Coty Agrees to Buy P&G Beauty Brands for $12.5 Billion

This article by Kevin Orland for Bloomberg may be of interest to subscribers. Here is a section:

Coty Inc. agreed to buy 43 of Procter & Gamble Co.’s beauty brands for about $12.5 billion in a deal that would more than double its sales and transform it into one of the world’s largest cosmetics companies.

The transaction will be conducted as a Reverse Morris Trust, meaning P&G will spin or split off the business, which will then merge with a Coty subsidiary, the companies said in statements Thursday. The arrangement is meant to reduce taxes for the companies’ shareholders.

The acquisition will add Hugo Boss and Gucci to Coty’s fragrances offerings and CoverGirl and Max Factor to its cosmetics portfolio. The deal also brings Coty into the hair-color business with P&G’s Wella and Clairol brands. All told, the combined businesses have annual revenue of more than $10 billion, compared with $4.55 billion for Coty in its most recent fiscal year.

There is a great deal of M&A activity happening at present with companies feeling under pressure to complete deals before borrowing costs rise. Heinz’s acquisition of Kraft’s US division and P&G’s decision to offload less profitable brands can be seen in this context. By the same token the IPOs of retail chains from Sprouts to Michaels over the last year is part of the same process.

Coty IPOed in 2013 and is currently in a process of mean reversion following its surge higher in June.

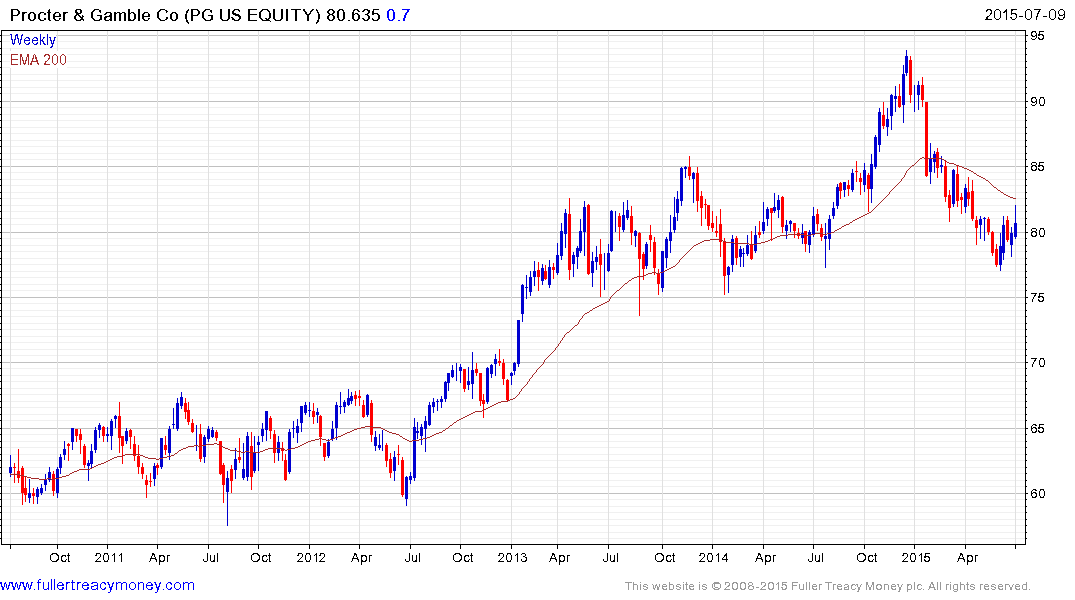

P&G has returned, over the last six months, to test the region of last year’s lows where it has steadied. A sustained move below $78 would be required to question potential for additional higher to lateral ranging.

Johnson & Johnson is also firming from the lower side of its range.

Elsewhere in the consumer sector Unilever is in the process of posting an upside weekly key reversal following a 14% pullback from its April peak. A sustained move below this week’s low would be required to question current scope for additional upside.

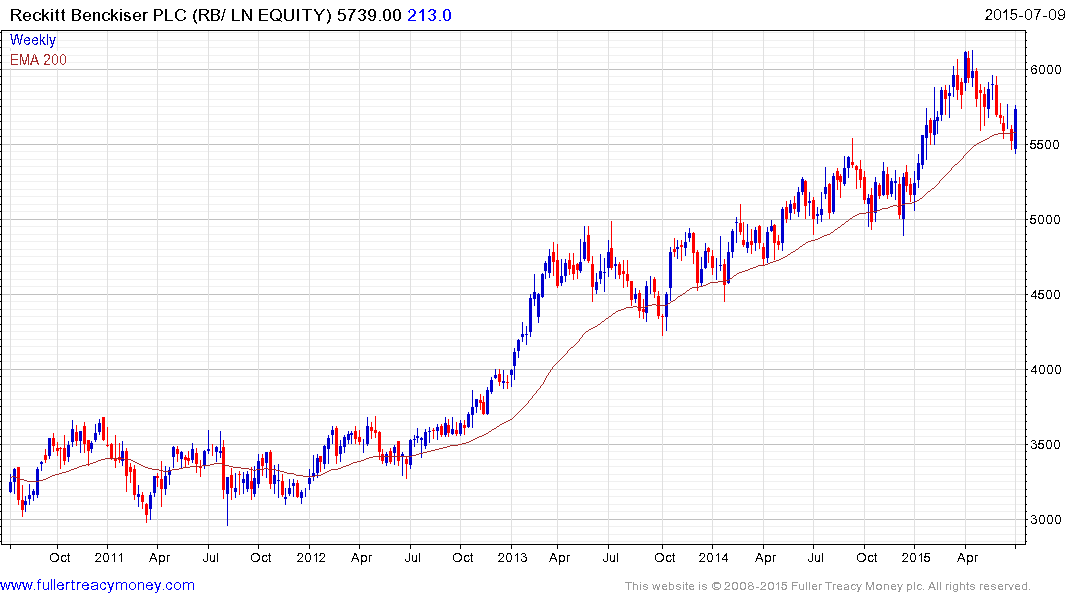

Reckitt Benckiser is also in the process of forming an upside weekly key reversal.

Estee Lauder is consolidating its earlier advance within what is still a consistent medium-term uptrend.

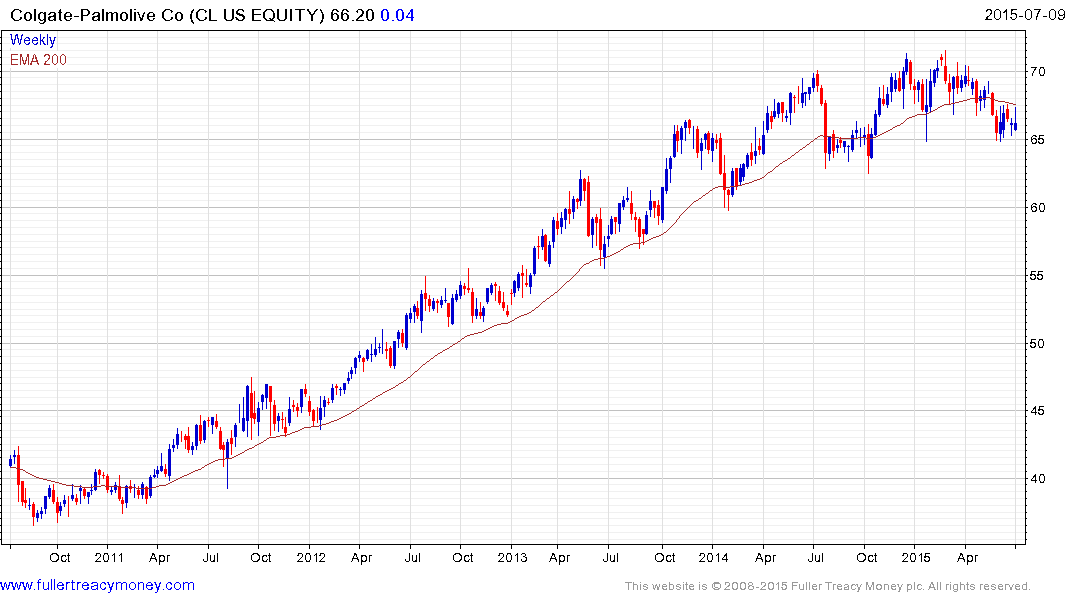

Both Kimberly Clark and Colgate Palmolive have lost momentum but remain within their respective ranges.

Church & Dwight is bouncing from the region of its 200-day MA.

Australian listed Ansell is also bouncing from its trend mean.