Crop Forecast Sends Corn Prices to Near Taxpayer Subsidy Trigger

This article from Bloomberg may be of interest to subscribers. Here is a section:

The $956.4 billion farm bill was touted as changing the subsidies that watchdog groups called excessive government support for farmers who last year had record profits. A $5 billion annual program to pay farmers regardless of crop price was eliminated, replaced by aid for insurance programs and a so- called Price Loss Coverage program, a vestige of the old subsidies approach that would still be an option for producers.

Booming prices for corn, soybeans, wheat and other commodities has led to less spending on traditional forms of payouts in recent years. Corn growers received $2.7 billion in 2012, down from a peak of $10.1 billion in 2005, according to Environmental Working Group, which tracks farm payments.

Assuming continued high prices, the farm bill was estimated to save $23 billion over 10 years, according to congressional estimates. That isn’t happening.

As surpluses push down prices, annual farm profits are forecast to drop 27 percent to $95.8 billion this year from last year’s record, the government said in February. Revenues from major crops will be $189.4 billion, down 12 percent.

Soft commodities and energy contracts have led declines on the Continuous Commodity Index this week sending it back below the 200-day MA despite the fact that industrial metals have been reasonably steady and precious metals advanced.

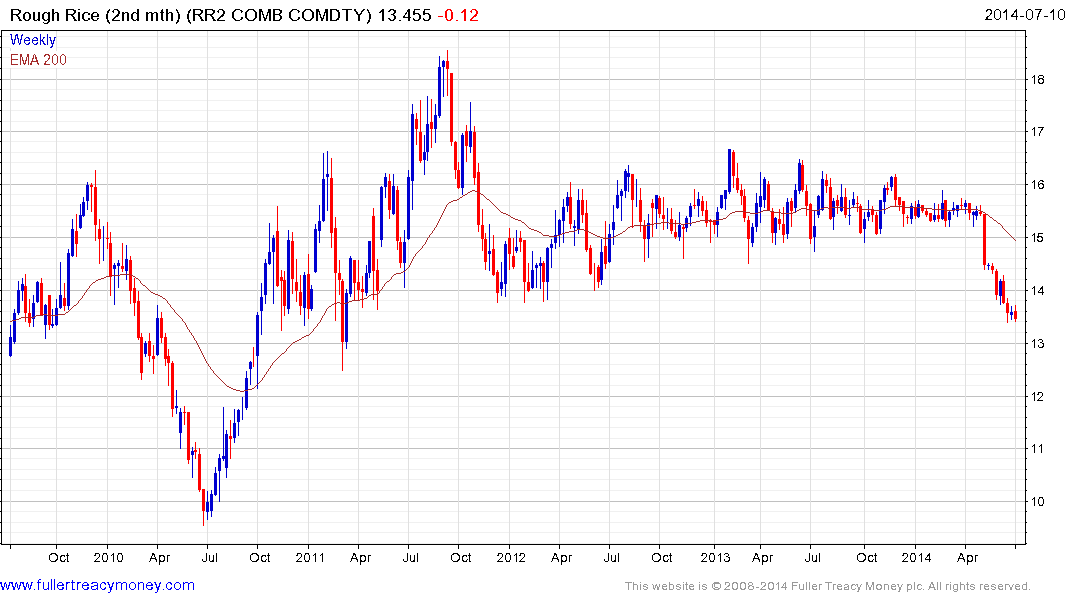

Accelerating downtrends are evident in corn and rough rice while a pattern of underperformance is evident across the sector. Limit moves to the upside will be required to chasten the shorts and signal a return to demand dominance.

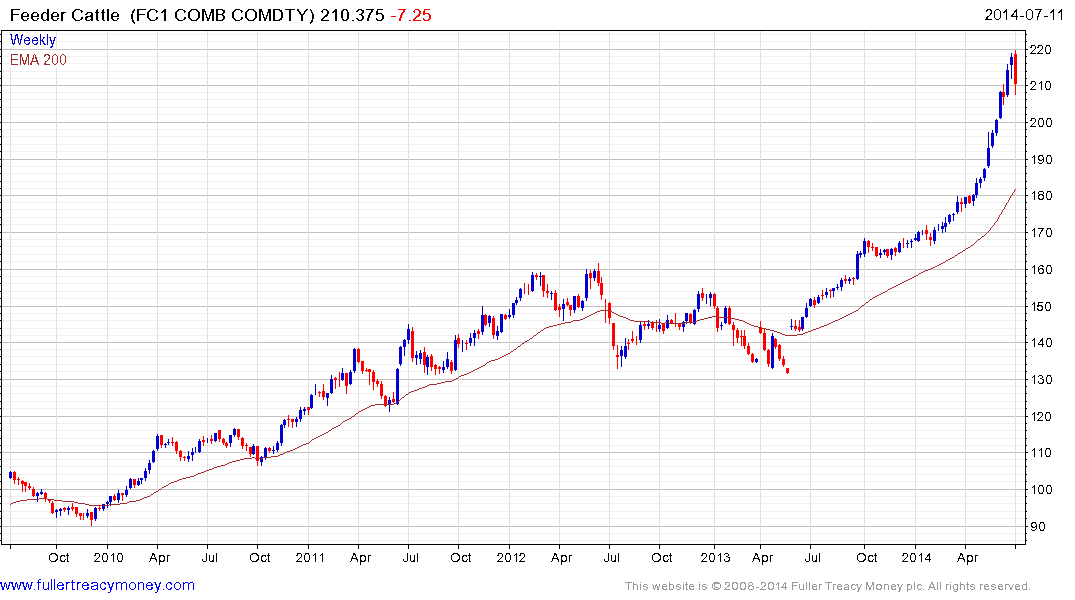

Feeder Cattle which has had one of the most consistent uptrends of any commodity posted a downside weekly key reversal this week. Additional follow through to the downside next week would help confirm a peak of more than short-term significance and a possible unwinding of the more than 20% overextension relative to the 200-day MA.