Crypto Lending Teeters Near Extinction After Genesis Collapse

This article from Bloomberg may be of interest. Here is a section:

Being in the SEC’s cross hairs is likely to lead to a further shake-up of what little is left of the lending sector.

“There will be two different models in the future,” said Campbell Harvey, a finance professor at Duke University. “First, certain organizations will register with the SEC and sell these products as securities. Second, investors may do this on their own by putting their crypto into decentralized liquidity pools and earning a fee for that.”

In decentralized finance, or DeFi, investors use software to automatically borrow and lend tokens, with positions being automatically liquidated if prices fall too low or they miss repayment deadlines. Some platforms such as Maple Finance organize pools where an operator can manage incoming investor funds and choose who to lend them out to, using due diligence to assess a borrower’s creditworthiness rather than asking for collateral. Such an approach has already lead to some defaults during the current crisis, in addition to plummeting volumes.

Because these types of loans are conducted on public blockchains, the collapse in lending is more visible. The total amount of value locked on DeFi networks hit a peak of $181 billion in early December, according to data from DeFiLlama, and now sits at around $45 billion — tarnished by wavering demand, declining crypto prices and several spectacular failures.

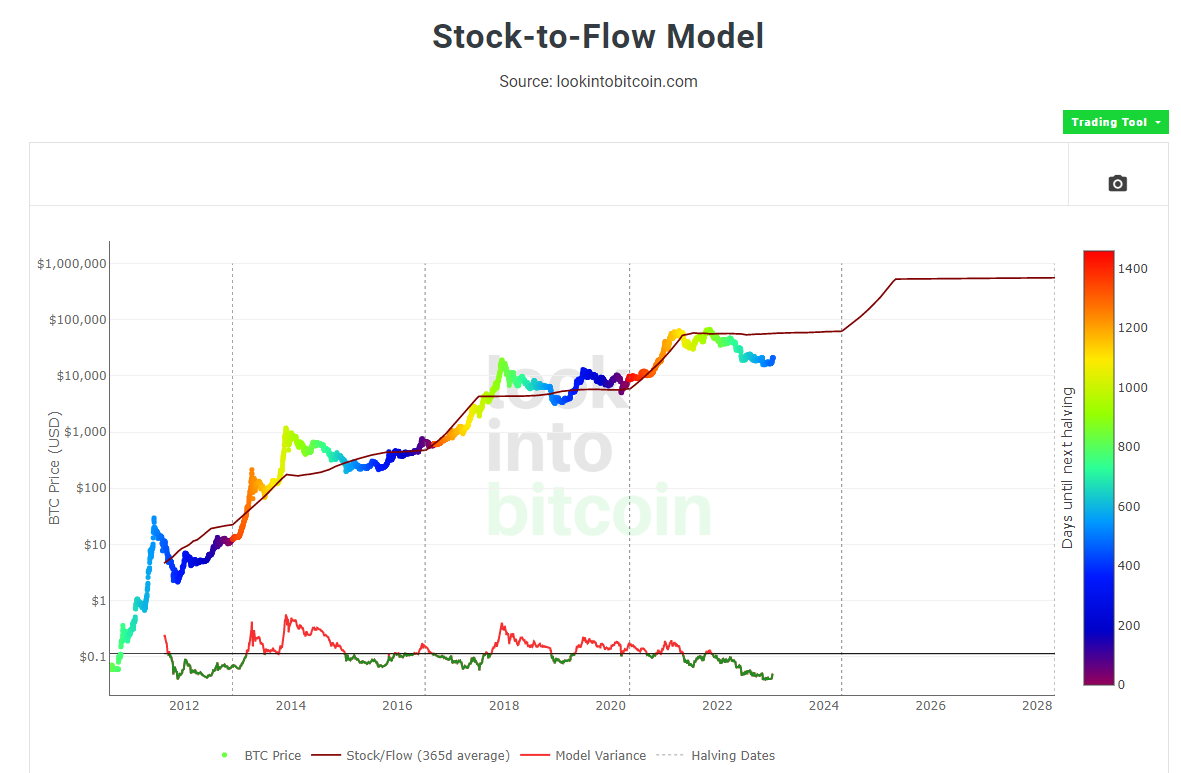

The next bitcoin halvening is due in April 2024. That will halve the reward for successful minting a new block from 6.25 to 3.125. Therefore the limited supply and rarity of the asset will become a topic of conversation again around this time next year.

The stock to flow chart for bitcoin highlights that important lows are generally reached around a year before the halvening. That suggests the price is in a bottoming pattern at present.

The important consideration is the price did not exceed the projected levels on the stock to flow chart during the last bull run in same manner as in previous moves. That is a trend inconsistency.

The implied target for a future bull run is $500,000. That would correspond with a crypto market size in the region of at least $20 trillion. The only possible way that is going to happen is if global money more than doubles during the next recession. For example that implies a Fed balance sheet of $18 trillion. It’s not unreasonable but to believe that means one has to fully discount the threat of inflation returning with a vengeance.

That may be what the inconsistency of the bitcoin chart is telling us. Perhaps we do not see $500,000 but rather the size of incremental gains shrinks as the law of big numbers and the end of the modern monetary theory experiment weigh on speculative activity. That does not preclude the potential for significant jumps in price.

Back to top