Debt Market Distortions Go Global as Nothing Makes Sense Anymore

This article by Daniel Kruger, Liz Capo McCormick and Anchalee Worrachate for Bloomberg may be of interest to subscribers. Here is a section:

It’s hard to overstate how illogical it is when swap spreads are inverted. That’s because it suggests that governments are less creditworthy than the very financial institutions they bailed out during the credit crisis just seven years ago. And as the Fed prepares to end its near-zero rate policy, those distortions are coming to the fore.

The rate on 30-year swaps, which allow investors, companies and traders to exchange fixed interest rates for those that fluctuate with the market, and vice versa, has been lower than comparable yields on Treasuries for years now as pension funds and insurers increasingly hedged their long-term liabilities.

But in the past three months, spreads on shorter-dated contracts have also quickly turned negative. Now, five-year swap rates are about 0.05 percentage points lower than similar- maturity Treasuries, while those due in three years are also on the verge of flipping.

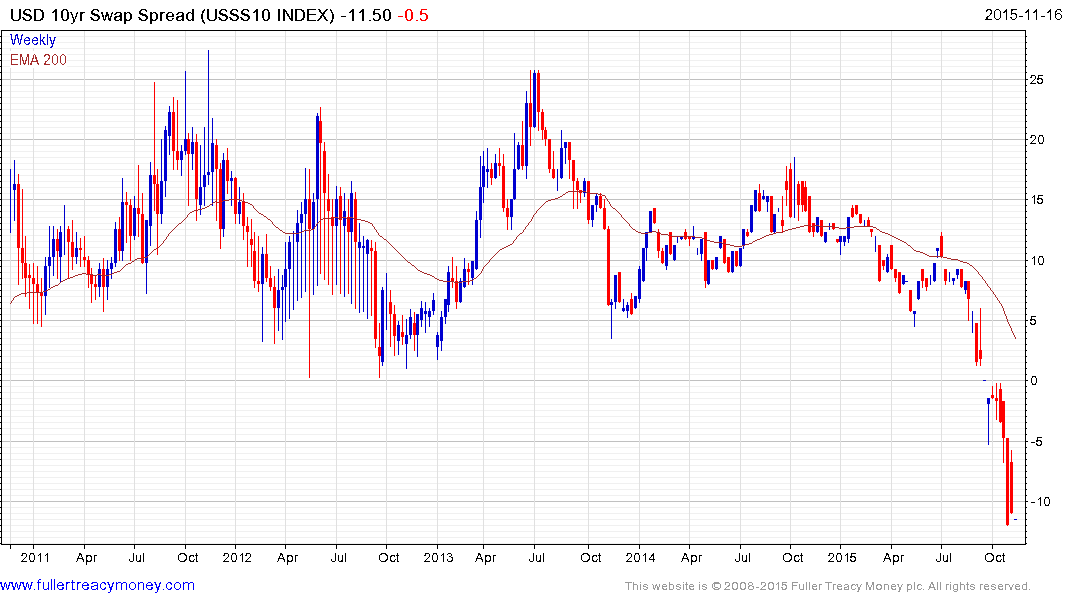

There are three important charts in the fixed income markets right now. The Swap spread is one of them because at increasingly wide negative levels important questions are being asked about how risk is being priced.

The simplest explanation is that floating rates are more attractive at shorter durations if one assumes the Fed will in fact raise rates next month. This would contribute to those cash flows being priced at a premium and particularly in a zero interest rate environment. However the condition also highlights just how much of a distorting influence quantitative easing has had and the gradual normalisation of interest rates, after such a long hiatus, will contribute to volatility as the status quo evolves.

BB yields found support last week in the region of the 200-day MA and a sustained move below that level would be required to question potential for additional expansion. Bond issuance has been setting records but as the potential for higher interest rates is priced in, the ability of junk issuers to continue to issue at record low rates is now being questioned.

US Treasury yields have base formation characteristics and a sustained move below 2% would be required to begin to question medium-term scope for continued higher to lateral ranging.