D.C. Joins Athens as Major Threat to Bull Market in U.S. Stocks

This article by Michael P Regan for Bloomberg may be of interest to subscribers. Here is a section:

And yet here we are. Buyback authorizations so far in 2015 have already topped full-year totals for 2008, 2009, 2010 and 2012 and are on pace to set a record of $993 billion, according to Birinyi Associates Inc.

Sen. Tammy Baldwin, like Sen. Warren, has asked the SEC to look into the practice. As Wilson reported, analysts at HSBC believe greater regulation may end up “tempering some of the gains in U.S. stock prices over the last few years, or in some cases, even reversing those gains.” That arguably could be an understatement. Can you imagine the market reaction if a headline crosses the tape that declares buybacks will be curtailed?

$1 trillion represents a potent source of additional demand in any market. With the Fed now finished its QE program, buybacks represent an even more important source of demand. It is unlikely that the US government will intervene in the corporate treasuries of major corporations to stop buybacks but it is still an important sector to monitor.

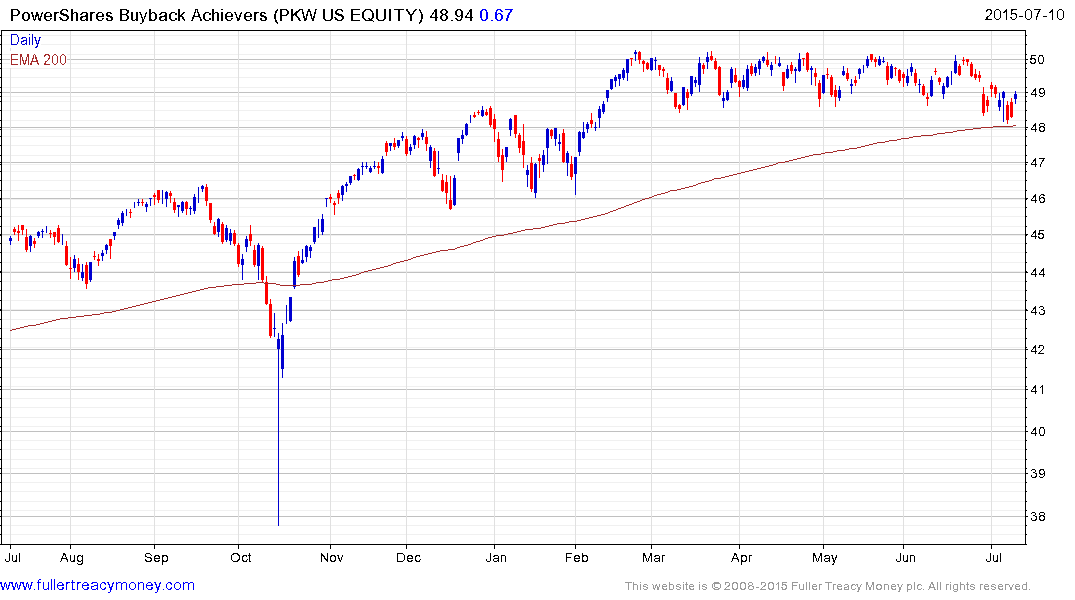

The PKW Buyback Achievers ETF has been confined to a tight range for the last six months and is currently rallying from the lower boundary. A sustained move below $48 would be required to signal supply dominance.

A number of companies have been raising their debt burden in order to increase buybacks. The sustainability of this approach will depend on their continued ability to source cheap credit. BB high yield spreads have been trending gradually higher.

The level might not yet be back at levels seen in 2010 and 2011 but the trend is clear and the quantity of debt that will eventually need to be refinanced will be high. This represents a medium-term risk since most debt was issued with a 5-year maturity making it a major consideration for 2018 and 2019.

BBB spreads have not expanded in a dynamic fashion but have been trading above the trend mean since the end of last year. A sustained move below the trend mean would be required to question potential for further expansion.

Back to top