Credit Bubble Dynamics: The Bursting of an Historic Bubble

Thanks to a subscriber for this report by Doug Noland, formerly of Prudent Bear, not at McAlvany. Here is a section:

Here is a link to the full report and here is a section from it:

In the final analysis, credit bubbles are mechanisms of wealth redistribution and destruction. Today we are faced with the concurrent crises of the unfolding collapse of the biggest financial bubble in world history and huge global geopolitical upheaval. The upcycle’s expanding “pie” promoted integration, cooperation and constructive relationships. The downside’s shrinking “pie” will foment fragmentation, animosity and confrontation. Regrettably, the world is heading into a collapsing bubble backdrop with an already alarming array of populism, nationalism, antagonism and authoritarism.

Even after a long U.S. expansion, Capitalism remains under attack and trust in our institutions becomes only more fragile. The harsh reality is that our country is deeply divided, and will surely become even more so. We are convinced: the world is now witnessing the beginning of the end to the greatest bubble in history - one that emerged in US finance and inflated to engulf the entire world. The bubble that began in US corporate and mortgage credit made its way to the very foundation of contemporary finance – government debt and central bank credit – on a global basis.

For 30 years now, we have witnessed repeated booms and busts that have triggered ever-more-dubious central bank reflationary measures, resulting in even more gargantuan bubbles. It reached the end of the line – zero and negative rates and trillions of QE. What comes next? When public confidence in central banking wanes; when the soundness of government debt and central bank credit become widely suspect; when the stability of the Chinese economy with its 1.4 billion population is no longer reality – we see a global financial crisis with a scope significantly beyond the 2008 dislocation.

We should ponder Adam Fergusson’s masterpiece, When Money Dies: The Nightmare of Deficit Spending, Devaluation, and Hyperinflation in Weimar, Germany. Incredibly, throughout the entire inflation fiasco, the Reichsbank saw its printing operations as a necessary response to outside forces. Akin to contemporary central bankers, its leaders remained somehow oblivious to the reality that unchecked money creation was the root cause of financial, economic, social, and geopolitical derangement. While reading the history from the late-1920s period, we recall pondering Irving Fisher’s “permanent plateau of prosperity” comment just weeks prior to the 1929 crash. How could one of America’s most celebrated economists have been so wrong – and everyone so unprepared? Today, we have an ominous sense of déjà vu that this is all happening again – only on a much grander global scale.

I feel a strong emotional identification with this argument. Surely it makes sense that continued bouts of credit creation will eventually result in the debts coming due and a massive round of defaults resulting in crashes for multiple asset classes? The increasingly vocal concerns about inequality and the rise of populism as a response to that are very real and likely to continue to be a factor that needs to be incorporated in our thinking. The biggest question is how urgent are the warnings?

Globalization and technological innovation fueled deflationary forces which have been with us for forty years. That allowed for massive debt accumulation because the cost of refinancing trended lower for decades which meant roll costs decreased and the principle could be increased. This has led to an accumulation of debt that beggar’s belief for anyone looking at historical norms.

The global financial crisis of 2008 represented a potential inflection point for the monetary authorities but they instead went with an intensification of the trend that had led to the crisis in the first place. Quantitative easing depressed refinancing costs even further which allowed the principle to increase to unprecedented levels, most particularly for governments, corporates and Dollar borrowers.

By contrast, the consumer has deleveraged but what is seldom discussed is this was not a choice. Consumers have not had access to credit and wages have been stagnant which has depressed capacity to borrow. In other words, many traditional credit hungry consumers are already too broke to borrow. The exponential growth in education and auto loans represent the only avenues of credit growth consumers have open to them in this part of the cycle.

It’s important to identify the problems but we also need to think about the solutions. First off, is the simple fact the USA is soon to be a net energy exporter for the first in nearly half a century. That is something that is going to have a very meaningful effect on the balance of payments.

Then we have the fact the Fed is no longer raising rates and is on the cusp of ending its balance sheet reduction. Meanwhile, the ECB is back running an LTRO program to ameliorate the impact of negative rates on banks. China is back to stimulating via the state-owned banks; having successfully banned credit growth in the shadow banking sector.

Next let’s consider that the 10-year Treasury yield failed to sustain the move above 3% and pulled back in a more dynamic manner than it originally broke out. A rule of thumb from The Chart Seminar suggests it will go back and test the lower side of the range and that is near 1.5%. If that transpires it would greatly enhance the ability of the US Treasury and corporations to refinance soon to mature debt at attractive levels, which would prolong the debt bull market for longer.

Meanwhile the equal-weighted Nasdaq-100 is trading at new highs suggesting broad-based recovery.

.png)

The traditional yield curve spread, represented by the difference between the 2-year and the 10-year, has not inverted yet, and even when it does, we can expect there to be an additional leg higher for the stock market.

We are also in the first half of the 3rd year of the US Presidential Cycle and it usually leads to the broad market turning to outperformance in the 2nd half of the year and carrying through into the 4th year.

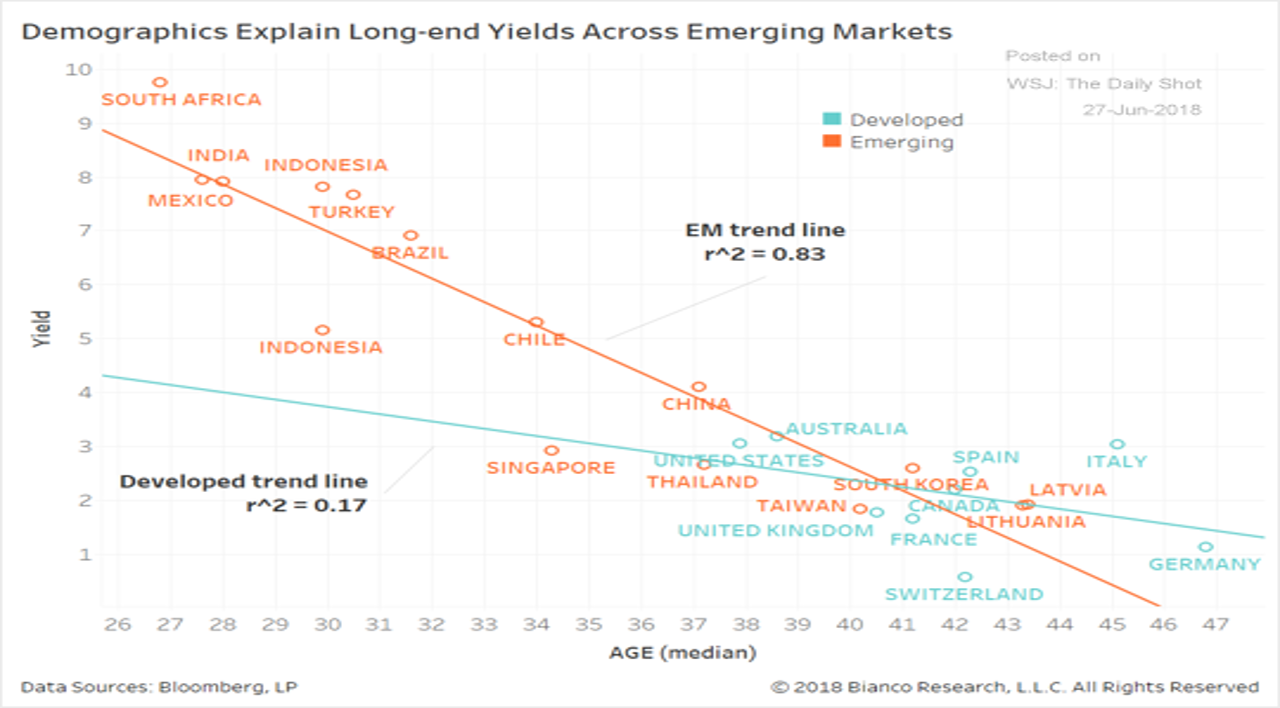

This graphic of global bond yields correlating with median age needs to be considered for anyone who thinks the rise of yields is inevitable.

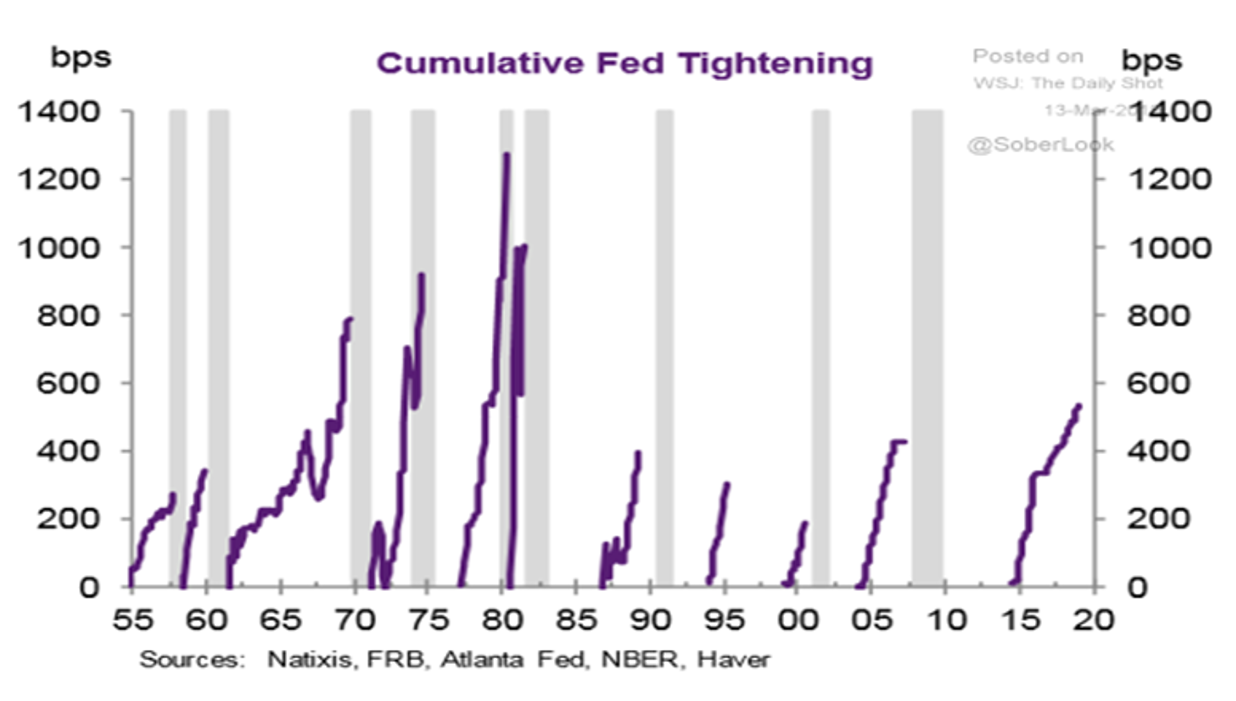

Meanwhile this graphic of the magnitude of interest rates hikes following recessions suggests that after the impending loosening cycle ends, potentially with a recession, the next tightening cycle will result in more rate hikes than the current one. The clear conclusion is the bearish debt arguments being made today are potentially too early in their conclusions.