Cracks Emerge in Bond Market

This article by Mike Cherney for the Wall Street Journal may be of interest to subscribers. Here is a section:

U.S. companies have increased borrowing to levels exceeding those just before the financial crisis, as firms pursue big acquisitions and seek to boost stock prices by buying back shares. According to one metric, the ratio of debt to earnings before interest, taxes, depreciation and amortization for companies that carry investment-grade ratings, meaning triple-B-minus or above, was 2.29 times in the second quarter. That’s higher than the 1.91 times in June 2007, just before the crisis, according to figures from Morgan Stanley.

“The metrics that you measure health and credit by have peaked a while ago,” said Sivan Mahadevan, head of credit strategy at Morgan Stanley. “They are beginning to deteriorate.”

Many investors and analysts say the concerns are overdone. They note that the U.S. economy is still expanding and that many large firms continue to raise money at historically low rates. They say the U.S. unemployment rate, which held at 5.1% in September, is the lowest since 2008, despite unease over slowing economic growth overseas.

While “there are some areas of weakness,” Ms. Lurie said, “there are many other points to show positive economic growth.”

Corporate finance chiefs have been willing to absorb downgrades because a stellar rating has become less important, with little price difference between some bonds with ratings a few notches apart. And until recently, companies had little trouble selling debt regardless of their rating.

Here is a link to the full article.

In an environment of ultra-low interest rates yield hungry investors have little choice but to move further out on the risk curve to achieve the returns they require. Since rates have stayed so low for so long spreads have contracted right across the curve. Issuers have been able to get money for whatever they want and this ample liquidity helped fuel significant momentum rallies. Petrobras’ successful issuance of a 100-year bond in June at spreads only marginally wider than much shorter-dated issues is a good example of trend.

Regardless of whether the Fed raises rates in October, December or 2016, they have made clear they are closer to raising them than announcing another round of QE. Bond investors have little choice but to respond. It is no longer acceptable to lump all bonds together. They need to be assessed on their individual merits. I don’t generally like posting charts festooned with lines but the one above highlights how yields have moved higher right across the risk curve over the last six months.

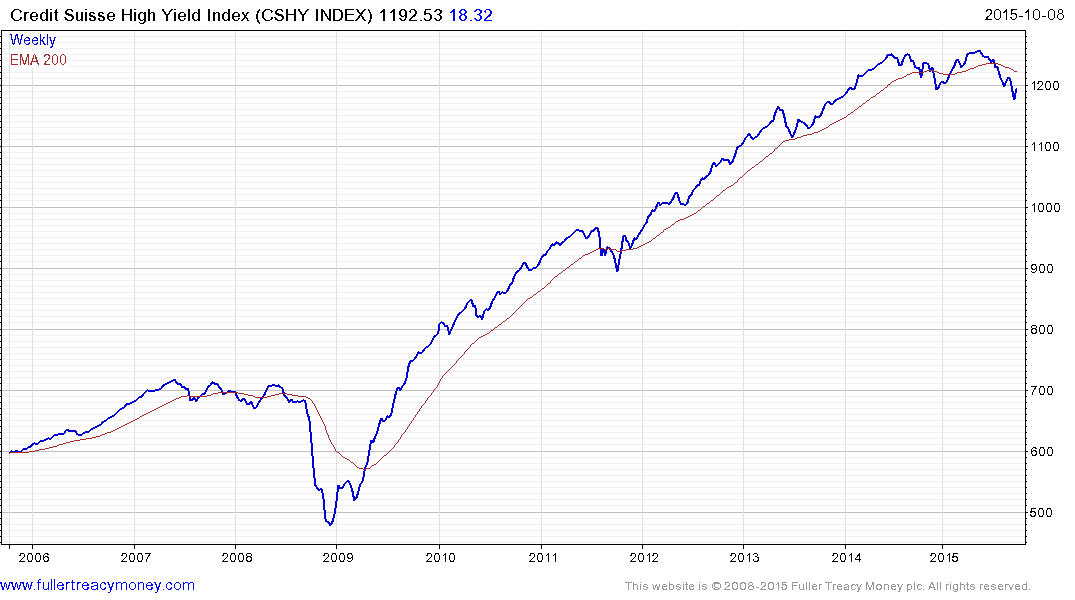

The Credit Suisse High Yield Index is updated weekly on Thursdays and trended higher between 2009 and early 2014 when it lost momentum. It will need to sustain a move above the 200-day MA to signal a return to demand dominance and to offset top formation characteristics.

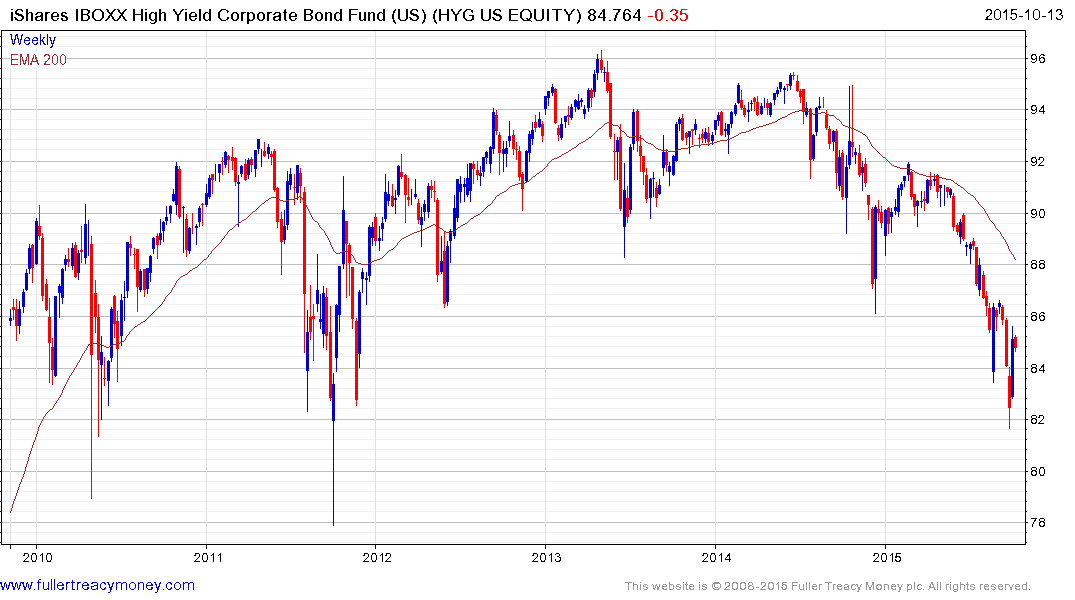

I last reviewed some of the largest bond ETFs on September 21st and since then they have all attracted additional assets. The iShares iBoxx $ High Yield Corporate Bond ETF offers an interesting example. It currently yields 5.6%, about 8% of the fund is invested in energy and the trend of yield compression remains intact.

The Fund returned to test the region of the 2010 and 2011 lows and bounced over the last month to test the medium-term progression of lower rally highs. An unwinding of the short-term overbought condition looks more likely than not and it will need to hold the $82 level if potential for continued higher to lateral ranging is to be given the benefit of the doubt.