Diamond Standard Market Outlook

I had the pleasure of speaking with the CEO of Diamond Standard, Cormac Kinney, last week and they kindly forwarded over their most recent market update. Here is a section:

The announcement of diamonds as a regulator-approved investment product has resonated across the industry. The anticipated 1% to 2% growth in rough diamond production over the next five years will not keep up with accelerated demand, especially now that a much broader pool of investors are indirectly competing with the consumer jewelry market for diamonds.

Precious metals saw similar evolutions as their use expanded beyond the functional and decorative and into storing value. Investors now hold at least 15% of each above-ground precious metal. Early evidence of the impact of diamond investment assets indicates a shift toward the hands of investors similar to that of precious metals. Presently fewer than 1% of above-ground diamonds are allocated to investors.

There is more institutional investment in bitcoin than diamonds. The primary obstacle to investing in diamonds has always been fungibility. No two stones are the same and the relative merits of colour, shape, size, cut, clarity and fluorescence mean pricing has always been inefficient and subject to interpretation. The inefficiency of the market has kept the market for stones opaque and deterred institutions from attempting to take positions.

Additionally, diamond miners have been terrible performers and historically have offered very little exposure to the capital appreciation of stones. Diamond Standard has created a solution to this problem. They are in the process of launching a closed-end fund for qualified investors and over the next 12 months will launch, a physical ETF and an asset-backed cryptocurrency.

The primary innovation is they have become market makers in the sub-1 carat category. Making a market in over 10,000 stones a month has allowed them to create a value curve. By partnering with the GIA (Gemological Institute of America) they have created physical coins which are fully fungible in value.

Even though every coin has different diamonds inside it, the total value of the stones in each coin is the same. For the first time a diamond product is fully fungible which greatly facilitates trading. The coins are held in HSBC, JPMorgan and Brinks vaults so custody is assured and every coin and bar has an embedded chip for authentication. Auditing holdings is an embedded feature of the products. The aim is to record custody and trading on an asset-backed blockchain via the Bitcarbon coin.

The 1-carat diamond price peaked in 2011 and trended lower for a decade. The commodity crash and Chinese campaign against corruption and conspicuous luxury took their toll. The price bottomed in 2020 and remains on a recovery trajectory. The Diamond Standard Trust (DIAM) is pending listing.

Modern Portfolio Theory creates demand for uncorrelated assets. Since early 2020, diamonds have a .013 correlation to gold, .082 correlation to the S&P500 and .053 correlation to oil.

The uptrend in pricing and the relative merits for inclusion in a diversified portfolio will create demand. That suggests there is clear potential for institutional demand to balloon over the coming years as diamonds take their deserved position as market traded hard assets.

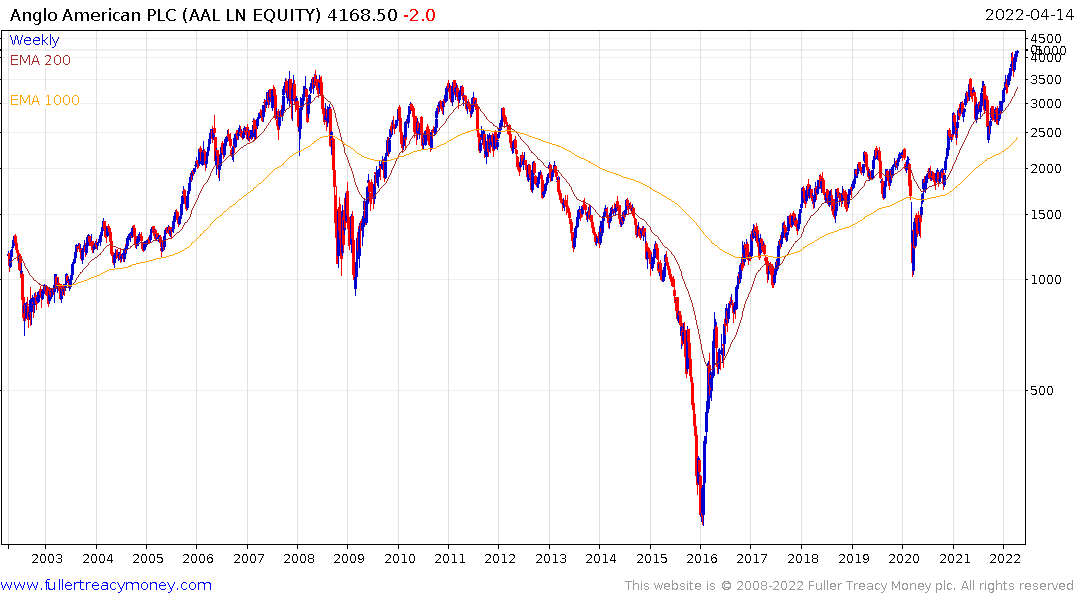

In addition to Diamond Standards emerging products, Anglo American, via DeBeers, is a significant potential beneficiary of this trend. The share continues to extend its breakout.

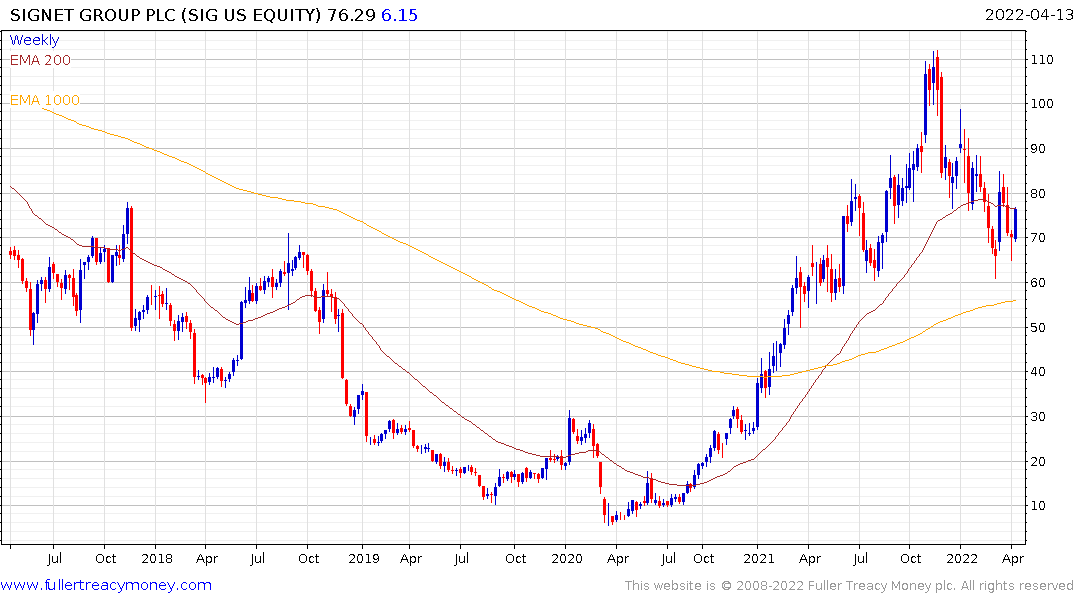

Signet Jewelers is a major retailer for diamonds. The share is currently firming from the region of the 1000-day MA.

.png)

UK listed Gem Diamonds is firming following the announcement of a buyback program.

Petra Diamonds is testing the upper side of its base formation, following an almost cataclysmic decline.

Petra Diamonds is testing the upper side of its base formation, following an almost cataclysmic decline.