Deadly Delta Variant Starts to Ripple Through Emerging Markets

This article from Bloomberg may be of interest to subscribers. Here are some soundbites from regional analysts:

"The U.K. has shown that the variant is not such a health challenge if people have been vaccinated. We are concerned that Australasia and the smaller markets in Asean could continue to be impacted. We remain cautious on Asean equities. Watching for any sharp increase in Covid cases in Asean”

Kelvin Wong, an analyst at CMC Markets (Singapore) Pte.: “Tactically, it is likely to be more of a rotation play that may last into the upcoming third quarter where high-quality technology stocks may outperform over cyclicals”

“Hence for Southeast Asian equities that tends to be heavily weighted toward cyclical/financials and the external sector such as tourism are likely to underperform, for example Singapore’s Straits Times Index”

“The major key support to watch on the STI will be at 2,950/2,920 which also coincides with the 200-day moving average”

Alan Richardson, a senior portfolio manager at Samsung Asset Management (HK) Ltd. “It’s a speed bump that could slow the speed of the recovery but doesn’t change the direction to a post-Covid economy. The delta variant should increase the urgency for countries to reach three-quarters immunization”

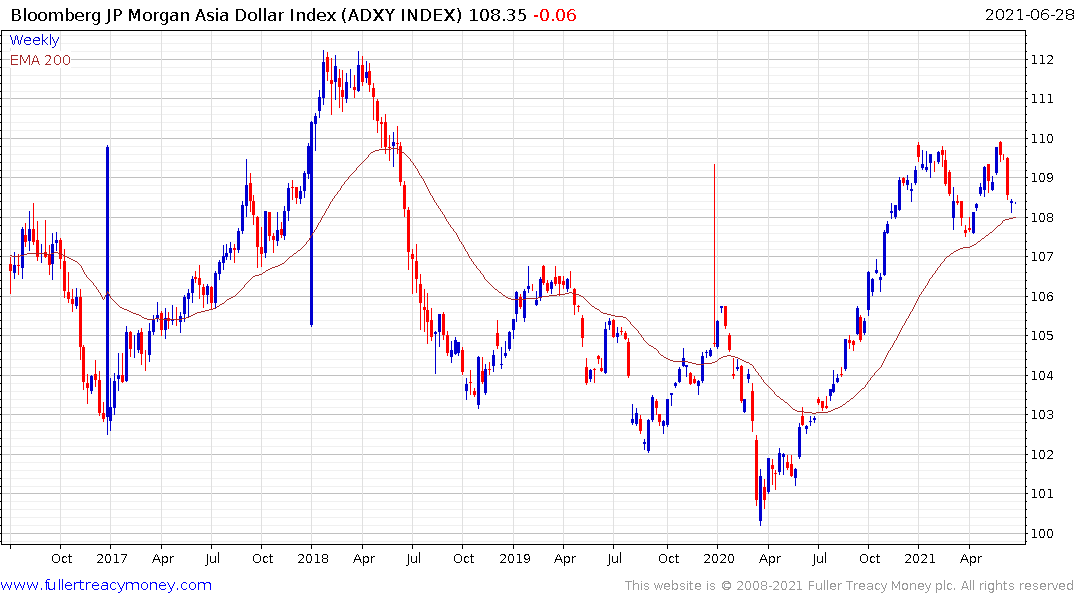

Paul Mackel, global head of FX research at HSBC Holdings Plc in Hong Kong: Market is watching closely the recent Covid resurgence as it has caused short-term depreciation of some currencies

“But the elephant in the room is whether the dollar has bottomed or not” and “it’s not yet. But if the dollar is indeed getting stronger and the Fed is becoming more hawkish, it could challenge the outlook of some Asian currencies”

There is an incredible variety of perspectives on the merits of vaccination. The primary point I made last year was it doesn’t matter what anyone thinks, global governments have all followed a similar set of policies. Having made the decision to lock down, there has to be a set of requirements which need to be demonstrably met to open back up. Vaccinations are key to that decision making process. Variants introduce some doubt into the equation.

The data from Israel and the UK, where there is a lot of testing and genetic sequencing for variants, supports the view that high vaccination rates reduce the threat from variants. That’s particularly relevant as the delta variant spreads quickly in the UK. Case numbers in the UK are breaking out. It is reasonable to expect a lag before the trend in deaths rises so within three weeks there will be observable data on whether the high vaccination rate acts as an obstacle to severe infections.

Even adopting this cautious approach, it is worth reminding ourselves that India’s case load peaked in early May and has come all the way back down. The reality is that remedial measures are available and global efforts tend to be concentrated in regions where case loads are rising in a worrying manner. That’s very encouraging and is the reason investors are not panicking.

The FTSE-250 has paused over the last few months, following a breakout to new highs. There is no real sign of selling pressure so investors are still willing to give the benefit of the doubt to the validity of vaccine data and progress towards reopening.

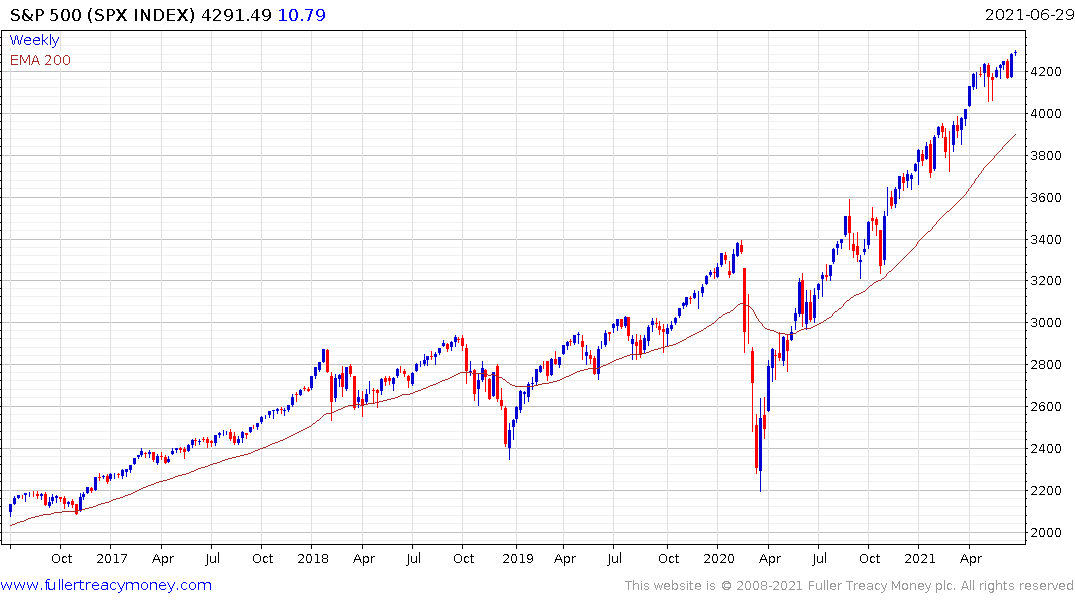

The S&P500 and Nasdaq-100 continue to extend their breakouts to new highs.

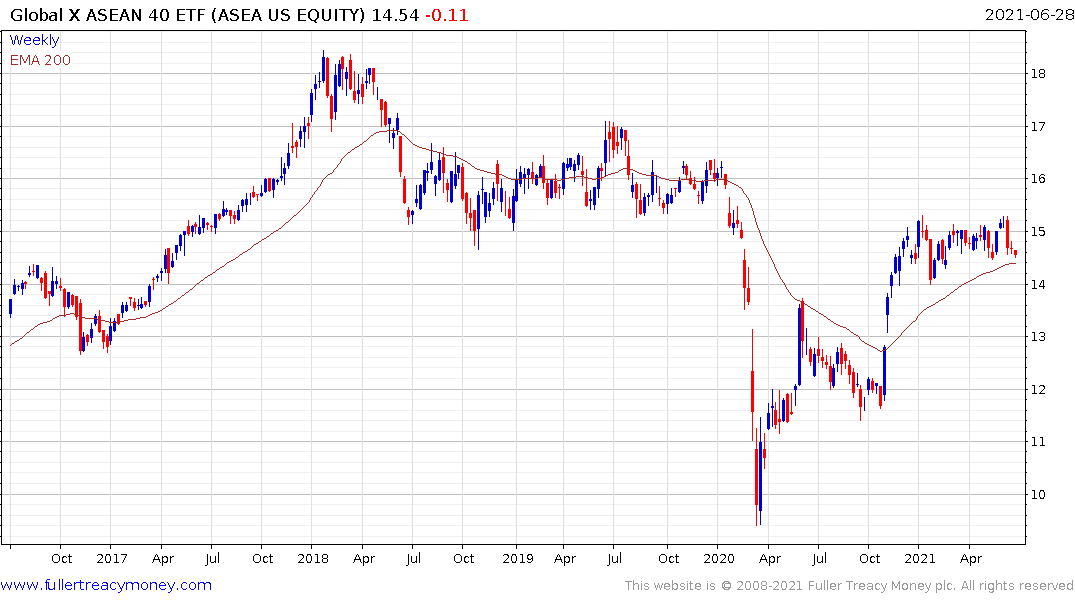

The ASEAN region, and emerging markets generally, are further behind in their vaccination efforts and have fewer resources. The higher transmissibility and anecdotal evidence that the Delta variant is more deadly, complicate the situation for these markets because it represents a short-term risk. India’s experience suggests it is not a medium-term risk.

The Global X ASEAN ETF broke downwards today and test the region of the trend mean. It will need to rebound soon if the recovery is to be given the benefit of the doubt.

Singapore’s STI has also eased back but continues to hold its sequence of higher reaction lows.

The Asia Dollar Index is also testing the region of the trend mean. The spread of the Delta variant represents a challenge in the short term but even under the direst of circumstances, the Indian example suggests the downward pressure on Asian currencies will be temporary.

The Dollar Index has rebounded enough to question the yearlong downtrend. I find myself very reluctant to deviate from my medium-term Dollar bearish view, but the recent action has been constructive and a sustained move back below the trend mean will be required to signal a return to supply dominance.