Daily Journal AGM Notes

I’d like to thank a subscriber for alerting me to the fact that the Daily Journal AGM was on yesterday only a few miles from my home. Charlie Munger of Berkshire Hathaway fame is the chairman and took questions for approximately an hour and half after the business of the Daily Journal was taken care of. In a wide ranging conversation, he covered a number of topics and in the following account I have conflated a number of comments to create a narrative of what I believe he was attempting to communicate.

.png)

The Daily Journal’s business is focused on issuing public notices of court orders that lawyers have an interest in seeing. During the housing bust, the company did very well because it has a 90% share of the market for public foreclosure notices. Mr. Munger’s witticism came to the fore saying “they were the biggest undertaker in town during an outbreak of plague”. However as the sector goes digital and the supply of new foreclosure notices dwindles the company has been forced to attempt to migrate to an instantaneous online format and hopes to introduce its system into court rooms directly.

This transition represented the first of Mr. Munger’s ruminations. He opined that the natural state of established companies is technological obsolescence. In other words the number of companies that can successfully adapt in order to continue to hold a position of leadership within their sector is very small. Investors don’t buy Daily Journal stock because of its business model, but rather because of the appreciating cash value of the investments Charlie Munger made with the company’s free cash flow in the teeth of the financial crisis; such as buying Wells Fargo a day before the bottom.

The Daily Journal was late in producing its auditor’s report because Arthur Anderson’s team were not happy with how the company had accounted for the acquisitions it had made in its development of a software led business model. A number of other attendees said that his talk last year focused on the merits of concentrated portfolios but this year I got the sense that the issues with the company’s auditors led him to think more about governance and bureaucracy.

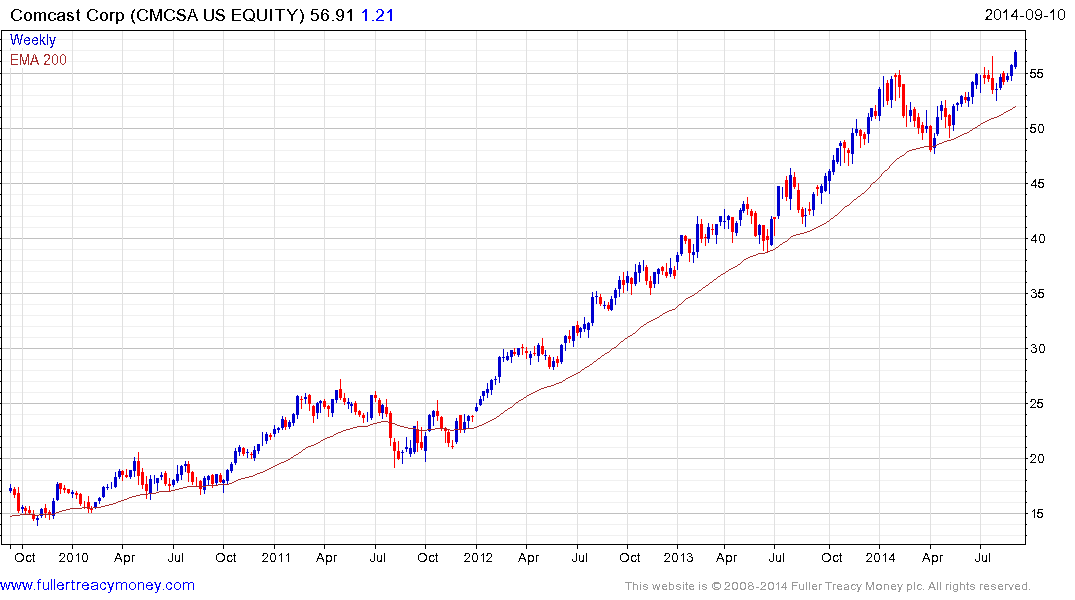

Framing the technological obsolescence comments in this light, he said that Berkshire Hathaway and Comcast were clear exceptions but in answer to a question about Tesco he said that it was getting left behind because its business model which had worked for such a long time was being overtaken in the international market by cheaper competitors and domestically by the likes of Aldi which only sells own-brand products.

On a number of occasions he poked fun at the groupies in the crowd and their questions but his answer to a query on what excites him both personally and professionally might be of interest. “It’s easy to get depressed and forget the good stuff”

He expanded by speaking at length on his dislike of Iegalised gambling including on Wall Street and the role of envy in promoting bad behaviour. Quoting the old testament on a number of occasions “every man's lifestyle is proper in his own view”, he resolved the actions of companies like Fannie and Freddie in lending to subprime creditors as the result of envy or a “me too” culture. Envy is a destructive force, citizens are consumed by it, marketers play to it and politicians pander to it. Outlawing institutional gambling would do a lot to fix the problems he sees.

Returning to the gambling mentality he said that giving credit to people who can’t handle it in order to make money from them is a crummy way to make a profit. If you sell products that are good for the customer you’ll do well. Berkshire will not go into the casino business, even though it is profitable, because they don’t want to make money that way. They believe that honesty really works if people trust you. They would never have been able to pull off the 8 biggest deals ever in the reinsurance business if people didn’t trust them.

He was of the opinion that the bureaucracy which ensures people can claim disability benefits by lying about their injuries was akin to paying people to commit fraud or to be crooks.

While talking about the partnership that he and Warren Buffet have he touched on the taboos that exist within organisations that inhibit people from speaking their minds. This also extends into the bureaucracy of corporations, regulation and fiduciary responsibility that makes sure people cannot do what they think is best. He clearly favours a concentrated portfolio and said that all one needs to own is Berkshire Hathaway, Costco and an Asian Fund. In response a delegate asked what someone who is not allowed to only have three positions is supposed to do? Mr. Munger avoided the question but also said he wouldn’t pay today’s price for Costco with a P/E of 28.

There was an air of cognitive dissonance to this discussion because Mr Munger has often invested quite heavily in banks. While wishing to see governance improve and for the gambling mentality that has crept into markets quashed, he also said that “if the world were not as stupid and bureaucratic as it is, we wouldn’t be as rich as we are.” He gave the example of the RFP process many companies go through in order to win business. Most people hate it because it is so cumbersome and difficult but they like it for exactly the same reasons. While coming down hard on the speculative practices engaged in by banks. Mr Munger also said that the practice of lending to people so they could buy their first home or car or new refrigerator was about as noble a profession as you could get.

On a brighter note, he said that he is not as optimistic as Warren but that no one could be. There is a lot to be optimistic about and that he is not afraid of how quickly technology is advancing, saying we should embrace it. An example he gave was that at Harvard a few weeks ago he heard they are close to producing pancreas cells from stem cells which represents a potential cure for diabetes.

He mentioned China as a clear example of a place where things have gotten better very quickly. Rather than do it on debt China has earned its way to prosperity by saving and by making sacrifices we, in the West, weren’t willing to. He was of the opinion that people sitting in a developed country working a 36 hour week shouldn’t look down their noses at the rise of emerging markets or get uneasy about increased competition. The rise of China, like Japan before it, represents a major upheaval and of course there are going to be necessary adjustments.

In answer to a question about BYD, he said it is in a sweet spot because of China’s pollution issues and the need to decrease emissions. He also believes that the iron sulphide solution the company has to the combustion potential of lithium ion batteries is a good one, although it is heavy.

When asked about corporate inversions he said that Burger King moving to Canada following its acquisition of Hortons was logical. In an age where capital is mobile, corporations can conduct business anywhere and there is a competitive arena in corporate tax rates, it was silly to have the highest corporate tax rates in the world. If you look at where consumers have done best, for example Hong Kong and Singapore it is has been where low corporate taxes have prevailed. The mobility of capital and the companies that can benefit from it has been one of the advantages enjoyed by FullerTreacyMoney’s Autonomy classification.

When asked about inflation he said “When you’re as old as I am you’ve seen a lot of inflation”. The country has come through these bouts of inflation successfully and once over they have represented powerful buying opportunities. He said he’s not as optimistic as Paul Krugman about inflation, that flirting with the debauchment of the world’s reserve currency is not responsible, but so far Krugman has been right.

When asked what he thinks of Elon Musk, he said he is a certified genius and one of the boldest people around but that he is cautious of people with an IQ of 190 who believe it should be 250.

At next year’s Berkshire Hathaway meeting Warren Buffet intends to speak at length about what it takes to succeed and how to do it again.

This article from Bloomberg also covers yesterday's meeting.

Back to top