Currency Special

Thanks to a subscriber for this report from HSBC focusing on the Dollar. Here is a section:

We believe the USD rally is nearing its end. This is in contrast to a market which appears determined to envisage ever greater upside for the currency. The USD has already rallied more than is typical historically, and many of the arguments currently being used to justify an extension are likely already in the price.

Having been one of the early adopters of a bullish USD view back in 2013, we now see factors that make us believe we are at the beginning of the end:

Recent data developments

US tolerance for USD strength has its limits

Valuations

Positioning / USD bullishness has become all-pervasive

USD does not perform once Fed has actually pulled the triggerThere is obviously scope for one last spike higher, as is often the case in the later phase of big bear or bull market moves, which sucks all participants into the narrative. So convinced become the participants that any rational arguments fall on deaf ears and forecasters start coming out with ever more extreme views. But it is time to start looking the other way as this last spike is likely to be reversed swiftly. When the world seems to be revising EUR-USD expectations ever lower, we are moving the opposite way. Our forecast for year-end 2016 is now 1.10 compared to 1.05 previously, and we believe the rate will move to 1.20 during 2017.

Clearly there are events such as EUR break-up or JPY debasement which could lead to destructive dollar strength. But these are very much tail risks and we believe it would be a mistake to be drawn into the forecasting fashion of relentless dollar dominance. Markets are so caught up in the price action they are ignoring anything that suggests the move might end. The feeling in the market is that we are in the middle of a sustained USD rally whereas we would argue this is, in fact, the beginning of the end of the bull run.

Here is a link to the full report.

On just about any measure the recent Dollar rally has been spectacular. However even the most powerful breakout must eventually give way to some consolidation of gains. This now appears to be unfolding but is likely to be limited to mean reversion. The medium-term potential for the Dollar to continue to outperform beyond some short-term weakness remains intact.

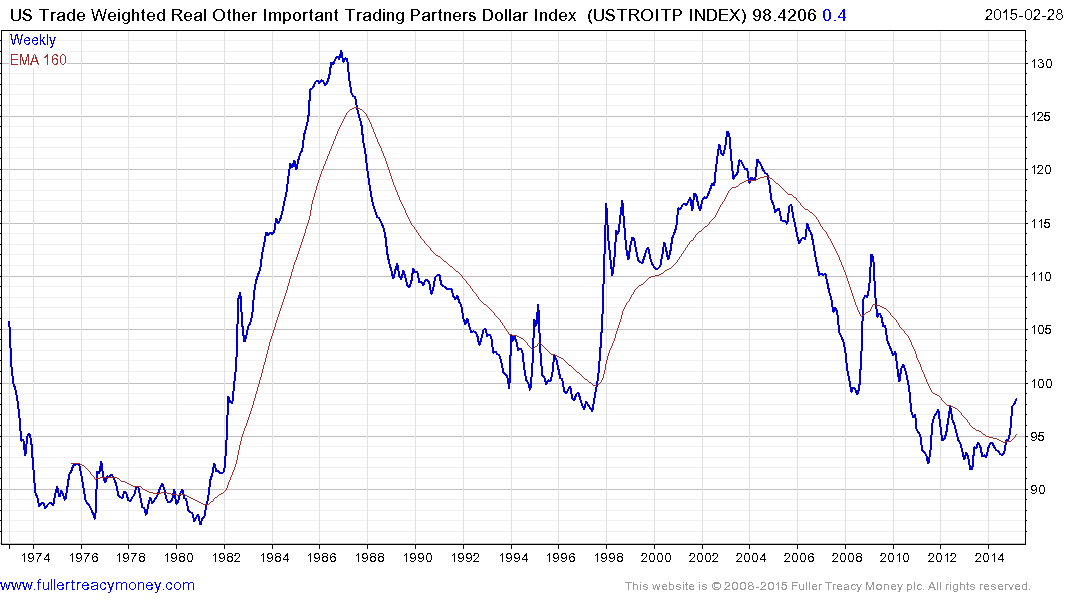

The Dollar Index is heavily skewed towards the Euro and gives an incomplete picture of just how strong the Dollar has been in my view. The Trade Weighted Real Other Important Trading Partners Dollar Index is updated by the Fed once a month and is comprised by the currencies of major trading partners outside the G7. It has also broken a progression of lower rally highs and is trading above its 200-day MA for the first time since 2009.

This Index helps to illustrate just how broad based the Dollar’s rally has been and explains why the Fed will be slow to raise interest rates aggressively. How could they when the risk of an additional surge in the Dollar would represent a further risk to the USA’s international competitiveness?

Meanwhile the Euro continues to rebound from its deep short-term oversold condition. Considering just how bearish the crowd had become the potential for a further short covering rally remains the base case and can be given the benefit of the doubt in the absence of a clear downward dynamic.