Deutsche Bank Investment Banking Revenue Up 20% This Year

This article from Bloomberg may be of interest to subscribers. Here is a section:

Deutsche Bank AG said investment banking revenue has risen about 20% so far this year, as the market volatility that spurred gains during the height of the pandemic endured into early 2021.

Chief Transformation Officer Fabrizio Campelli gave the outlook for the German lender’s largest revenue contributor at an online event hosted by Morgan Stanley on Thursday, saying also the firm has continued to win market share in investment banking. He didn’t give further details.

Germany’s largest lender earlier flagged a “good start” to 2021, signaling that trading returns are helping to offset a weak economy. Credit Suisse Group AG and Societe Generale SA each flagged strong investment banking momentum recently, with the Swiss lender seeing revenue up 50% from last year.

It’s not so long ago that investors feared Deutsche Bank would go bust or need to be nationalised. The return to profitability in trading and the steepening US yield curve is a tailwind for many investment banks. Banks are highly cyclical stocks that thrive on liquidity provision during steep yield curve phases.

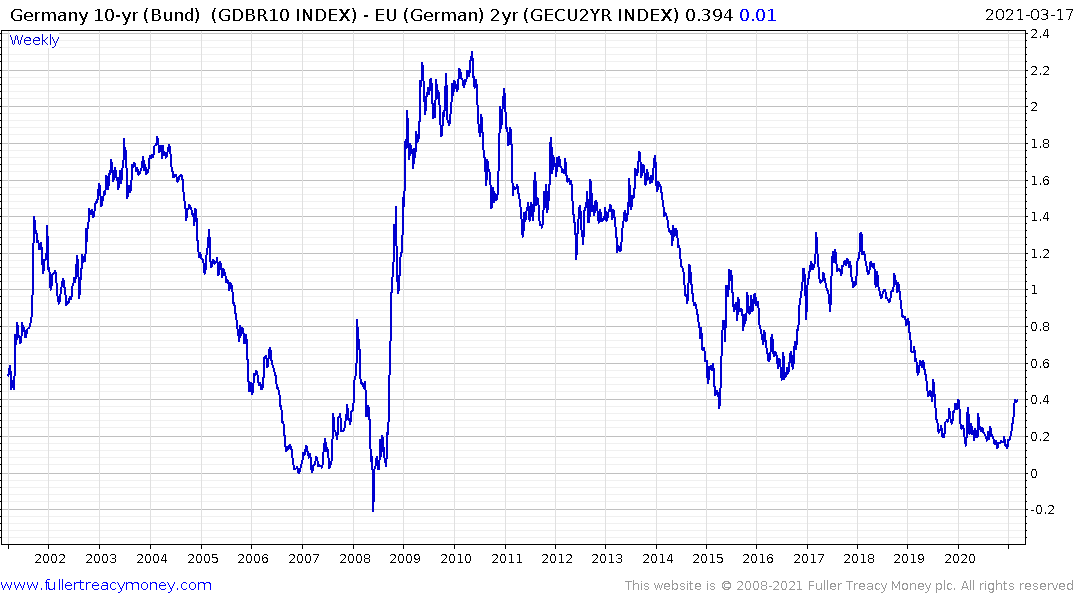

The German 10-year - 2-year yield curve spread bottomed in December and has rebounded to break the yearlong sequence of lower rally highs.

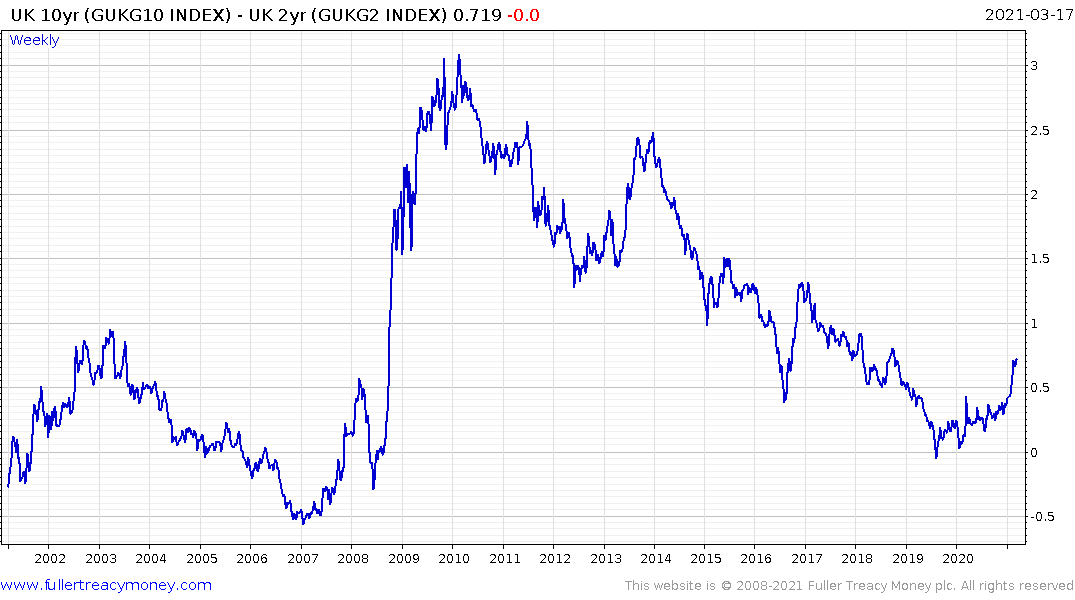

The Japanese, Swiss and UK curves also have bottoming characteristics.

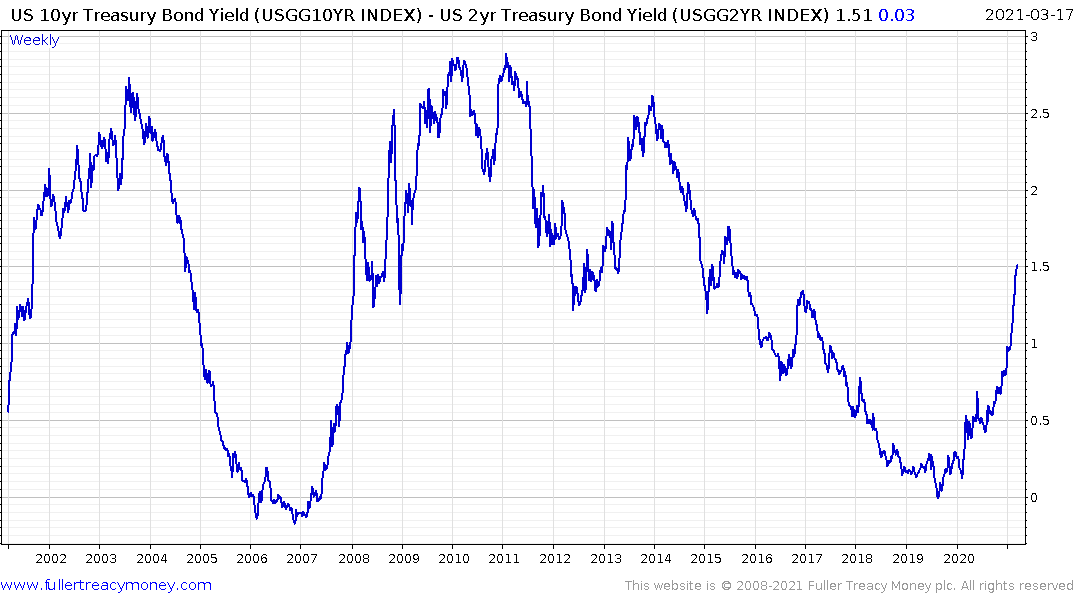

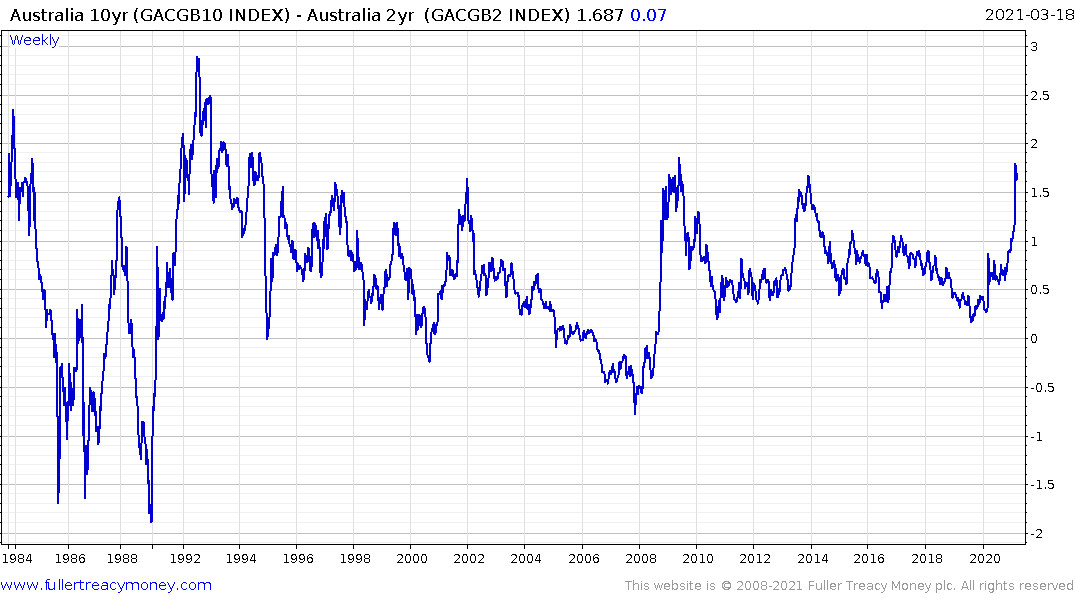

Meanwhile the US, Australian and Canadian curves are already well on the way to trending back to their historic peaks.

This suite of charts suggest banks everywhere are now back to making money. The bigger question is whether we are at peak regulation. Will consumers demand the opportunity to live their best life after the pandemic? Everything I’ve seen from travelling around and talking to people suggests that is already the case. That doesn’t come free, so it implies more spending and more demand for credit.

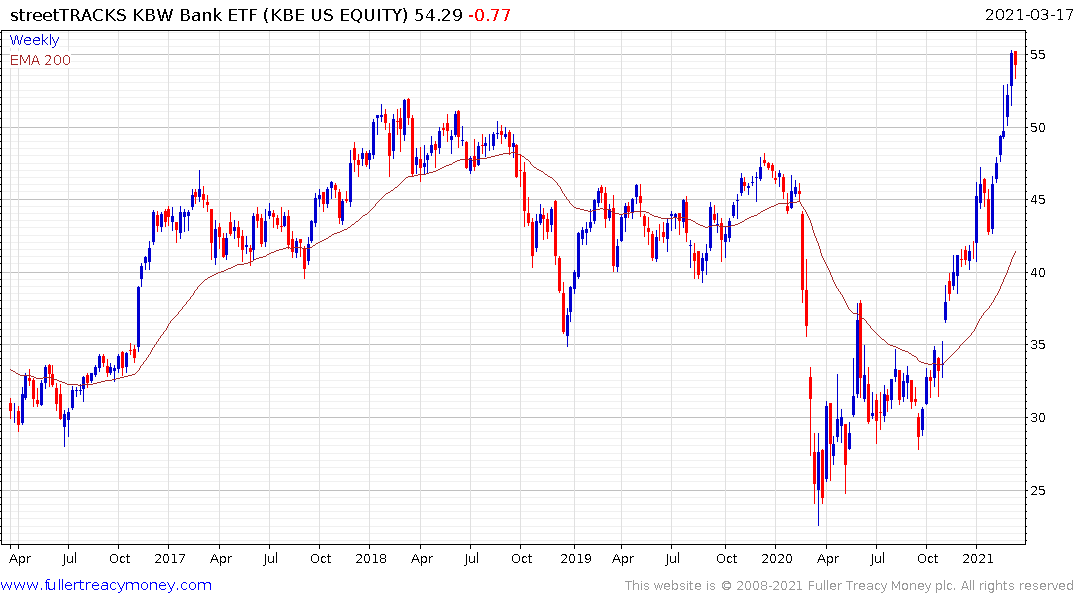

The streetTRACKS KBW Bank ETF hit a new all-time high this week.

The Amundi ETF MSCI Europe Banks UCITS ETF remains on a recovery trajectory.

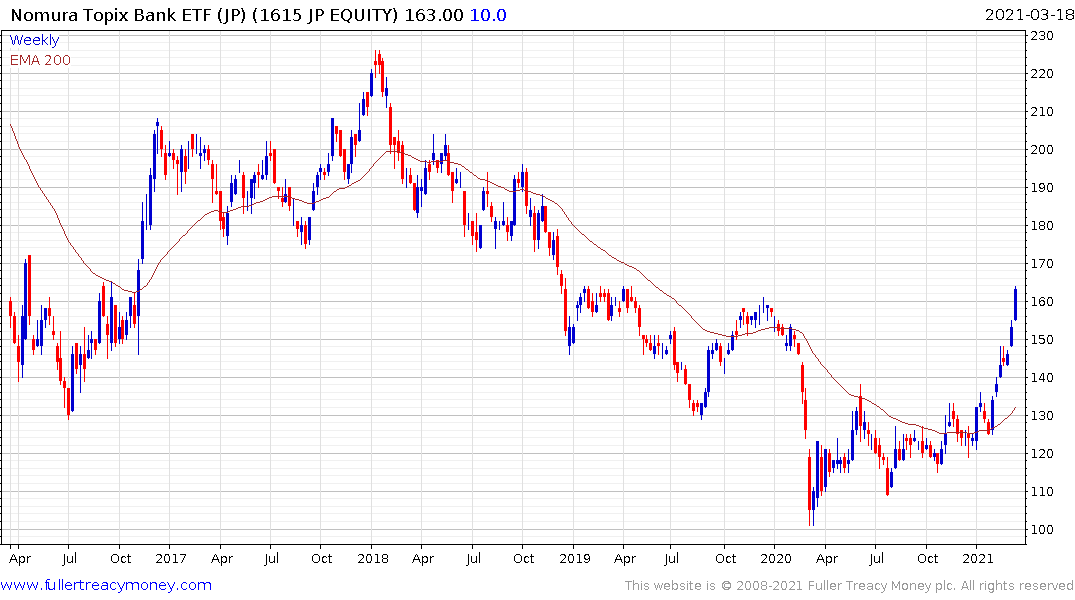

The Nomura Topix Banks ETF is also on a recovery trajectory.

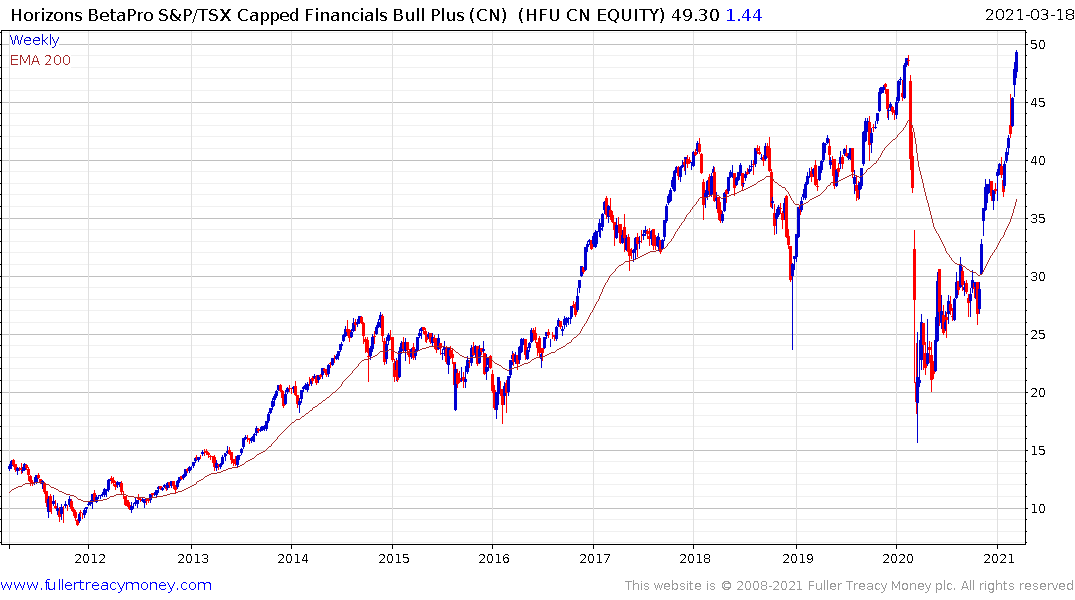

BetaPro S&P/TSX Capped Financials 2x Daily ETF is breaking to new highs.