Delivering Alpha Conference Notes 2016: Singer, Dalio, Chanos, Miller & More

Thanks to a subscriber for this list of quotes from the recent CNBC & Institutional Investor’s Delivering Alpha Conference. Here is a section:

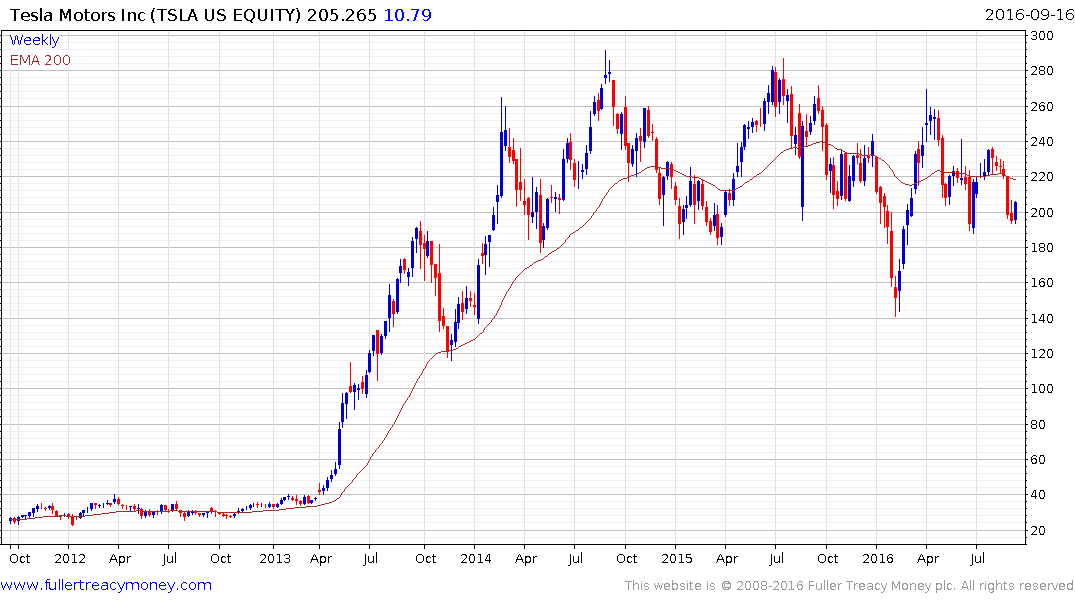

Jim Chanos (Kynikos Associates): Still short Alibaba (BABA), says they're "buying anything that's for sale, just burning cash." He's also still short Tesla (TSLA) and SolarCity (SCTY). Says the two companies combining basically puts TSLA on a path to potential bankruptcy.

And

Barry Sternlicht (Starwood): Real estate in New York City is "a disaster" with rents at the high-end down 15%. Noted the problem many investors face: "you have to invest in something, you can't just sit in cash." On Tesla, says he loves the car but would probably be short the company. Questioned Pinterest's valuation, arguing it seemed like a lot of money for a bulletin board. Said Doppler Labs could be like the next Oculus Rift.

Mary Erdoes (JPMorgan): "They're called crowded trades when they don't work and momentum trades when they do work." Says it's time to weed out the stock pickers who aren't the best.

Tesla produces cars many people aspire to own which is a major accomplishment for the USA’s first new car company in a century. However the company is under pressure to continue to accelerate the pace of innovation to help justify its aggressive valuation.

With a number of major milestones approaching such as the opening of its large battery factory and the rollout of the Model 3 slated for later this year and early next, it simply cannot afford to fail to deliver on its promises not to mind the self-driving technology it is attempting to perfect.

The primary risk with Tesla is that Musk will continue pushing the boundaries of normalcy until he fails, suggesting that while near-term challenges may be overcome he will simply go out and find new mountains to climb. That is a recipe for either a major success or abject failure with little room for a middle way alternative.

The share has steadied once more in the region of the psychological $200 and will need to hold this week’s low if potential for higher to lateral ranging is to be given the benefit of the doubt.

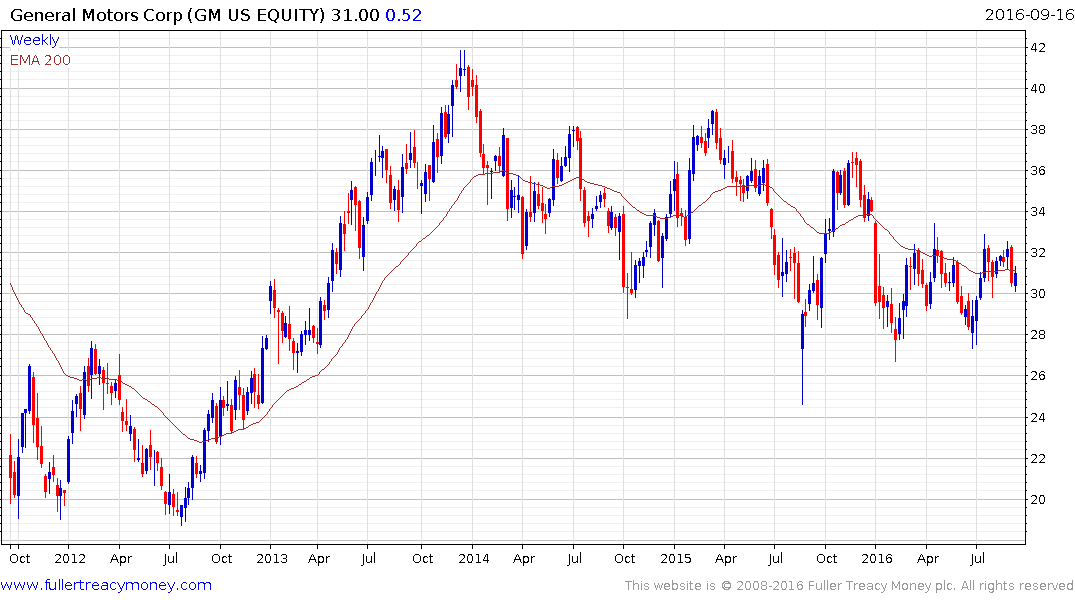

Elsewhere, Ford (Est P/E 6.65, DY 4.96%) remains in a medium-term downtrend and will need to sustain a move above the trend mean to suggest it does not represent a value trap.

GM (Est P/E, DY ) has at least firmed in the region of $30 and a sustained move above $33 would break the medium-term progression of lower rally highs.