Credit Suisse Default Swaps Widen, Bonds Sink as Optimism Fades

This article from Bloomberg may be of interest to subscribers. Here is a section:

Support from the Swiss National Bank, which offered as much as 50 billion francs ($54 billion) from its liquidity facility, had brought some temporary relief to Credit Suisse and risk gauges for the broader European banking sector. That fizzled amid comments from the European Central Bank that some of the region’s lenders could be vulnerable to monetary policy tightening, followed by its decision to proceed with a planned half-point increase in interest rates.

The continued selloff signals more action may be needed to arrest a collapse in confidence that’s prompted clients to step back from the Swiss lender and banks to shield their finances from the potential fallout. While the panic surrounding Credit Suisse has so far shown little sign of infecting the broader financial system, any further turmoil would pose a significant risk for markets already on edge amid soaring interest rates and rampant inflation.

I have always been intrigued by the idea of Aleph null. It’s the infinity of infinities [ℵ0]. The set of natural number is infinite, but so is the set of even numbers, and so is the set of uneven numbers. There is also an infinite number of times a single number can be divided. Most of the time that is an academic novelty but when it comes to confidence and bailouts infinity matters.

$50 billion is a lot of money and in the normal course of events it is probably enough to solve the Credit Suisse’s immediate issues. However, it is not “whatever it takes” and it is not “unlimited”. The SNB has weighed in and the company is unlikely to go bust but it is also unlikely to survive in its current guise. Confidence has been shattered. There is a good chance the share bottomed yesterday but the most likely scenario is the bank will be taken over.

From a broader perspective, pandemic largesse peaked in 2021. The outstanding total of negative yielding debt peaked at $18.38 trillion in early 2021 and compressed to zero by early 2023. The implication is anyone who bought those bonds between 2019 and 2022 is sitting on significant losses. Since the biggest buyers of those bonds are EU and Japanese pensions, insurance companies and banks that suggests they will not be immune from the strife.

The VP of the ECB told finance ministers EU banks are vulnerable to similar issues. The Euro STOXX Banks Index rebounded impressively earlier this year as the reserves set aside to provide for an energy crisis were brought back on their balance sheets. The sector is now rolling over.

Deutsche Bank, as a major buyer of negative yielding German debt is leading on the downside.

Deutsche Bank, as a major buyer of negative yielding German debt is leading on the downside.

The SNB’s approach differs sharply with the USA’s where the guarantees are open ended. Large banks have been mustered to inject deposits into First Republic with the aim of either JPMorgan or Morgan Stanley taking it over.

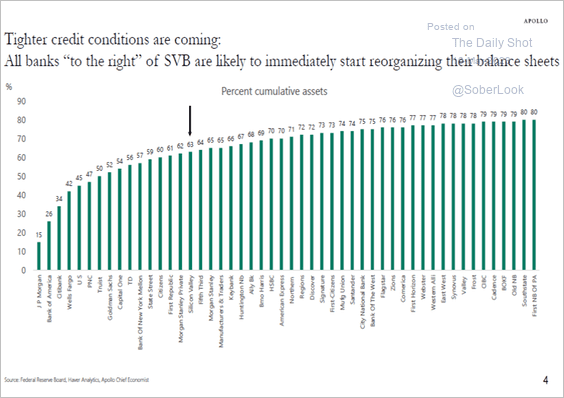

This chart from Torsten Slok at Apollo, highlights how US banks are likely to tighten lending standards in response to the events of the last week. That suggests tighter monetary conditions going forward.

This chart from Torsten Slok at Apollo, highlights how US banks are likely to tighten lending standards in response to the events of the last week. That suggests tighter monetary conditions going forward.

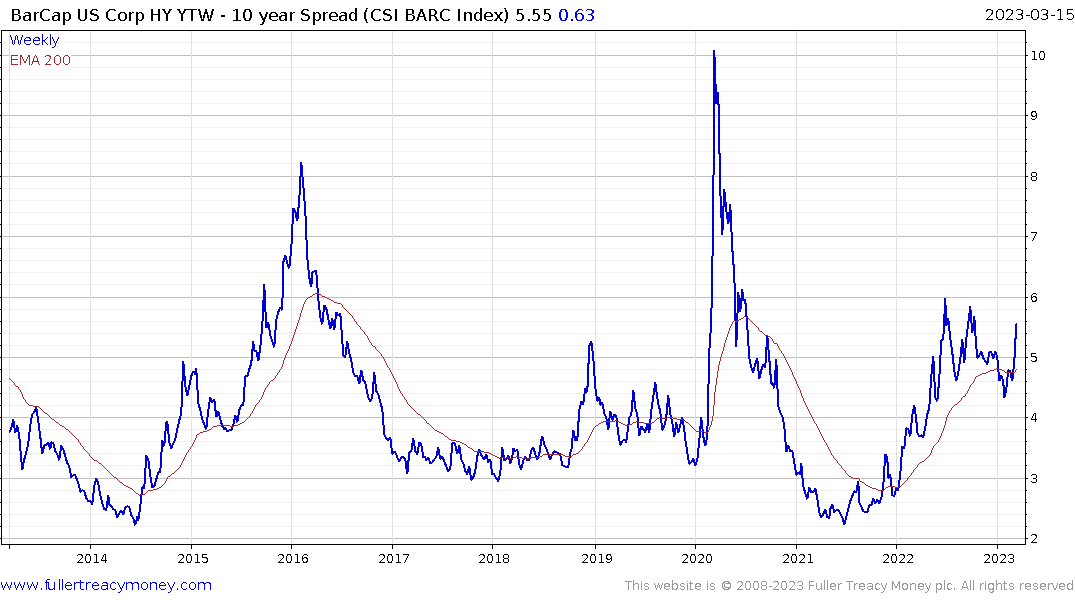

High yields spreads have broken back above 500 basis points. That is generally consistent with trouble in the wider economy and markets.