alone has seen its bond portfolio swell to $4.5 trillion, an amount it wants to reduce without roiling longer-term interest rates. Minutes of the Fed’s June 13-14 meeting indicate policy makers want to begin the balance-sheet process this year.

“When that happens of size or substance, it could be a little more disruptive than people think,” Dimon said. “We act like we know exactly how it’s going to happen and we don’t.”

Cumulatively, the Fed, the European Central Bank and the Bank of Japan bulked up their balance sheets to almost $14 trillion. The unwind of such a large amount of assets has the potential to influence a slew of markets, from stocks and bonds to currencies and even real estate.

“That is a very different world you have to operate in, that’s a big change in the tide,” Dimon said. All the main buyers of sovereign debt over the last 10 years -- financial institutions, central banks, foreign exchange managers -- will become net sellers now, he said.

These are common sense statements from one of the most important CEOs in the industry and suggests central banks need to be very careful about how they adjust the status quo. That’s particularly true considering the effect quantitative easing has had on asset price inflation which was by design.

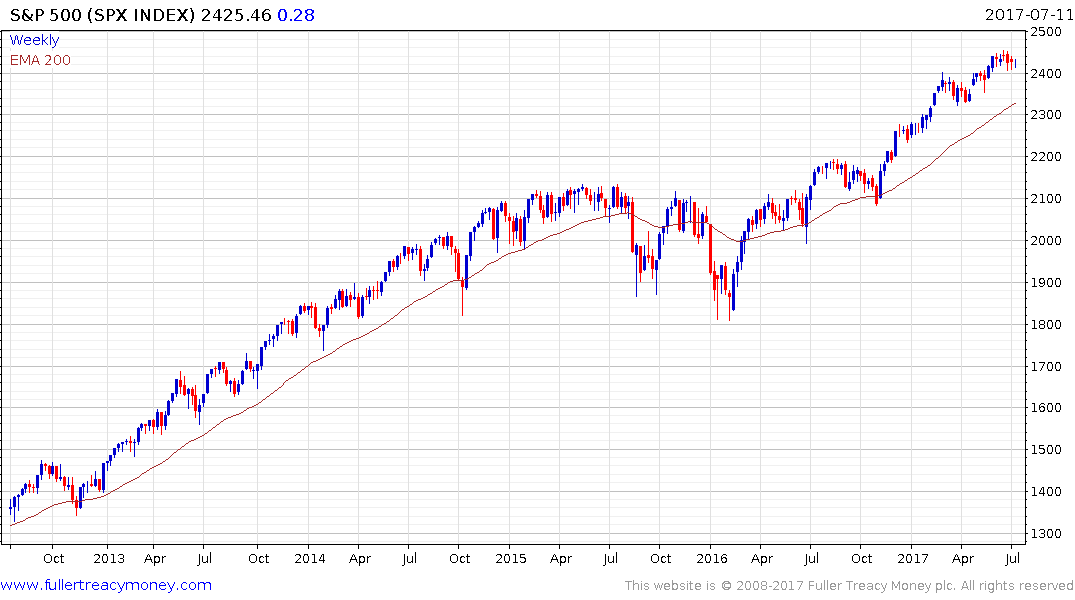

The S&P500 has been ranging in a tight manner between 2400 and 2450 snice late May and that is within the context of a very consistent staircase step sequence uptrend evident since early 2016. A break in that sequence will be required to begin to question current scope for additional upside.

The Europe STOXX 600 Index has been hampered by the strength of the Euro since its May peak and that has translated into the largest pullback since it broke successfully above 350 in December. However, a sustained move below the trend mean, currently near 370, would be required to question medium-term upside potential.

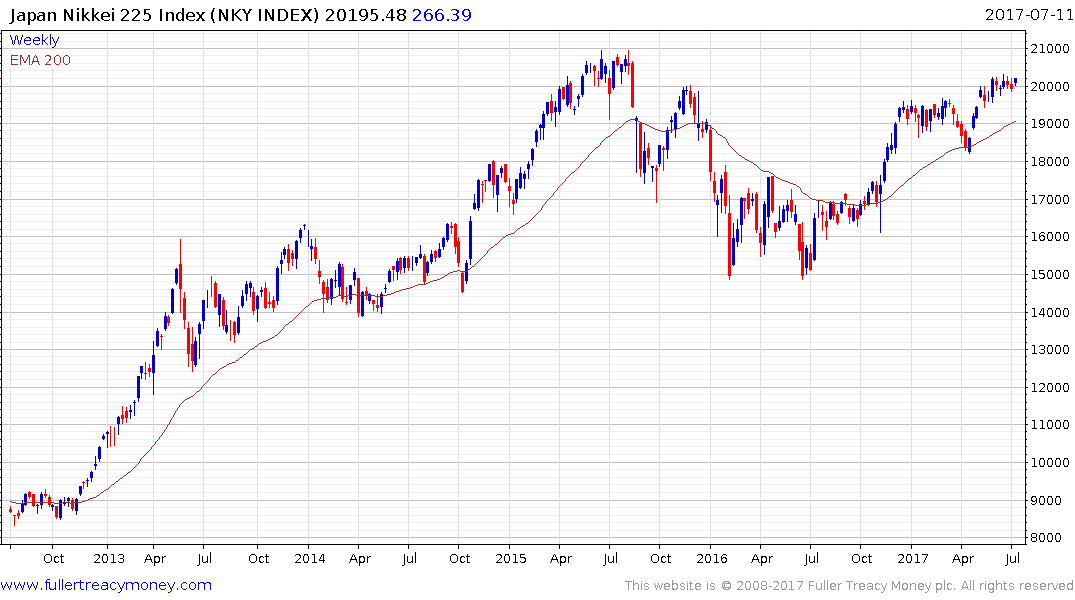

The Nikkei-225 Index pushed back above the psychological 20,000 level again this week and a sustained move above it would signal a return to medium-term demand dominance.

There is a constant flow of proclamations on whether the bond bull market is over or has years left to run and the stakes are high. The fact it is possible to make reasonably credible arguments on both sides helps to explain the range that has been in place in Treasury yields so far that year and that supply and demand are back in a relative balance. However, the much broader point is yields are at low absolute levels and this broad range evident since 2011 has Type-3 bottom formation characteristics which gels with a war between supply and demand.

While the risks are reasonably clear there is, so far, no urgency in the minds of investors because they have not experienced profit erosion. That will eventually change and central bank tightening and balance sheet rationalization could well be the catalyst. However, it would coincide with top formation characteristics in stock markets and right now there is no evidence of that.