Demand, supply, prices and geography

Thanks to a subscriber for this report from Deutsche Bank focusing on the Chinese fertiliser sector. Here is a section:

China, USA, Brazil and India are the world’s largest importers of potash each demanding of 4-9 mln tons annually. On 21-January, China signed an import contract with Uralkali (Russia) for 700k tons at a price of US$ 305/ ton gross of transport or roughly US$ 285/ ton net of (US$ 20/ton) transport. The current market price for wholesale Potash in China is US$ 335.8/ ton (Figure 19) which includes 17% VAT (US$ 278/ ton x-VAT). The prior China import contract was signed in January 2013 with Canpotex at a price of US$ 400/ ton. The 21-January China purchase set the first reference price for commercial potash since the breakup of BPC and the potash pricing cartel in July 2013. We think the price level is meaningful in that it seems to be set just north of what we believe to be the cash production cost of K+S from Germany. Germany supplies ~9% of the world’s potash market at a cash cost of ~US$ 262-270/ ton. There are other smaller potash producers from Brazil and USA that are knocked of the cost curve at US$ 262-270/ ton production cost. We suspect that knocking K+S (9%) off the global potash production line would cause prices to spike. We suspect 1) that Uralkali has set this price very deliberately to instill a bit of price discipline in the global potash market; and 2) that we have most probably hit the bottom of potash prices globally. It looks as if global potash prices have stabilized over the past 6-8 months (Figure 24).

here is a link to the full report.

Russia is a swing producer of a large number of commodities not least crude oil, natural gas, palladium, nickel and potash. Deteriorating relationships with the USA and Europe raise the possibility that it will use its position in any one of these markets to exert pressure, perhaps in response to additional sanctions. There is an element of cutting off one’s nose to spite one’s face in that kind of action so we could consider these alternatives as extreme responses. Cancelling orders of European goods is more likely. The wild card is that the Russia administration acts in accordance with a different set of values than many understand.

Uralkali has been trending lower since breaking the BPC agreement which in effect disrupted the global oligarchy. The cancellation of the agreement was aimed at reasserting its dominant market share which it felt was under pressure from higher cost producers. The current geopolitical tension represents an additional risk premium for the share.

K+S rebounded impressively from last year’s lows, but fell recently to break back below the 200-day MA. It will need to find support in the region of €21.75 if medium-term scope for continued higher to lateral ranging is to be given the benefit of the doubt.

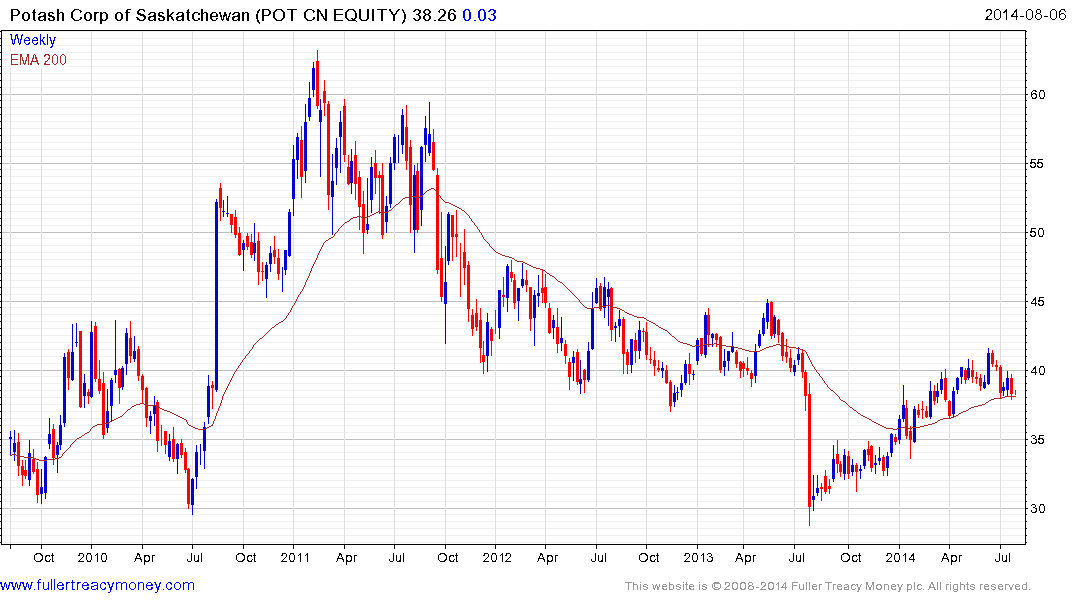

Potash Corp of Saskatchewan has a relatively similar pattern and is currently testing the region of the 200-day MA.

Back to top