Crop Prices Rally as Report Points to Easing of Glut

This article by Jesse Newman for the Wall Street Journal may be of interest to subscribers. Here is a section:

The Agriculture Department report offered the first official forecast for the new season’s production and consumption around the world.

It said poor weather in South America would contribute to a surge in soybean exports from the U.S. as production in places like Argentina falls off.

“The demand that USDA set forward is incredible,” said Mr. Reilly of the forecast for soybean exports.

The USDA expects U.S. soybean reserves to dwindle to 305 million bushels by August 2017 from an estimated 400 million a year earlier as exports pick up.

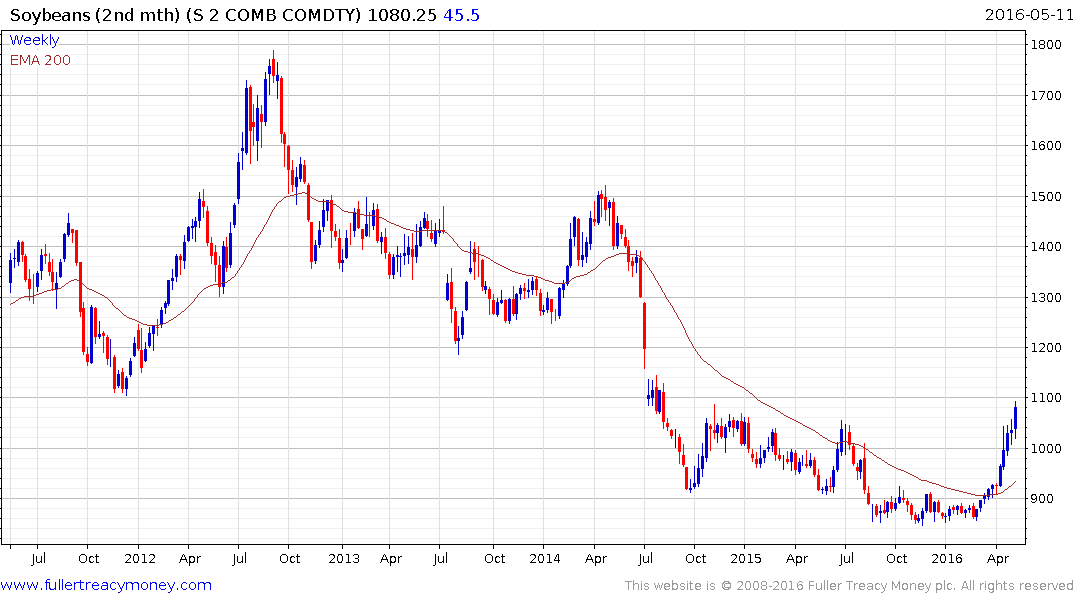

Even at their current level, however, soybean prices are about 40% lower than their peak in 2012, and the level of stocks still are comfortable.

Corn futures jumped even though the USDA forecast farmers would harvest a record 14.43 billion bushels this year. The agency’s supply estimates, however, fell short of analysts’ expectations. The USDA projected stockpiles will climb to 2.153 billion bushels by August 2017 from 1.803 billion a year earlier, the largest since the mid-1980s.

The USDA said global corn reserves at the end of the 2016-17 season would total 207 million tons, down from an estimated 207.9 million tons for the current season.

Here is a link to the full article.

The full effects of the El Nino weather phenomenon are now becoming evident in soft commodity pricing despite the fact it has already peaked. Soybeans completed a six-month base in March and continues to extend the breakout. An increasingly overbought condition is developing but a clear downward dynamic would be required to check momentum.

Latin America is also a major producer of sugar and prices continue to hold a progression of higher major reaction lows.

Arabica coffee may have posted its first higher reaction low in more than a year last week and pushed back above the 200-day MA today. It has rallied for five consecutive days so there is scope for some consolidation but a sustained move below 120¢ would be required to question potential for additional upside.

Back to top