Currency Wars Evolve With Goal of Avoiding Deflation

This article by David Goodman, Lucy Meakin and Ye Xie for Bloomberg may be of interest to subscribers. Here is a section:

While not strictly speaking stimulus measures, the Swiss, Danish and Czech currency pegs -- whether official or unofficial -- have a similar effect by limiting gains versus the euro.

Measures like these are necessary because, even after a broad-based dollar rally, eight of the Group of 10 developed- nation currencies remain overvalued versus the dollar, according to a purchasing-power parity measure from the Organization for Economic Cooperation & Development.

Some central banks have GDP, rather than inflation, in their sights. That’s particularly true of exporters, for whom a lower exchange rate makes their goods cheaper.

New Zealand, where second-quarter annual inflation was the fastest in 2 1/2 years, announced last month its biggest currency intervention in seven years, sending the local dollar to a 13-month low.

Currencies are never a one sided debate so while much of the media is concentrating on whether the Fed will raise rates in July, October 2015 or sometime in 2016, the rest of the world is adopting looser monetary policy in order to combat deflation and/or reignite growth. Additionally falling commodity prices, not least oil, remove some of the inflationary pressures from stimulating the monetary base.

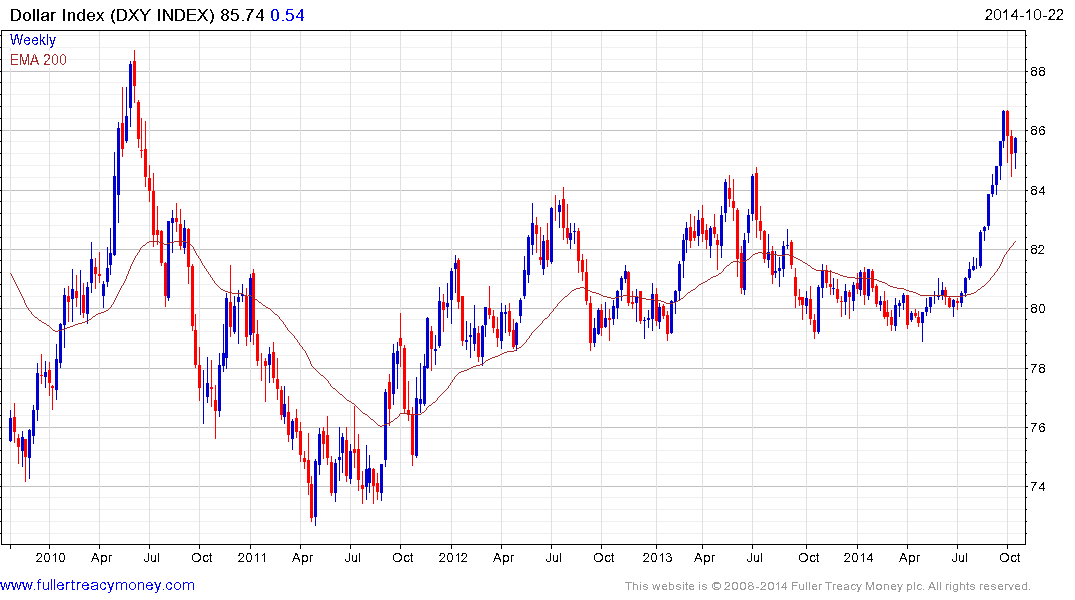

The Dollar Index rallied persistently between July and late September and spent much of this month consolidating at least part of that advance. It found support in the region of 84.5 last week and a sustained move below that level would now be required to question potential for some additional upside.

An additional consideration is that the Dollar has been so weak for so long that it was a carry trade currency of choice for traders. Its strength puts pressure on anyone borrowing Dollars to trade overseas. Today’s upside key day reversal on the VIX Index suggests it is too early to sound the all clear for stock markets.

Back to top